Getting To Grips With Covid-19

The fast-evolving Covid-19 crisis has now taken hold of normal life and the economy. It’s scary but Miriam Bell discovers it’s probably best for investors to keep calm and carry on.

31 March 2020

There’s no escaping it: we are living in worrying times, times that are out of our control. As the Covid-19 outbreak spreads like wildfire, official pandemic responses such as travel bans and isolation measures - are coming thick and fast.

And, as those measures take hold, both in New Zealand and overseas, the economic repercussions are also increasing and becoming more severe. Certain industries, notably air travel, tourism and hospitality, are already suffering and economists across the board say that we are now in recession territory and will see a significant economic downturn. There’s already a trickle of reports of job losses and business failures, and that trickle is only going to grow.

It’s scary stuff, made more so by the prevalence of catastrophic predictions. But authorities are acting to try and quell the economic fallout.

On March 16, the Reserve Bank slashed the OCR by 75 basis points to a new record low of 0.25% to provide monetary stimulus to the economy. It also announced that it would delay the introduction of new capital requirement rules for the banking sector by one year to support credit availability.

The next day, the Coalition Government announced a $12.1 billion economic package in a bid to cushion New Zealanders’ jobs and the domestic economy from the virus. It is worth 4% of GDP and is a larger plan than that implemented in response to the Global Financial Crisis.

But the future remains uncertain. So where does this all leave the outlook for the housing market – and for property investors?

Market On Hold, But Not Out

Not so long ago, New Zealand’s housing market was surprising punters with its buoyant resurgence. Sales activity was up significantly in recent months and, because listings remained low, prices were climbing even in Auckland’s market, which had been in the doldrums for some time.

Just a few short weeks on, the game has changed. With the stock market tumbling and economies around the world heading for recession, many feel the bell will soon also be tolling for the housing market.

But that view may well be without foundation. Independent economist Tony Alexander says the housing market will stall for the Covid-19 lock down period, but when things begin to return to normal it will pick up again.

“And things will return to normal. Because this will be a severe economic downturn but, as the Reserve Bank governor has said, we can see an end game in it. And that’s unlike the GFC when everyone was questioning whether it was the end of the financial system.”

So while the housing market will go on hold for a while, the long-term fundamentals which have been driving it for many years remain in place, he says.

“There is still a major supply shortage in the major cities, and huge unmet demand from people wanting to buy, including investors. These factors have not changed and they will kick in again once the Covid- 19-imposed restrictions are lifted.”

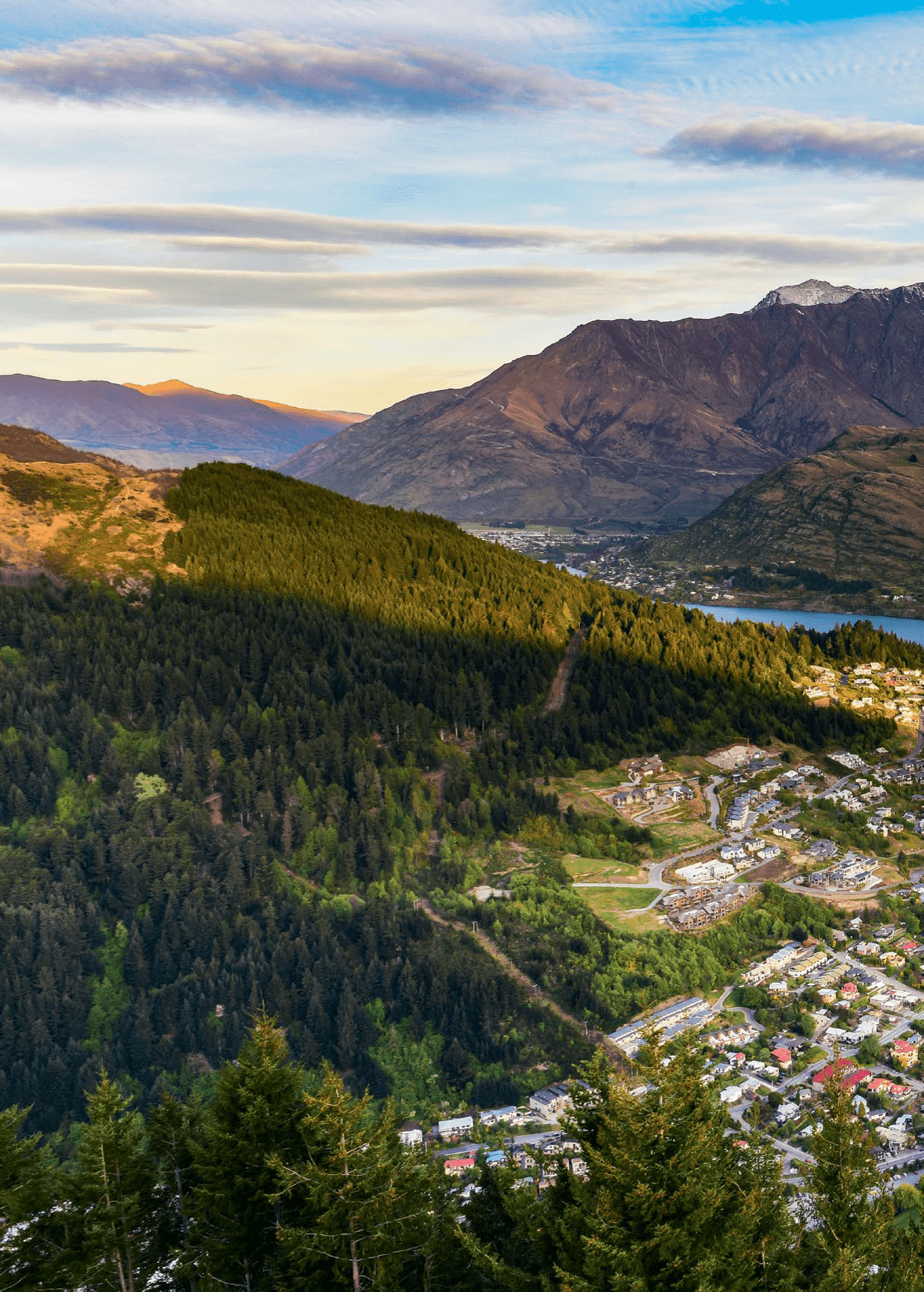

An exception to that will be tourism hotspots, like Queenstown and Rotorua. Having enjoyed phenomenal growth in recent years, thanks to the tourism boom, they will be hit hard by the changed economic conditions. Alexander says that will have a major impact on the housingvmarkets in those areas and you canbexpect their house prices to drop.

However, in the main centres, particularly Auckland, it’s different. “Sales activity will go down and prices may fall slightly but that fall will get lost in the statistical wash. Again, those underlying supply and demand fundamentals haven’t changed and by 2021 they will come back into play.”

Many people will remain in the market, he adds. “There could be some big opportunities for well-capitalisedb investors with a long-term view to make a good purchase during this period.

“It’s worth remembering that in the five years after the Asian Crisis in 1997 average house prices rose by 45%. In the five years after the GFC average prices rose by 24% nationwide and in Auckland by 58%. When we see the light at the end of this tunnel, we will see a big catch-up begin.”

Investor Perspectives

Much like Alexander, the property investors we spoke to about the Covid-19 prompted economic downturn aren’t, at this stage, expecting a housing market crash.For investor Nick Gentle, it’s early days yet but he doesn’t believe a coronavirus prompted recession will be as bad as that of the GFC which involved the fundamental failure of the banking system. The Reserve Bank’s OCR cut and the delaying of the planned bank capital requirements for a year will help the situation, he says.

“When it comes to property, I think many people will sit on their hands for a bit and the housing market will flatten out for a while. But, in the GFC, house prices did drop a bit and there were few people in the auction room. So if something similar happens this time round, investors who stay active will probably be able to do quite well.”

As an investor himself, Gentle says he has a 50% LVR across his portfolio, is in a positive cash flow situation, has his properties rented at market rate and has sufficient cash reserves to tide him over in the event of vacancies.

“That means I feel I can get out and buy. But people with investment properties which aren’t cash flow positive and/or are under-rented, if they lose their job and only have enough money to cover them for a few weeks, they could run into problems.”

People with investment properties on Airbnb will also run into problems pretty quickly as tourism dries up in response to the travel ban, he adds. “Not only are some Airbnb rentals no longer suitable for the traditional rental market, but some owners will be wary of putting them back into the traditional market because of the looming tenancy law reforms which would make it hard to get tenants out, to go back to Airbnb.

If Airbnb rentals do go back into the traditional rental market, it will help out with the existing shortages there though.” The developing situation is, obviously, one that investors are keeping close tabs on. But, at this stage, investor advocates are more concerned about the potential long-term impact of the Government’s proposed tenancy law reforms. Auckland Property Investors’ Association president Andrew Bruce thinks that the biggest risk in the Covid-19 situation revolves around what the banks do.

“Will they genuinely do what they say they are going to do and be supportive of business or will they start to get tougher on criteria and impose new requirements?” There could be some risks with tenants, if they work in coronavirus

affected industries, and rents, Bruce says.

“So that’s something to be aware of and to keep a close eye on. “In practical terms, if someone is in self-isolation, it could impact on property management activities like inspections.

But you’d hope that insurers would show a bit of flexibility in a situation where someone was in self-isolation and a quarterly inspection was scheduled.” Overall, he’s not hugely pessimistic about the housing market going forward.

“For investors, who are cash flow positive and well-structured, there shouldn’t be too many problems.”

Practical Considerations

Commentators and investors feel the housing market is likely to weather the current storm in the long-term. But, as signalled by Bruce, investors are, increasingly, starting to worry about practical finance and property management issues in the short-term.

This includes such issues as getting lending; how to approach auctions, open homes and rental viewings; potential problems with rent payments; and conducting property inspections. So we’ve talked to some experts in those areas to get their advice on what to do in the challenging and unchartered times that lie ahead.

Financial Security

When it comes to lending, the Mortgage Supply Company’s David Windler says that banks will want to be seen to be doing the right thing. That means they have passed on the OCR cut quickly and most have emphasised they are openmfor business and will be listening to customers with concerns.“Whether they act on it is another question. It’s very much ‘watch this space’ on how generous they are actually going to be. The Reserve Bank’s postponing of the capital requirements for banks for 12 months has released lots of money for lending. But it remains to be seen whether the risk weighting that was being applied to commercial and business lending is revised to allow easier access to credit.”

Lending itself in this environment will be riskier, he says. “Banks will need to make smart decisions about who to lend to and why. If you are in an industry like tourism and hospitality you are probably not going to get a mortgage. But there are some industries out there that will actually do well.”

For that reason, they are talking to clients, who are weighing up whether to buy property, about what they do for a living and the safety of their income.

“Investors shouldn’t panic. But they should take the time to take stock and assess whether they are in a strong position or a vulnerable one. If they are vulnerable they need to think about the decisions they can make to help themselves out.” Windler recommends that investors should stockpile cash for a safety net; change their loan structure to increase cash flow if it’s possible; and go over their fixed overheads to see if they can get the same thing cheaper. “It is about looking at your spending and seeing if you can have a cash buffer, so that there is protection there now and going forward.”

THE BUYING & SELLING BUSINESS

Much business activity is slowing as Covid-19 social distancing requirements become more stringent and the likelihood is that so too will the real estate business. But

REINZ chief executive Bindi Norwell says the reality is that people always need to buy and sell houses, so they don’t expect the market to come to a complete stop.

To date, they’ve had no significant feedback from their members that people aren’t buying and selling as per usual, but it’s still relatively early days, she says. “Most questions we have had are around health measures such as signage at open homes or providing access to hand sanitiser.”

With auctions, open homes and rental viewings, REINZ’s current recommendations include that hand sanitiser is made readily available; Covid-19 information and hygiene notices are displayed at the entrance; and registers of those who attend (with contact details) are made in case an attendee develops the virus and other attendees need to be informed.

But, as the Government rules around gatherings of people change, the way

‘You’d hope that insurers would show a bit of flexibility in a situation where someone was in self-isolation and a quarterly inspection was scheduled’ ANDREW BRUCE

auctions, open homes and rental viewings are able to be conducted are also likely to change. If the Covid-19 situation develops further, agencies must seriously consider alternative selling methods, such as tender or private treaty or using virtual-reality tours where possible, Norwell says.

“The use of technology may have a significant part to play in how the housing market can try and continue in a ‘normal’ fashion. For example, open homes or rental property viewings can utilise options such as video walk throughs or virtual-reality tours.

“With auctions, people have the ability of phoning in or even bidding online through registered apps, so it will be interesting to see how both the real estate profession and members of the public embrace new technology in these unprecedented times.”

Managing Property

A couple of the thorniest questions arising come within the property management sphere. It should be no surprise that one of these is what to do if a tenant loses their job and can’t pay the rent.

The Government’s Covid-19 economic response package comes into play here. It contains $5.1 billion in wage subsidies for affected businesses in all sectors and regions; $126 million in Covid-19 leave and self-isolation support; and provision for a permanent $25 per week benefit increase.

While this should have some positive effects for people (tenants) who have lost their job due to the Covid-19 outbreak, some tenants may still be left struggling to pay rent. To date, there has been no official advice about this. But, off the record, landlords we’ve spoken to feel that reasonable landlords should be empathetic and work with tenants who run into problems in this area – perhaps by offering them discounted rent for a contractually specified period of time, for example.

Property management consultancy Real iQ’s director, David Faulkner, thinks the Government’s financial assistance package is reassuring and will help. But he believes that rents will have to drop or else there will be a major problem with rent arrears.

“I can even see the government putting in place rent controls. Which I would be completely opposed to in normal circumstances, but these are extreme times. So I think we should be dropping rents to soften the blow for people.”

The other issue garnering a lot of queries is what to do about routine property inspections – particularly if tenants are in Covid-19 related self-isolation. Whilenit might seem logical to simply postpone the inspection, the reality is that insurers require inspections to be carried out at regular intervals, usually quarterly.

As Bruce says, hopefully, insurers would be flexible on the inspection front in the age of Covid-19. However, at this stage, the industry position is unclear. The NZ Property Investors’ Federation is currently talking to the insurance industry to try and clarify the situation.

In the meantime, REINZ recommendations are that tenants should be emailed relevant Covid-19 information before an inspection; disposable gloves should be worn during an inspection and disposed of immediately afterwards; and tenants who feel unwell or who are selfisolating due to Covid-19 requirements should notify their property manager or landlord before the inspection so it can be rescheduled.

Faulkner takes a more extreme stance. He thinks routine inspections should simply be postponed for the time being. “Another option could be to fully utilise technology which allows tenants to conduct video inspections, with their property manager present remotely. This situation could, in fact, be the prompter we need to make better use of the cutting-edge technology and tools now available to help us manage properties more effectively.”

One final note: Some landlords might find it useful to check out Tenancy Services’ new Covid-19 webpage. It has links to general information about Covid-19, as well as information about the rights and responsibilties of landlords and tenants when dealing with a Covid-19 situation. It can be found here: https://www.tenancy. govt.nz/about-tenancy-services/news/ coronavirus-covid-19-what-landlordsand- tenants-need-to-know/.