A Place Of Beauty, Culture And Good Coffee

Sally Lindsay discovers why Dunedin tops resident rankings and achieves a higher satisfaction rate than eight other urban centres. Images DunedinNZ

2 October 2023

The Otago Harbour Cycleway bridge crossing the Water of Leith.

The second-largest city in the South Island, Dunedin, is getting more recognition for its natural beauty, coffee and culture.

A mishmash of landscapes, this urban-meets-nature city is home to lush hinterland, rolling green mountains and spectacular beaches.

It is also a middle-sized student city, with job opportunities, study options and affordable house prices and rents. The country’s second university was established in Dunedin in 1869 and the city now has the highest population of students. Out of 126,255 people living in Dunedin, there are more than 25,000 students.

As a place to live Dunedin ranks highly for 85 per cent of its residents. The city topped resident rankings as a great place to live, achieving higher satisfaction than eight other urban centres in New Zealand in a survey last year. It has the only castle in NZ and the country’s steepest street.

Dunedin is also the commercial hub of Otago, and its hinterland excels in agriculture, engineering, hi-tech manufacturing, information communication technology, biotechnology, fashion, forestry, tourism, the meat sector and more. Projects planned for the city look to a future of steady, sustainable growth, ensuring a prosperous trades industry.

On the recreation front, the city’s beaches are different from anywhere else in the country. They are serene but wild and, most importantly, empty. On the Otago Peninsula residents can walk amongst distinctive nature and landscapes, which include dramatic cliffs, hills and wildlife.

A sunrise swim at St Clair’s Hot Water Salt Pool – heated to 28 degrees year round.

Cafe Culture

After a day at the beach or on the peninsula, Dunedin, as the most Scottish city in the country, offers many pubs to enjoy craft beer at its finest. Cafe culture is also well-established in the city.

It is one of the best-preserved Victorian and Edwardian cities in the Southern Hemisphere, and house prices are considerably less than other parts of the country. House prices have dropped over the year to August 1, but the gap is only 1.4 per cent from the biggest to smallest drop.

CoreLogic data for 10 of Dunedin’s suburbs where the largest changes in prices occurred show the biggest drop at 7.4 per cent and the smallest at 6 per cent.

Andersons Bay dropped 7.4 per cent from $693,200 on August 1 last year to $641,600 on the same date this year. Waldronville also dropped by the same percentage, from $790,000 to $731,900, followed by Outram dropping 7.3 per cent, from $778,750 to $722,250, and Fairfield declining 7 per cent from $789,000 to $733,600 as did Opoho, from $717,900 to $667,900. The smallest decline of 6 per cent was in Forbury where prices fell from $461,250 to $433,500.

Emerson’s Brewery in central Dunedin has been producing craft beers since 1992, tours include a guided tasting.

House Prices

Harcourts Dunedin branch manager Richard Stringer says it is realistic to buy a two or three-bedroom home for about or just over $500,000.

House prices appear to have bottomed out, with the city’s prices hovering around $580,000 for five months but rising to $625,000 in June on the back of low sales. He predicts prices will probably come back to sit in the $580,000-$600,000 range.

Gross yields on investment property are also better than most areas of the country. A median valued property of $580,000 generates a gross yield of 5-6 per cent, underpinned by consistent rental demand. “That is a good return,” Stringer says.

Despite the decent yields, investors are still sitting on the fence. “While it is not a bad time for investors to start looking at buying, most are waiting to see if there is a change of government.”

The exception is new builds – terraced houses or townhouses, with two bedrooms and two bathrooms, selling for $800,000-$850,000. Over the past three or four years, Stringer says many older houses on large sites have been cleared to make way for townhouse developments, but investors still have to hedge their bets and decide whether they can live with higher mortgage interest rates to potentially benefit from the possibility of a shorter bright-line test and reinstatement of tax deductibility after October’s election.

“Some investors will have confidence in the fact that although things might not change immediately, they will change at some stage,” he says.

He doesn’t think any investment interest will be a flood. “A National-led government says it’s unlikely there will be any changes in the first two years, but I think there will be some confidence changes will happen. Once a few more investors come back into the market we’ll start to see a bit more pressure, a few more bidders at auctions and a few more multi offers.”

ABOVE CLOCKWISE FROM TOP Loganburn Reservoir northwest of Dunedin, Penguin Place reserve, Sea Lion spotting at Otago Peninsula.

Land Supply

While house prices have been fairly stable, Stringer believes there is room for a little movement, but what will keep them from going up too far is the supply of residential land.

There are more than 1,000 residential sections in the pipeline and building prices seem to have levelled out. “So, if interest rates come back a little then building new will hold more appeal again and I think that will cap what buyers will be willing to pay for an existing older property.”

Along with the rest of the country, Dunedin’s listings have dropped, although in winter it is generally quieter. There were about 472 properties listed on Trade Me in July compared to about 700 in March. That is 300 to 400 shy of where Harcourts expects the summer market peak to be.

However, Stringer says the agency is starting to see properties that have been sitting on the market for some time now being bought as first home buyers with pre-approved finance realise there is a lack of choice.

Most of their buying has been in areas around Green Island and Concord where median priced houses of between $400,000-$600,000 sit. “There’s still steady activity in the upper end of the market, but most of the activity is in these areas.”

For buyers with more money, new-build four-bedroom, two-bathroom homes that might have been pushing $1.2-$1.3 million two years ago might now be selling for about $950,000 to $1.2 million. He says it is hard to find quality properties in Maori Hill, Roslyn, Waverley and St Clair, where they still command good value.

Buyers who are moving have ramped up their activity over the past 12 months.

“As the market has slowed this year people are taking the opportunity to upgrade and the improvement cost in terms of real dollars won’t be this close again,” Stringer says. “A buyer, for example, upgrading their $500,000 house to an $800,000 property applied the percentage difference in a few years and the $300,000 upgrade becomes $400,000. So, in real dollar terms, it’s probably as close as it’s going to be for some time.”

ABOVE CLOCKWISE FROM TOP LEFT iD Dunedin Fashion Show 2023, evening at Dunedin Octagon, Thieves Alley Market Day, summer fun at St Kilda Beach, Forsyth Barr hosts the All Blacks against Australia, Amanda Shanley Ceramics Studio.

The Rental Scene

New investment rentals are still appearing on LJ Hooker’s Dunedin books every month.

While some investors are buying and handing over their new properties to be managed by LJ Hooker, the agency’s management division operations manager Richard Thompson believes many of the new rentals are a result of landlords not wanting to take the risk of self-management because of Healthy Homes Standards and other onerous legislation.

“Tenants are also generally upskilling themselves and becoming aware of their rights, so they are keeping not just private landlords but property management firms across the board in check as well, which is great.”

Most of the new rentals have been bought by investors with existing portfolios. However, mum and dad investors sitting on the sidelines for two years because of tightened lending and rising interest rates, have been coming back. “They probably think if they can afford it now, they will be able to keep the property or they are taking a gamble the government will change in October,” Stringer says.

There is a general shortage of Dunedin rentals, if the student market is excluded, but even that has fallen back because of the change to 90-day notices.

Most private rentals are in central and North Dunedin and the market normally sits at about 180 to 250 available properties, whereas there are now 370 for rent, Thompson says.

Popular areas for renters are St Kilda and St Clair beach suburbs on the flat, Waverley and Otago Peninsula, with spectacular views, and Roslyn for mature families as it is quiet. “Every area has its own niche market, which all people seem to like.

“No area seems to be more popular than another because people who have to move just need a house. The first thing they have to sacrifice is area,” he says.

Smart Approach

“We get quite a few people showing up to a viewing because the landlord is selling and has given them a 90-day notice to leave. If they don’t act smartly, they then start running out of time and have to take something somewhere because not only do they have to get their foot through the door, they have to be able to secure the property against a number of good applicants.”

Two-bedroom townhouses are always popular with Dunedin renters. “All properties in the city have their own market and every property seems to be renting at about the same sort of pace – going out the door after one to three viewings. Other sought-after rentals are one-bedroom units or flats.”

An average two-bedroom property can range from $400-$450 a week, and an average three-bedroom, between $450-$580 a week.

“Rents can depend on the area and the landlord as well. Some landlords need higher rents so they can cover the costs of owning a rental. Other landlords, who don’t have big mortgages, like to be fair, offer a bigger selection of rentals or open their rentals up to a larger clientele, so they don’t need their properties priced at market rent. They are happy to drop it below market rent, which is great to see.”

Beautiful Andersons Bay – ‘Andy Bay’ to its friends – sits to the south east of Dunedin city.

Over the past year tenants have become savvy at putting their best foot forward. Stringer says the agency has received group CVs containing photos and a rundown of who the prospective tenants are to go with their application. “We’ve actually been quite impressed.”

The student market, a large part of Dunedin’s rental sector, has turned upside down since the ban on no-cause 90-day notices. Thompson does not disagree with it but says it has meant there are fewer properties available as student renters don’t want to say whether they are going to renew the tenancy or look for somewhere else. “There are probably only 100 student properties available now, whereas normally there are 300. With those hundred properties, 20 to 30 groups show up per viewing and we are only able to select one.”

Investing In Dunedin

For more information about investing in Dunedin go to www.otago.nzpif.org.nz.

Dunedin

by Corelogic Kelvin Davidson, Chief Property Economist

The Data

Rental data is sourced from the Ministry of Business, Innovation and Employment based on rental bonds lodged. This data is supplied grouped into geographic areas based on statistical area units used by Statistics NZ for the census and as a result do not always match well with common usage suburb names.

The rental data for each area is matched to property price information from our database to determine property prices and therefore yield. The yield is calculated as the annualised rental income divided by the median property value calculated using our E-Valuer.

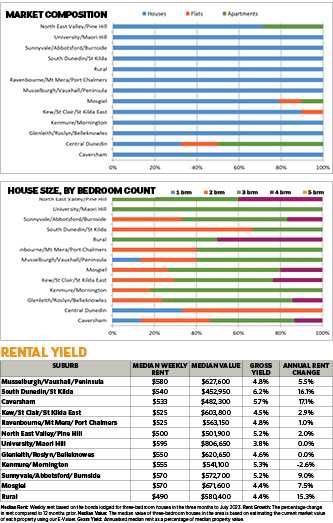

Market Composition

The rental market across Dunedin is dominated by houses. Of the 492 properties recently available on the market for rent, 411 have been houses (84 per cent), 27 flats (5 per cent), with 54 apartments (11 per cent). Flats have been concentrated in Central Dunedin (15 properties), with six each in Kew/St Clair/St Kilda East and Mosgiel. These properties have represented 18 per cent of all those on the market for rent recently in Central Dunedin. Apartments are also a key property type in Central Dunedin (42), with a handful in Mosgiel and North East Valley/Pine Hill.

Turning to houses, the largest markets for rentals lately have been Glenleith/Roslyn/Belleknowes (63), Kew/St Clair/St Kilda East (51), with Mosgiel, Musselburgh/Vauxhall/Peninsula, and Caversham all with 45. But in terms of concentration rates, many parts of Dunedin are 100 per cent – eg Kenmure/Mornington, University/Maori Hill, South Dunedin/St Kilda, Sunnyvale/Abbotsford/Burnside, Rural, and Ravenbourne/Mt Mera/Port Chalmers.

House Size, By Bedroom Count

Looking at the 411 houses recently for rent across Dunedin, none have had five bedrooms, and only 21/5 per cent with one.

The four-bedroom category has also been relatively small, with only 54 properties, or 13 per cent, of houses recently for rent. Kew/St Clair/St Kilda East has been the largest area for four-bedroom houses.

Looking at the more significant market for two-bedroom rental houses in Dunedin (123/30 per cent), the largest areas have been Central Dunedin (18), and Caversham, Glenleith/Roslyn/Belleknowes, and Kew/St Clair/St Kilda East, with 15 each. In Central Dunedin and South Dunedin/St Kilda, two-bedroom properties have been 67 per cent of all houses recently available for rent.

For three-bedroms, 213 were available for rent across Dunedin, or 52 per cent of houses. Glenleith/Roslyn/Belleknowes (39), Kenmure/Mornington (27), and Musselburgh/Vauxhall/Peninsula (27) have been the largest markets, with fairly high concentration rates; Kenmure/Mornington (82 per cent) and Glenleith/Roslyn/Belleknowes (62 per cent).

Rent And Yield

Median weekly rents for three-bedroom houses across Dunedin are in a tight range from $490 in rural areas, up to $595 in University/Maori Hill.

The values for these properties are more widely spread, from $452,950 in South Dunedin/St Kilda up to $806,650 in University/Maori Hill.

Rental yields have quite a wide range, from less than 4 per cent in University/Maori Hill, up to more than 5.5 per cent in Caversham and South Dunedin/St Kilda.

Rental growth itself has been wide-ranging across Dunedin lately, with three-bedroom houses falling by 2.6 per cent in the past year in Kenmure/Mornington, but rising by more than 15 per cent in Rural, South Dunedin/St Kilda and Caversham.