Culture, Heat And Affordable Homes

Rotorua is famed for its geothermal activity and heritage. It’s also a cheaper spot to buy property, Sally Lindsay discovers. Images RotoruaNZ.com and iStock

3 December 2023

Rotorua is an all-round tourist magnet with its geothermal attractions, adventure activities, lakes and forests.

This city attracts many visitors to its smoking cracks and craters, despite the at times overwhelming smell of sulphur. While the famous bubbling mud pools and thermal springs scattered across the city and its outskirts provide much of the appeal, Rotorua offers more than just the natural wonders of its restless footing.

It has glistening lakes and spectacular forests where residents benefit from world-class outdoor activities like boating, swimming, mountain biking, trail running and fishing.

As the home of Te Arawa and centre of Maori arts and crafts learning, as well as Maori tourism, this is a place where culture thrives.

The city’s name is derived from the Maori terminology Te Rotorua-nui-a-Kahumatamomoe, which means the second great lake of Kahumatamomoe. A total of 17 lakes make up the system of water bodies that are collectively Lake Rotorua. The lake is used for various water-sporting events and often as a landing and take-off site for seaplanes.

Nicknamed Rotovegas by its inhabitants, the city’s main street is lined and characterised by various restaurants and businesses perhaps a little like those found in Las Vegas.

However, it is more than that – an inland city of 80,000 in an ancient (240,000-year-old) volcanic caldera, which has one of the country’s most diverse economies with businesses offering job opportunities across forestry and wood processing, tourism, geothermal, agribusiness, education, health, manufacturing and social services.

ABOVE Rotorua has a large timber industry; jade carving is a local specialty.

East Access

Within a 63-kilometre radius, a one-hour commute or less, Rotorua is easily accessible from the neighbouring towns of Tauranga, Whakatane, Kawerau, Edgecumbe, Taupo and Tokoroa, significantly widening the workforce catchment area.

One of the city’s top attractions is its globally acclaimed mountain biking. Red Bull declared the Whakarewarewa Forest as one of the top eight mountain biking locations in the world.

The city and its vicinity are also famous for other adventure sports, including kayaking, shooting and angling. The Rotorua Pistol Club is one of the largest in the world.

It’s also cheaper to buy property in Rotorua which has lakeside, rural and city living options to rent or buy to suit all budgets and lifestyles.

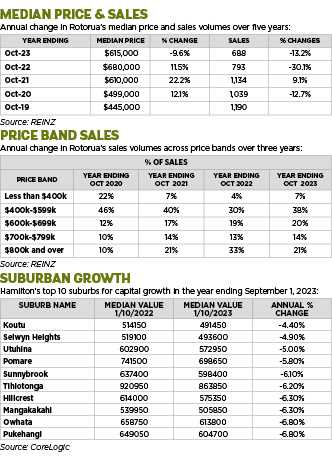

An average three-bedroom house will cost $600,000-$650,000. Rotorua has not been immune to falling prices; the latest CoreLogic data shows house values in 10 suburbs falling between 6.8 and 4.4 per cent.

The biggest falls were in Pukehangi, with prices dropping from $649,050 at October 1 last year to $604,700 on the same date this year; Owhata dropped from $658,750 to $613,800; Mangakakahi declined 6.3 per cent, from $539,950 to $505,850.

Among the smaller house price drops were Koutu, falling 4.4 per cent from $514,150 to $491,450, followed by Selwyn Heights (4.9 per cent from $519,100 to $493,600) and Utuhina (5 per cent from $602,900 to $572,950).

In the pricier suburbs, Tihiotonga dipped 6.2 per cent from $920,950 to $863,850, while Pomare fell 5.8 per cent from $741,500 to $698,650.

ABOVE, CLOCKWISE FROM TOP LEFT CBK, Whakarewarewa Forest Loop, Treewalk, Kaituna Cascades at Tutea Falls, Hidden Forest Venue, Eat St.

‘Good Value’

Located just outside the golden triangle of Auckland, Hamilton and Tauranga, Rotorua is touted as “good value for the money” despite declining prices.

First National Rotorua director and auctioneer Murray Piesse says compared to Tauranga, just over an hour away, Rotorua’s house prices are $100,000 less. “Prices have still risen at an ‘insane’ rate, though; $100,000 a year since 2015 and $150,000 in 2019/2020.”

Now there is a new National-led government, Piesse expects investors to return. Either they will be buying or selling, having waited until the bright-line test is brought back from 10 years to two years as National promised. “There will be a pent-up swathe of investors who have been sitting and waiting and I think both sides of the market will take off – listing and buying.”

Listings for his business are typical for this time of the year – they were low in winter and rising in the spring.

Skyline Luge.

Rotorua has been a local buyers’ market recently, although it did have some foreign purchasers before the previous Labour government put a 2018 ban in place.

It might once again appeal to foreign buyers who will be able to buy if the value is over $2 million and they pay a 15 per cent tax on top (if National’s housing policy goes ahead).

“Owners with a $1.8 million house who have not been that keen on selling might put their house on the market for $2 million-plus to see if they can make an extra $200,000 by selling to a foreign buyer. It sounds possible, but whether it will work is anybody’s guess. It’s an interesting rule, though.” However, he says $2 million houses in Rotorua are few and far between. “They are mainly lakefront and there is a waiting list.”

Rotorua’s average sale price is about $650,000 for a three-bedroom house, Piesse says. At $700,000 buyers are starting to get something better and at $800,000 it’s nearing the top of the range, although a new house will be more expensive, particularly if it has been finished in the past year. “Developers are still looking for top dollar as building costs are so high.”

New private housing subdivisions have been on the back burner. “There haven’t been any at all, apart from social housing and iwi-led developments,” Piesse says. “I can’t remember the last one of any decent size in Rotorua.”

He says the standstill in private subdivisions is down to excessive land and building costs. “As an investor, they are too expensive to buy and the return isn’t good enough – the rent doesn’t anywhere near cover the mortgage, rates, insurance and other expenses.”

Median Sale Price

Piesse says he has found that the best rate of return on a Rotorua investment property is buying at the median sale price. “If buying a cheap rental in a less salubrious area, there is the risk the rent won’t be paid regularly because the calibre of tenant/s might not be good enough. If buying a higher priced rental in a good area it will attract a good rent and tenant, but an investor might still need to top it up by $400 a week to cover the mortgage. I have always bought median priced rental properties and it has worked out about right over the years.”

Landlords have been attacked on every front over the past five years. “Even if the properties are freehold, investors are not getting much of a return after bringing them up to the Healthy Homes standards and paying ever increasing rates and insurance.

“Even owning two rentals will not be enough to retire on. An investor probably needs a portfolio of properties, so they can sell one or two, make possibly $1 million and put the money in the bank for retirement living expenses.”

But rentals are still a good investment, he says. If Piesse puts one of his on the market, he can get dozens of tenants applying for it and rents keep rising.

Gone in a Day

The desperation of tenants looking for a rental is a recurring theme for Rotorua’s housing market, which has been hampered by a lack of rentals for years.

Making it worse has been the influx of the homeless taking over the city’s motels rented by the Ministry of Social Development for emergency housing during the pandemic. The huge number of homeless have added to the number of tenants looking for private rentals.

Many turn up to viewings, but property managers know they are only there to show the ministry they have been making efforts to find a rental to keep their emergency housing place. Most can’t afford a private rental and even if they could it is difficult to get one. “We get something and it’s gone,” says Raewyn Greer, Professionals McDowell Property Management business development manager. “We’re not even getting to advertise some rentals because we’ve got an overflow of tenants still looking after a previous property we have had on the market is rented.

“Recently we had a three-bedroom house advertised. I showed 10 groups of people through – all good tenants already in the system, and nine had to be rejected before I had another property to rent, which I let to one of this group before it was advertised. We have a real shortage or rentals at every level.”

Rents are also rising with tenants willing to pay them, Greer says. Most properties being re-rented are put back on the market for another $50 a week. “Nobody is querying the rent rise because they’re so desperate to get something. It’s just being accepted.”

What better way to end your day than watching the sunset at Rotorua’s lakefront.

Rent Scene

About $500 a week is normal for a three-bed house. There are still properties the agency has had on its books for years that are renting in the $280 a week range. “We are telling landlords to put the rent up otherwise tenants are going to get a shock if it suddenly rises to $500-plus a week if it is ever re-rented,” Greer says.

For existing tenants rents are going up incrementally. “They know if they move out and want to rent a similar property again, it could cost them probably another $100 a week.”

Investing in Rotorua

For more information about investing in Rotorua go to www.rotorua.nzpif.org.nz

Corelogic Analysis – Rotorua

Kelvin Davidson, Chief Property Economist

The data

Rental data is sourced from the Ministry of Business, Innovation and Employment based on rental bonds lodged. This data is supplied grouped into geographic areas based on statistical area units used by Statistics NZ for the census and as a result do not always match well with common usage suburb names.

The rental data for each area is matched to property price information from our database to determine property prices and therefore yield. The yield is calculated as the annualised rental income divided by the median property value calculated using our E-Valuer.

Market Composition

The rental market across Rotorua is dominated by houses, which is normal for most parts of the country. Of the 309 properties recently available on the market for rent, 243 have been houses (79 per cent), with 39 flats (13 per cent) and 27 apartments (8 per cent). All the flats and apartments are in Kuirau/Hillcrest/Glenholme.

The largest market for houses recently available for rent in Rotorua has been Ngongotaha/Pleasant Heights/Koutu (99), followed by Kuirau/Hillcrest/Glenholme (66), and Holdens Bay/Owhata/Ngapuna (42). Pukehangi South/Springfield and Rural Rotorua have been smaller markets for rental houses, but this property type has still represented 100 per cent of all dwellings recently available.

House Size, By Bedroom Count

Looking specifically at the 243 houses recently for rent across Rotorua, none have had five bedrooms, and only nine with one bedroom – all in Kuirau/Hillcrest/Glenholme.

About 60 per cent of houses recently for rent have had three bedrooms, with Ngongotaha/Pleasant Heights/Koutu (63) the largest market. Pukehangi South/Springfield, Holdens Bay/Owhata/Ngapuna, and Kuirau/Hillcrest/Glenholme have all had between 20 and 30 properties in this bracket. In Pukehangi South/Springfield and Rural Rotorua, three-bedroom properties have represented 100 per cent of the houses recently available for rent.

Two-bedroom properties have recently accounted for 23 per cent of all houses available for rent, with Kuirau/Hillcrest/Glenholme (30 houses) and Ngongotaha/Pleasant Heights/Koutu (21) being key areas. And, finally, for four-bedroom houses recently available for rent, Ngongotaha/Pleasant Heights/Koutu and Holdens Bay/Owhata/Ngapuna have been the key markets.

Rent and Yield

By matching average value to rent we can look at gross yield for three-bedroom houses in each area.

Median weekly rents for three-bedroom houses across Rotorua range from $535 in the Rural market, up to $600 in Kuirau/Hillcrest/Glenholme, although Pukehangi South/Springfield also comes in just a little lower, at $598. The range of median values for this property type is also quite tight, from just short of $590,000 in Kuirau/Hillcrest/Glenholme up to a bit more than $680,000 in Pukehangi South/Springfield.

This results in a relatively uniform picture for gross rental yields too, ranging from 4.5 per cent in Pukehangi South/Springfield up to 5.3 per cent in Kuirau/Hillcrest/Glenholme. Even in the lower end of that spectrum, Rotorua yields for three-bedroom houses look pretty attractive by national standards, reflecting solid levels of rents themselves.

In addition, those rents have shown decent growth lately, of 3-4 per cent over the past year in most parts of Rotorua, but right up at 7 per cent in Kuirau/Hillcrest/Glenholme.