A City On The Rise

Hamilton is part of a golden triangle poised to play a vital role in housing a large chunk of our population in the future, writes Sally Lindsay. Images WaikatoNZ.com

24 October 2023

World-renowned Hamilton Gardens – a great place for a leisurely weekend catch-up.

The third fastest growing urban area in New Zealand, Hamilton, or the “the Tron” as it’s affectionately known, is a city on the rise.

It’s part of the golden triangle along with Auckland and Tauranga, which combined will be home to 53 per cent of the country’s population by 2031.

Hamilton’s population of about 165,000 is youthful and innovative – about half of Hamilton’s residents are under the age of 30. It’s also a culturally diverse city – home to more than 80 ethnicities.

Agriculture and mining play a big part in Hamilton’s economy, with an abundance of jobs in both industries that offer excellent career progression and new challenges. The demand for specialist skills within these sectors, especially in various engineering roles, is set to increase with growth of the area. A broad range of other job opportunities are also on offer, with education and research and development among the biggest providers.

The 65km Te Awa River trail, along the Waikato, stretches between Ngaruawahia and Karapiro.

Hamilton City Council is creating a “smart city” where not only can Hamiltonians monitor hold-ups or bus route information via an app, they can also check availability of parking in the CBD. The city is also in the process of creating an open data portal.

River Attraction

New Zealand’s largest river, the Waikato, cuts through the centre of town, providing plenty of outdoor activities from strolling along the shore to boating, white-baiting, trout fishing, canoeing, jet boating or even parasailing. Exploring the Waikato River can also include a river cruise.

There are many places to explore around Hamilton, including the Waitomo Glowworm Caves and the Hobbiton village movie set. In the city itself, Hamilton Gardens are world renowned and the Waikato Museum, ArtsPost Galleries, the Classic Car Museum and Hamilton Zoo are all popular.

Hamilton’s property market is perceived as affordable, compared to Auckland and Wellington.

Despite housing values recovering in some areas of the country, Hamilton is still firmly in a downward trajectory. Prices have dropped in 10 suburbs between 5.3 per cent and 2.1 per cent across the year from September 1 last year to the same date this year. Nawton fell 5.3 per cent from $690,250 to $653,550 followed by Maeroa dropping 5.1 per cent from $761,750 to $722,950 and Baverstock declining 4.8 per cent from $973,900 to $927,300. And Grandview Heights from 4.5 per cent from $912,200 to $870,700.

Cyclists taking a riverside break.

Moving South

As a result of Hamilton’s property market being cheaper than Auckland, Lodge real estate managing director Jeremy O’Rourke says many Aucklanders are making the move south as are new migrants who have been in the country for 18 months or more.

“They are attracted by jobs that are paying reasonably close to Auckland wages and housing. Cambridge is finding the same – Aucklanders making the choice of moving to the rural town because it has easy access back into Auckland.”

Across Hamilton’s housing market he says there is still a bit of apathy. “It hasn’t really recovered from the downturn and while buyers are showing they’re prepared to transact, they are price sensitive. From an investment point of view, we’ve got few investors in the market, next to zero.”

First home buyers are the most active. They are not competing with investors showing urgency and that’s releasing people further up the chain.

The right type of properties priced up to about $1.5 million attract plenty of buyers and often multiple offers. Above that level, the market is short of stock, says O’Rourke.

While the Cambridge market seems to have actually lifted, Hamilton is meandering along, largely due to lack of stock. Listings are still light and not giving buyers the choice they require.

Much of the stock is townhouses and multi-unit housing and not always what buyers are looking for. “That part of the market seems to be overweighted and other parts of the market are struggling for properties even though buyers are showing good intent.”

FROM TOP Eight-metre-tall Tongue of the Dog sculpture above the Waikato Museum, Victoria on the River city park on Hamilton’s Victoria Street.

The Market

Sellers are mainly homeowners wanting to move within the city. “It’s tough – if they’re selling, they want to buy again, and they don’t want to sell unless they can actually find the property they’re looking for.”

O’Rourke believes if the bright-line test is pulled back to two years and tax deductibility phased back many of the town and multi-unit houses will be soaked up quite quickly by investors returning to the market.

“There are definitely investors who don’t know what to do. They don’t want to be in the residential market because they haven’t been able to make the numbers work and some of them don’t have any knowledge about other investment opportunities, such as commercial real estate.”

Generally, investors make up about a quarter of Hamilton’s market at any given time and O’Rourke says it would be good to see them back in the market creating rental properties because that market is tight.

New development has taken a dive in the city, particularly infill housing.

“Hamilton City Council has restrictions on infill housing because of under-investment in wastewater, water and sewerage, which is at capacity in many areas. Developers are telling us it is getting increasingly hard to develop infill almost anywhere in the city. There are some projects under way, but they have already been consented.”

The Renting Scene

Renting is equally as difficult as buying in Hamilton.

About 30 per cent of Lodge’s rentals in any given month are going to people who are coming predominantly from Auckland

Waikato Real Estate manages about 1,300 properties, from one-bedroom to executive houses that can rent for $1,000-plus a week. The expensive houses can prove troublesome in attracting tenants because no-one wants to pay $50,000 a year in rent; they are better off buying.

However, none of Waikato Real Estate’s managed rentals are sitting empty – the first time that has happened – and the agency has only 20 listings. Normally, it would have 40-50. Because of the tight market 40-50 renters are turning up at viewings.

“It’s just hard for tenants,” says Oliver Pearson, the property management team’s manager. Our property managers are doing more tenant due diligence than ever, given changes to the RTA and the difficulty of moving bad tenants on. Property managers are really not willing to take any risk at the moment.”

And rents are rising. Pearson says he is surprised at some of the rents being achieved. “Rent for properties we manage have probably risen on average 5 to 6 per cent or higher in the past 12 months – about $30 a week. That’s not unreasonable based on supply and demand. If there are 40 people turning up to a viewing, then it can’t be unreasonable, in my view.”

An average three-bedroom property is attracting rent of $575-$580 a week and a two-bedroom property $480-$500 a week. Tenants who can’t secure a Hamilton property tend to look further out to Cambridge, Raglan and Te Awamutu, but they have the same issues – too many tenants, not enough rentals and rents ticking up.

Changes to the Residential Tenancies Act have had unintended consequences for tenants, Pearson says. “Now the no cause eviction notice has disappeared private landlords don’t want to take any risk on tenants. At the lower end of the market it is tricky for tenants to find something. It’s the higher end of the market that is really in demand, about $650-$670 a week in rent.”

CLOCKWISE FROM TOP LEFT The city by night, Fieldays annual agricultural show, yummy Duck Island ice creams, Hobbiton village in nearby Matamata, dining out in Cambridge, Waikato stadium crowds.

Picturesque coastal Raglan – 40km west of Hamilton – is popular for surfing and its nearby native forests.

Property Movement

For the first six months of this year new properties added to the agency’s management portfolio came mainly from people moving to Australia who did not want to sell, preferring to rent out. “That has slowed down and we’re seeing more property investors picking up new properties to be managed. Things have turned around a bit probably because interest rates are possibly not going to go much higher and surging immigration, which is sort of spurring people on.”

Newer properties have been more popular over the past 12 months for investors because they still attract interest deductibility.

“Once that is phased back in again, investors will become more interested in buying older properties,” Pearson says.

Investing in Hamilton

For more information about investing in Hamilton go to www.waikatopia.org.nz.

Corelogic – Hamilton

Kelvin Davidson, Chief Property Economist

The data

Rental data is sourced from the Ministry of Business, Innovation and Employment based on rental bonds lodged. This data is supplied grouped into geographic areas based on statistical area units used by Statistics NZ for the census and as a result do not always match well with common usage suburb names.

The rental data for each area is matched to property price information from our database to determine property prices and therefore yield. The yield is calculated as the annualised rental income divided by the median property value calculated using our E-Valuer.

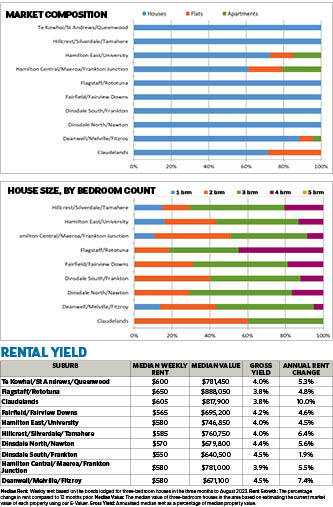

Market Composition

The rental market is dominated by houses. Of the 1,413 properties recently available for rent, 1,215 have been houses (86 per cent), with even numbers of flats and apartments – 99, or 7 per cent each.

The flats have been concentrated in Hamilton Central/Maeroa/Frankton Junction (42) and Hamilton East/University (36), with smaller numbers in Claudelands and Deanwell/Melville/Fitzroy. Hamilton Central/Maeroa/Frankton Junction and Hamilton East/University have also had the most apartments for rent (48 and 42 respectively), with a handful in Deanwell/Melville/Fitzroy.

Turning to houses, the spread recently available for rent has been right across Hamilton. This property type represents 100 per cent of recent rental listings in many suburbs – Dinsdale North/Nawton, Dinsdale South/Frankton, Fairfield/Fairview Downs, Flagstaff/Rototuna, Hillcrest/Silverdale/Tamahere, and Te Kowhai/St Andrews/Queenwood.

House Size, By Bedroom Count

Looking at houses recently for rent across Hamilton, none have had five bedrooms, with relatively few in the one-bedroom bracket too (7 per cent, or 87 properties) – mostly in Hamilton East/University and Deanwell/Melville/Fitzroy. The four-bedroom bracket has also been relatively small, accounting for 18 per cent of houses recently for rent, with Flagstaff/Rototuna a key market.

Two-bedroom houses make up 28 per cent of the rentals here. Hamilton Central/Maeroa/Frankton Junction, Hamilton East/University, and Deanwell/Melville/Fitzroy have all been key areas, with at least 50 properties in this bracket. Claudelands also has a strong share of two-bedroom houses, but it’s a smaller area.

In the key three-bedroom bracket (47 per cent of houses recently available for rent) there’s been a reasonable spread across the city, with at least 90 properties in each of Te Kowhai/St Andrews/Queenwood, Hamilton East/University, and Deanwell/Melville/Fitzroy. Te Kowhai/St Andrews/Queenwood and Dinsdale North/Nawton have the highest concentration, at 57 and 54 per cent.

Rent And Yield

Median weekly rents for three-bedroom houses across Hamilton are in a tight range from $550 in Dinsdale South/Frankton up to $650 in Flagstaff/Rototuna. The median values of these properties don’t differ all that much either, from $640,500 in Dinsdale South/Frankton up to $888,050 in Flagstaff/Rototuna.

Rental yields are quite closely bunched, from around 4.5 per cent in Deanwell/Melville/Fitzroy, Dinsdale South/Frankton, and Dinsdale North/Nawton, down to a touch less than 4 per cent in Hamilton Central/Maeroa/Frankton Junction, Claudelands, and Flagstaff/Rototuna. This compares well to many other parts of NZ.

Rental growth has been fairly solid across Hamilton for three-bedroom houses lately, in the range of 5-7 per cent annually, other than Dinsdale South/Frankton (a bit softer) and Claudelands, which has hit 10 per cent.