A Tale Of Two Halves

Intense focus on Auckland’s flatlining property market ignores the reality for drama, but it does highlight that the country’s property story is now in two distinct parts, reports Miriam Bell.

30 April 2019

Anticipation over potential policy changes aside, Auckland has been hogging the property market spotlight of late. But these days that’s due to flat, if not slipping, price growth and muted sales activity, rather than market exuberance. And it’s fanning the flames for those predicting a crash.

This speculation is a persistent and ongoing discourse, which just won’t let up. Yet it doesn’t reflect the more complex reality of Auckland’s market. Nor does it reflect the state of the rest of the country’s markets to any extent.

The very different state of the Auckland market versus other markets is a tale of two halves, so we’re taking a look at each side of the great divide.

Super City Focus

The halcyon days of the Auckland market’s recent past were never going to last. Price growth at that level is not sustainable. When the cycle turned, growth and sales were always going to drop off. It took a while to become evident, but a slowdown is exactly what is happening in the market now. QV’s latest House Price Index shows that values in the Auckland region decreased by 1.5% year-on-year and by 0.8% over the past quarter. This left the region’s average value at $1,039,917, as compared to $1,055,992 at the same time last year.

This month’s REINZ data has Auckland’s median house price dropping by 2.7% year-on-year to $856,000 in March. Likewise the most recent data from Realestate.co.nz records the region’s average asking price dropped to $942,232 in March. Trade Me Property shows the region’s average asking price has fallen by $25,000, to $925,550, from its peak in October last year.

Barfoot & Thompson’s price data was slightly more upbeat. It had Auckland’s average sales price at $931,673, which was up on both February and March last year. It also had the median price up on February at $836,000 but it’s considerably down on March last year.

At the same time as prices are flatlining, sales activity across the region can best be described as subdued. According to REINZ, sales plummeted by 18.2% to the lowest number (2,006) for the month of March since 2008. It’s worth noting though, that sales volumes were up on February by 45.3% respectively.

‘Extreme view holders are seizing on titbits of information to lay hints that things are uglyin Auckland and about to get worse’ TONY ALEXANDER

Barfoot & Thompson’s data suggests some pick-up in sales volumes, as compared to February. The agency saw 963 sales in March and that’s nearly double the 474 sales seen in February.

Yet sales were still not over the 1,000 mark, which is what the agency would expect for sales in March. Given the data across the board shows new listings and the amount of housing stock on the market are both up, there’s a growing consensus that the Auckland market has shifted to favour buyers.

Looking Nationwide

Around the rest of the country, the picture painted by the data is far rosier. While growth has slowed overall, many markets continue to perform very strongly. And that is giving support to the national market, which still looks very healthy.

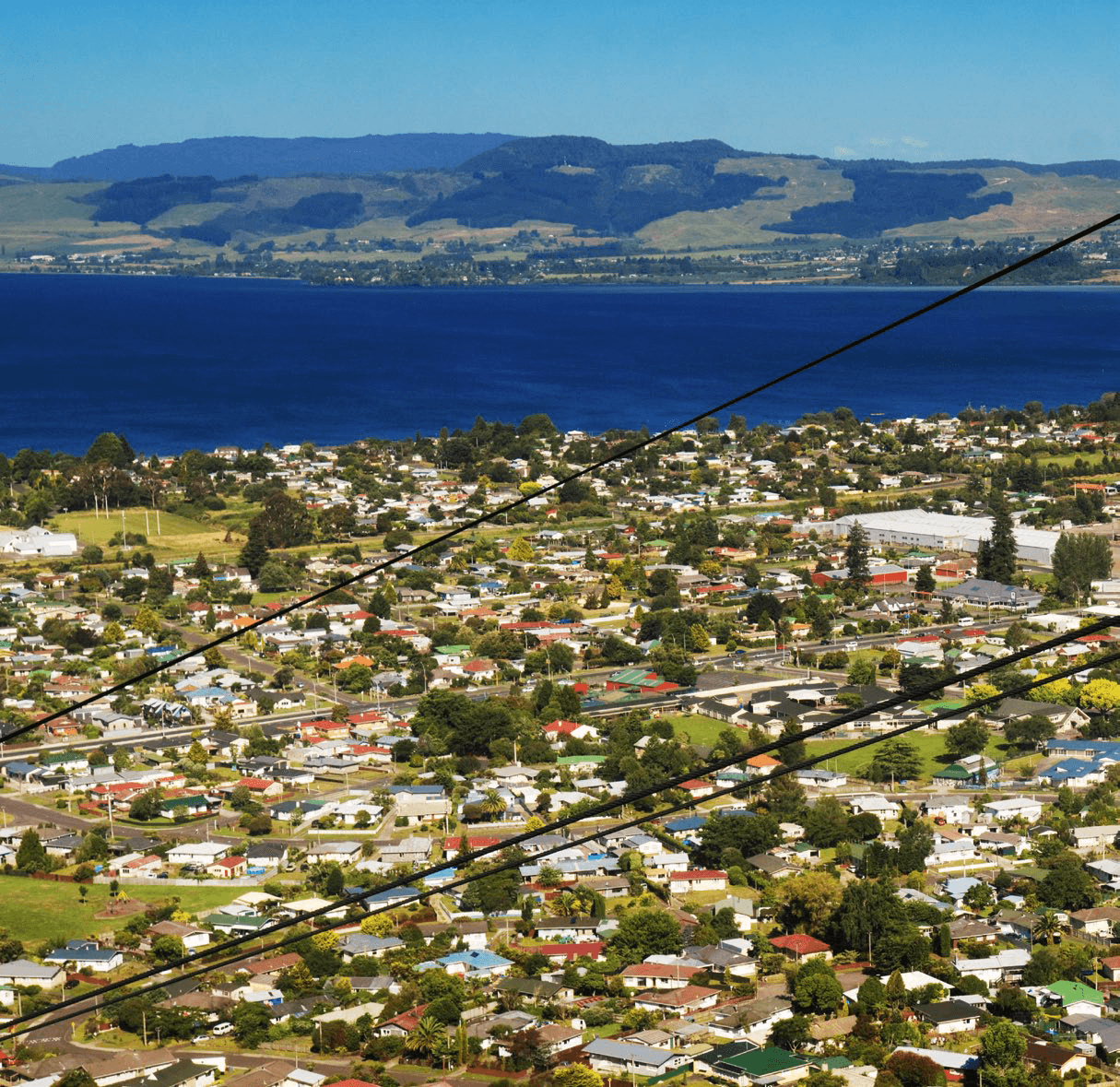

According to the QV House Price Index, national property values grew by 2.6% over the past year and by 0.5% over the past quarter. That left the national median value at $686,523 in March 2019. But the strongest value growth is being seen in areas like Rotorua and the Hawke’s Bay. Of the main centres, Dunedin and Wellington are leading the way.

Dunedin saw value growth of 13.3% year-on-year and by 3.7% in the three months to March, which left the city’s average value at $451,199. In the Wellington region values rose by 8.4% year-on-year and by 2.2% over the past quarter, leaving the region’s average value at $702,896.

Realestate.co.nz and Trade Me Property’s data both also recorded increases in national prices and strong regional price growth in many markets. However, it was the REINZ data which was most interesting. First up, it has sales activity nationwide taking a fall.

The number of properties sold in March was down by 12.9% to 6,938, as compared to 7,964 in March last year. Breaking the data down further, 15 out of 16 regions across the country saw an annual fall in sales volumes. This follows on from a drop in

listings in both February and March.

Despite the plunge in sales activity, median house prices around the country

increased by 4.5% year-on-year in March, leaving the national median price at a record $585,000. Around the country, 14 out of 16 regions saw an annual increase in the median price and Hawke’s Bay, Otago and Southland all hit record median prices.

No Drama Ahead

Looking ahead, most commentators are predicting more of the same for the market nationwide, with slowing growth but nothing dramatic. Most also say the Auckland market is plateauing, but has been flat for some time and is settling into a new normal – rather than teetering on the edge of a crash.

BNZ’s chief economist Tony Alexander is outspoken on this. He says extreme view holders are seizing on titbits of information to lay hints that things are ugly in Auckland and about to get worse.

As an example, he points to stories about some houses selling for 30% below their RVs and of rapidly falling sales and prices easing in the inner-city apartment market. He doesn’t set much store for such examples and says they are entirely consistent with the market being in the flat stage of its cycle. “It will now and then go down a bit, now and then go up a bit. But underneath population growth continues apace, interest rates are falling, and while dwelling consent numbers are high many projects will never come to fruition.”

Alexander says it is not in Auckland that the most interesting housing developments have occurred over the past two years, but in the regions, and that will remain the case through this year. “Then we expect to see the regions slowly flatten out as we advance through 2019 into 2020.”

After that the next interesting thing will be Auckland rising again, he adds. “That might happen in 2021, but it feels too soon and people risk placing too much emphasis on the economic stimulus from a really big international meeting and boat races.”