Buy Or Build

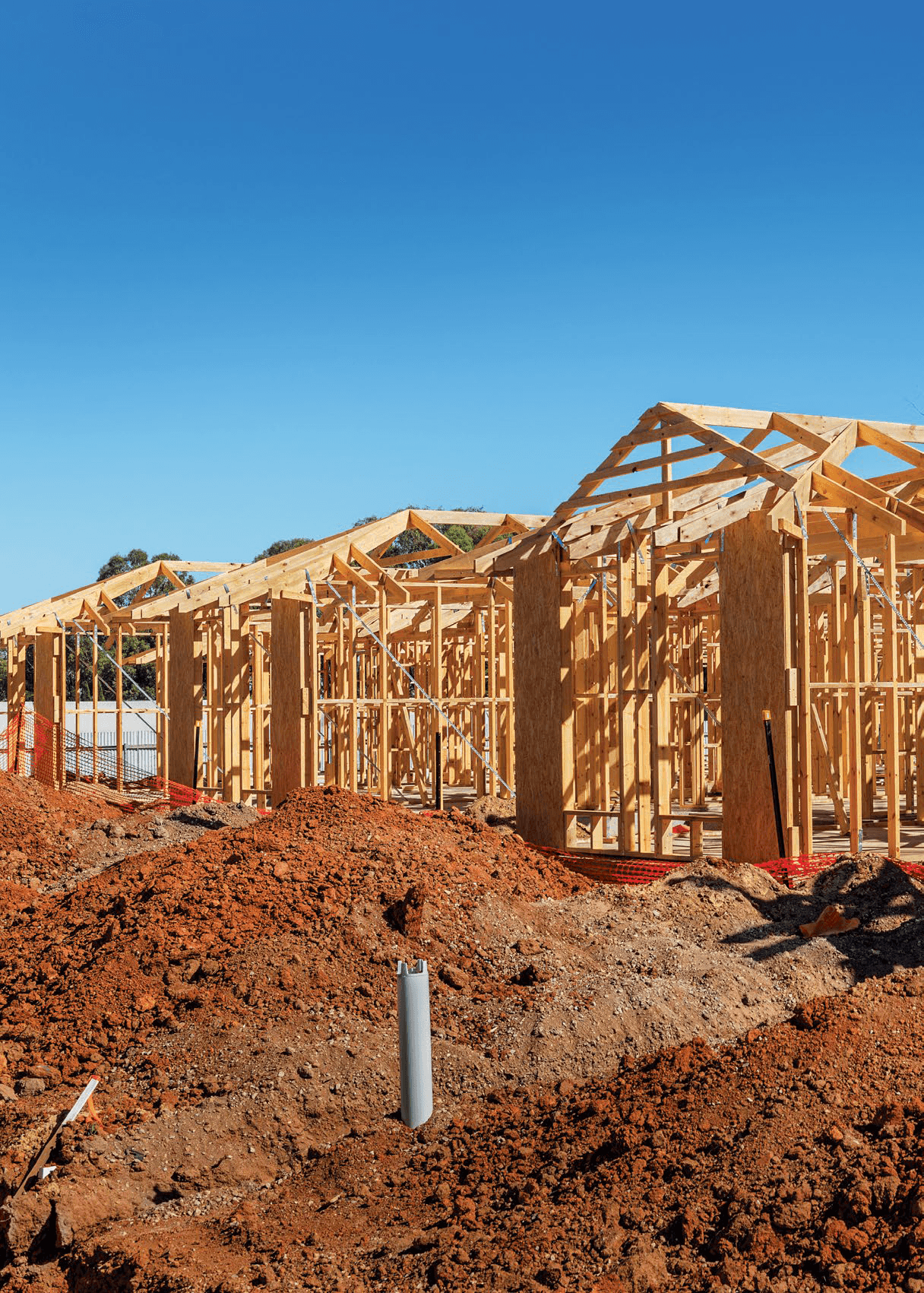

There are locations across the country where you can buy a house that couldn’t be built for the purchase price. Amy Hamilton investigates the cost of construction versus buying an existing modern home.

1 March 2018

New Zealand’s property market right now is a tangled beast of a thing: investors are nervous, first home buyers are ravenous and listings are tight. Yet there is always untapped value out there waiting for the right buyer. There are properties on the market below the price it would cost to build them – even relatively new properties. How does this happen? It’s a combination of factors, but the biggest factor is the higher cost of construction in 2018.

“Our data shows there has been a 25 to 28% increase in construction costs over the past five years,” says Geoff Hayr, associate director at Maltbys. “It all comes back to supply and demand. In Auckland there’s a scarcity of labour resources and construction is booming generally. Christchurch is tapering off but, over the past five years, it’s contributed to the increase. Resources were pulled into Christchurch and now other parts of the country are taking off, so it’s harder finding tradespeople. Materials have increased in cost, and health and safety compliance has added some cost, too. When you break it down into trades – carpenters, electricians, plumbers – they can be really hard to find. It’s also hard to get builders to price work.”

The result is that building, renovating and extending are expensive. Pricing a mid-range 140m2 house cost based on a group build [see sidebar] gives you a build price of $252,000, plus GST, taking it to $289,800 – and remember that siteworks are not included. If you’re planning a oneoff build, it will cost $420,000 plus GST, taking it to $483,000.

To investigate the general balance between house and land prices, across New Zealand, we’ve compared only standalone three-bedroom houses between 120 and 160m2. Only houses built after January 1, 2005 are included, because they meet the current building code. So, in theory, these are less likely to require a major renovation to make them approach the quality of a new build. Then we’ve used land you could build one on, between 300m2 and 1,100m2. Side-byside we’ve compared a 140m2 three bedroom house from each price quartile with the same quartile for land.

Our data shows there has been a 25 to 28% increase in construction costs over the past five years’ GEOFF HAYR

Crunching the region-by-region data on house prices versus land prices produces some surprising results. First, there are areas in New Zealand where you can buy a house that’s only a few years old, including the land, for below what it would cost to build today. That looks like a fantastic buy for the future. Unless construction costs come down, you’ve instantly got built-in value when you buy a house like that. Second, there are parts of New Zealand where section prices haven’t yet caught up to house prices. That means buying land right now could be an excellent strategic move.

You Couldn't Build It For That

There are several regions of New Zealand where existing houses, built under the latest Building Code look like especially good value – or where land is incredibly overpriced. Land looks particularly overpriced in Auckland. Finding a section is nearly impossible and, for those sitting on a decent piece of land, the numbers say you’d be better off subdividing and selling the land rather than developing it yourself. If you were planning on doing a serious extension on your home, the construction costs mean you might be better off selling it and buying a new one.

In other regions, land prices are also relatively high compared to the price of newish homes. Southland is one of those regions: “The market here has been stagnant for a long time,” says Avinash Varghese, CEO of Pride Property. He says Gore looks really good for the future, with a new milk processing plant being built that will create 80 new executive jobs. Lumsden, too, he thinks is one for the near future. In his home town of Invercargill, he sees young professionals take huge leaps up the career ladder compared to what they could achieve elsewhere. “It’s terribly underpriced, and it’s been underpriced for far too long.”

Taranaki is another region where you can find “couldn’t build it for that” properties, but that may be for a limited time only. Local investor Lew Sarten, president of the Taranaki PIA, says land prices are catching up fast; “land is flying off the shelf here at the moment.” In the meantime, though, he says there are still plenty of good deals in the area.

Buy Land, They're Not Making Any More Of It

The story is quite different in other regions of New Zealand. Northland has a high supply of land, resulting in prices that make building a house look much more attractive. It has the largest gap between house and land prices of any region, giving you a more substantial build budget.

“Land is always good – even if you just buy it and sit on it,” says Lisa Struneski, co-director of Mike Pero Whangerei. She’s had her eye on several sections over the past few months, having seen some three-storey townhouses selling for a million dollars each while sections can sell for under $200,000. Struneski says buyers are often worried about what the council will or won’t allow on a section, but she thinks that will gradually change as the region develops.

“Look at Marsden,” she says, an area which Winston Peters has promised will be developed as part of a Northland rail project. “You can buy a piece of land there right now for $450,000 and that is a subdivision waiting to happen. Run cattle on it in the meantime and then chop it up later.”

‘Invercargill’s terribly underpriced, and it’s been underpriced for far too long’ AVINASH VARGHESE

Otago is another region where land is surprisingly affordable when compared to house prices. In a reversal of the Auckland situation, land in parts of Otago leave you a bit of a budget to build a house. Kelvin Collins, managing director of Harcourts Otago, says you can buy a “family section” in Central Otago, excluding Queenstown, for under $300,000. Dunedin, he adds, is “extremely cheap – but you’d be better off buying existing.” There’s a trend towards smaller sections across Central Otago as buyers shift toward smaller homes. But Collins says that, for his money, the best buy would be a seriously excellent section, at the top of the market, with a lake view. You’d spend a big chunk of cash, but there’s so few of those sites left that he thinks they’ll see growth in the future.

The Wellington property market has gone off like a rocket over the past 12 months, so perhaps it’s not surprising that land prices haven’t quite kept up. Nick Goodall, head of research at CoreLogic, worked on putting together our data. He said several people in their Wellington office have been starting work on builds recently after struggling to find houses. Local investor Suzanne Taylor says the market barely took a breath at Christmas before surging again in early January: “If land prices aren’t high at the moment I would have said they will be going up,” she says, with first home buyers out in force and “blimming good prices”

Find Value In Your Local Market

How much is a section in your location? How much is a new house or one off the plan? What is the price on a five to 10-year-old house? How much would it cost to buy the land and build that house? Would a build be better value than a major renovation?

It’s worth asking all these questions before you stick to a tried-and-true “buy a dunger and renovate it” strategy. Renovation prices have skyrocketed alongside build prices, so a newer lowmaintenance property could be a great buy when you take the long-term costs into account. Even within a region each suburb, and even each street, can have its own pricing and peculiarities. But if you analyse the numbers and think laterally, you can take advantage of inefficiencies in the market and become an innovative, creative and successful property investor.