Deals In Christchurch City Centre

The rental oversupply is lessening and opportunities are presenting in the Garden City centre, writes Louise Richardson.

1 April 2018

A natural disaster can change a city or town’s dynamic, in ways that were previously unimaginable, and that’s certainly what’s happened in Christchurch.

We are seven years out from the shake in September 2010, and the more deadly and destructive earthquake of There was a small amount of growth (just over 0.8% over the last quarter) in Christchurch. February 2011. Much of the housing that was marked with a red sticker in the aftermath has been replaced with new builds, superior in quality to the destroyed properties. These owners are settling in, finally, with thoughts of selling far from their minds.

Additionally, most owners of repairable dwellings are also now back in their homes and many of the hundreds of tradespeople, and associated rebuild workers, who moved in immediately after the quake, have finished what they started and left the city.

Interestingly, in January, Christchurch City Centre was the most searched South Island location on Trade Me Property, with 8000 searches. There’s clearly no lack of interest in the local market – just a notable lack of action.

So, it’s understandable that Christchurch Central which extends beyond the CBD to Addington, Bishopsdale, Papanui, Fendalton, Ilam, Merivale, Riccarton, Richmond, Shirley and other surrounding suburbs is being widely described as flat. Although QV reports that there was slight growth in value of 0.8%, over the last quarter, which may provide justification for guarded optimism.

Oversupply Lessening

For some property investors the high-supply of stock is bad news. Particularly if they are being forced to join the still small, but rising, number of owners selling at a loss in the Garden City. Unable to positively gear their investment, while facing increased costs due to impending tenancy regulation.

In addition, although rental oversupply in the city is generally accepted, Christchurch rental listings on Trade Me have fallen by 19% in the year to January 2018.

Nigel Jeffries, Head of Trade Me Property, says that’s actually a good thing, in many ways. There had been a huge surplus of rentals, leading to lower rents in the two years prior, dating from about the time that temporary residents started leaving the city.

“It certainly hasn’t turned into a situation with too few rentals yet,” he says.

He suspects that increased costs, low growth, and maybe impatience with the market, could be motivating some landlords to get out of the investment business.

“But I’m broadly optimistic that values are going to improve [there] but it won’t be by a lot – at this stage, maybe 1-2% this year.”

Jeffries says that Trade Me is creating around 25 jobs in Christchurch – partly because the company believes in having representation in centres outside Wellington, but also in the expectation that the Christchurch Central property scene is going to improve in time.

“If enough businesses do this, it will hopefully help to stimulate growth.”

What Tenants Want

Naturally, if you want to rent out a property in Christchurch, quality is key. If a dwelling – especially an apartment, townhouse or unit – all of which are enjoying a current upsurge in popularity, is well-presented, with insulation and sufficient heating already installed, there will generally still be suitable tenants around. However, landlords have to accept that the letting process can take time, and they will need to be able to cope financially while they wait.

‘I’m broadly optimistic that values are going to improve but it won’t be by a lot’ NIGEL JEFFRIES

Sharon Layton at Quinovic Merivale, a suburb that retains its reputation for quality dwellings, has extensive experience in the local market. She, too, believes that things will eventually pick up in Christchurch Central but agrees that the changes, over the last two years, have been fairly dramatic in terms of the drop-off. Nevertheless, she did have a surprisingly busy Christmas and New Year period. However, since then, it’s been quiet again.

She says that tenants now have so much choice on offer, in the inner suburbs. They take their time, applying for a number of rentals – and then go with the one offering the best deal, disappointing those landlords whose, often high-quality, properties are being rejected.

Market Outlook

iFind Property’s Christchurch based finder, Maxine Clason-Thomas, says the market is currently very flat making it a strong buyers’ market. While Christchurch’s population fell after the earthquakes it has recovered and has now exceeded its pre-quake levels. She says there is also strong predicted growth over the coming years.

This will help reduce the current situation where there is an over-supply of houses.

Clason-Thomas says because of this oversupply situation investors can get good deals and acquire properties for prices below the current CVs (council valuations) which came out back in 2016 (gross yields of 7-8% are on offer on the fringe of the city).

She says investors can pick up good buy and holds and many are preferring to purchase new houses rather than existing stock. Well-located new builds can be bought with forecast yields of between 5 and 6.5%. Some of the properties bought in the Central Christchurch area are predicting a higher demand for AirBnB style rentals potentially generating yields of between seven and eight percent.

Investors are being warned about buying houses which have had earthquake “repair” work done on them. There have been a number of reported stories where the repair work has been substandard with some damage issues not identified and/or fixed.

Clason-Thomas recommends investors do “very thorough due diligence” on these properties and go through the Scope of Works with a fine tooth comb.

There remains a lot of activity in the as-is-where is market. Some groups are buying these earthquake damaged properties, renovating and on-selling them 12 weeks later, complete with full insurance cover.

The St Albans, Riccarton and Ilam areas have been popular with buy-andhold investors as they are within the zones for Christchurch Boys and Girls high schools.

She says although the earthquakes happened eight years ago some investors are still fearful more will come.

However, she likes Warren Buffet’s quote: “when people are fearful be greedy, when people are greedy be fearful.”

Layton goes on to say that it’s nothing like the immediate post-quake days when property owners – some of whom were savvy professional investors while others were ‘accidental’ landlords – could charge sky-high rents and have potential tenants literally beating a path to the door.

“Basically, I believe that even if the earthquakes hadn’t happened we’re now at about the same point with the market as we would have been without them. Growth wasn’t especially strong before the quakes, and it’s really level at the moment,” she says.

And asked whether investors should still be looking in Central Christchurch, she says yes, but adds that they need to have a long-term plan and be prepared to ride out static rents, slow growth in value, and the possibility of interest rate rises.

“Anywhere in the four avenues is still a good bet, if you know what you’re doing, as there will always be demand there.”

Canterbury Property Investors’ Association president Steven East is another who sees Christchurch Central as a slow and steady part of town.

“It’s never been a ‘gung-ho’ sort of market, apart from just after the quakes, but it’s basically quite reliable and there are still some good deals around, in those suburbs close to the centre.”

He says that with the opening of new entertainment strip – The Terrace, the CBD itself is coming back to life and, with its new dynamic, will likely see more people wanting to live in that vicinity.

“The as-is where-is opportunities are still there but some owners have adjusted their price expectations, for these ones, up a bit. If you can afford to buy one, do it up and reinsure it, I certainly wouldn’t be advising against that.”

Where To Buy

Investment sales expert Angela Webb, from Bayleys, Canterbury, says that she, too, still sees scope for successful purchases. She cites Lynwood as a place that has good potential – especially on the city side.

“There are still lots of character homes there and it’s quite affordable. It has good access to all the things that are being built, and developed centrally, such as the new sports stadium, for example.

Webb recently bought a property in the family-friendly area of Avondale which is surrounded by the red zone, not far from the river. She expects that, in time, once now empty sections and streets are developed into parkland, it will become very popular.

The property consists of a fourbedroom house with a one-bedroom attached flat at the rear.

“I bought it from traders who had picked it up privately from the original owner who had cashed, settled damage and kept the money,” she says.

“I paid $260,000 for the property and embarked on a huge amount of work, which started with levelling, floor repairs, repainting, removing liquefaction, doing repairs to the foundations and to a leaking roof.

“Next up was new floorcoverings, curtains and blinds and I tidied the bathroom and kitchen. After that there was landscaping and new fences.”

Webb says that the process took longer than she expected and cost more than she’d budgeted (at $100,000), largely because of the engineers’ reports and other red tape with council, contractors and insurers.

“I approached the bank, with valuations and insurance in place, to finance at 65% and pull out $300,000,” she says. Because I spent more than planned, I had to leave around $70,000 cash in the property.

The time taken to get insurance, once it was all fixed, was a little longer than Webb expected, as was the time it took to find tenants, but she’s very happy with the outcome now. From start to finish the project took five months. The front house is bringing in $420 per week and the back house $260. Now valued at $460,000, Webb’s return is 9.5%.

“I’ve created equity and it’s good to have multi-income cash flow,” she says.

Why Christchurch?

- As a new Christchurch arises – like a phoenix, from the ashes and the rubble, there are numerous exciting projects taking place.

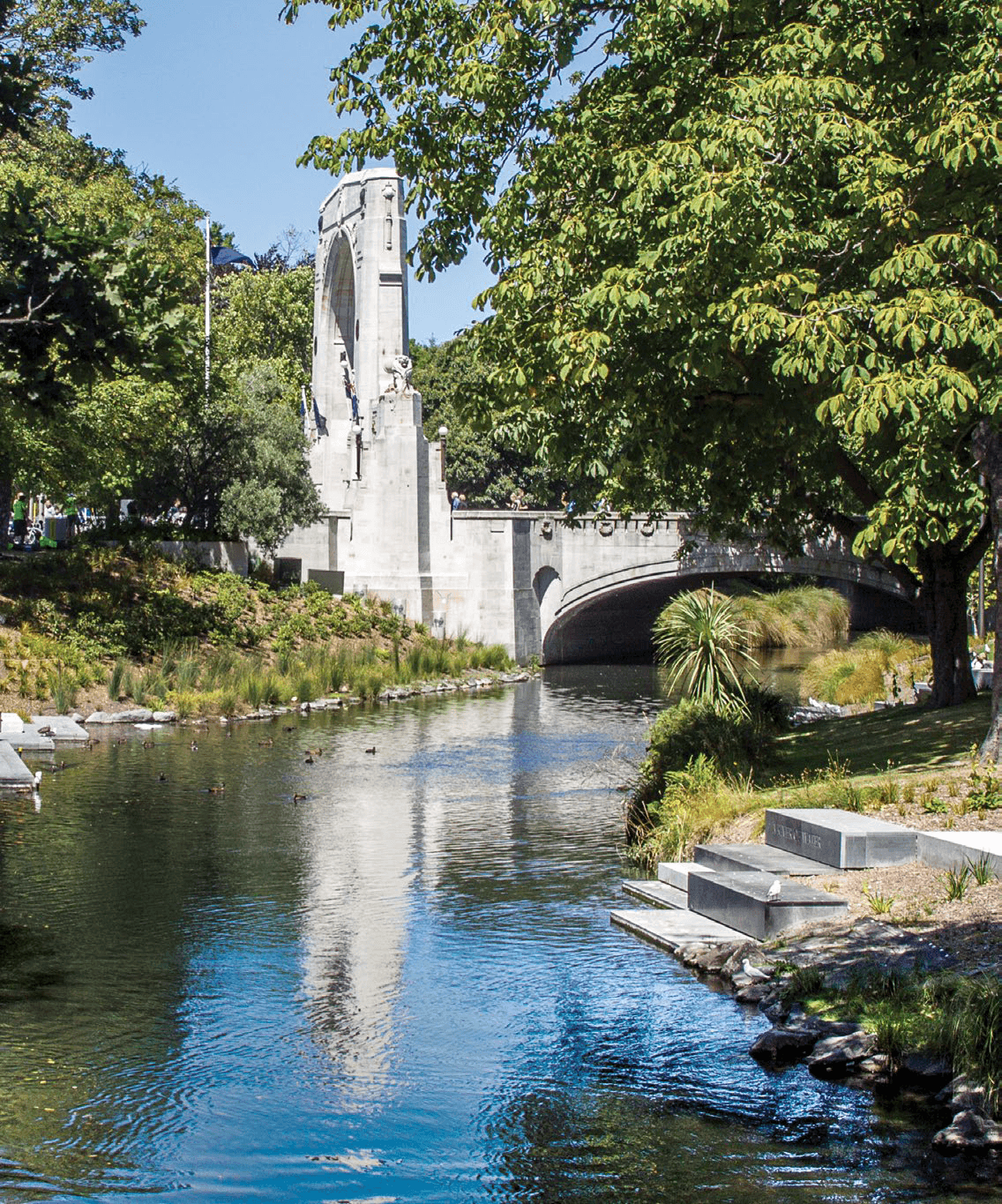

- The Canterbury Earthquake National Memorial, on the edge of the Avon River, opened in February 2017 and is a quiet, tranquil place for reflection and remembrance.

- The Metro Sports Facility complex, currently being planned, will have an aquatic hall, with pool, diving tower, hydro-slides, nine indoor courts, a gym and weights facility, dance studios, café, childcare and parking.

- Turanga (the new central library), on the corner of Gloucester Street and Cathedral Square, will be the largest in the South Island,with cutting edge architecture and design.

- A number of precincts are being planned for the city centre including the waterfront Avon River Precinct, the Innovation Precinct, the East Frame residential precinct with townhouses and apartments for the expected influx of CBD residents and its own park.