Life In The Fast Lane

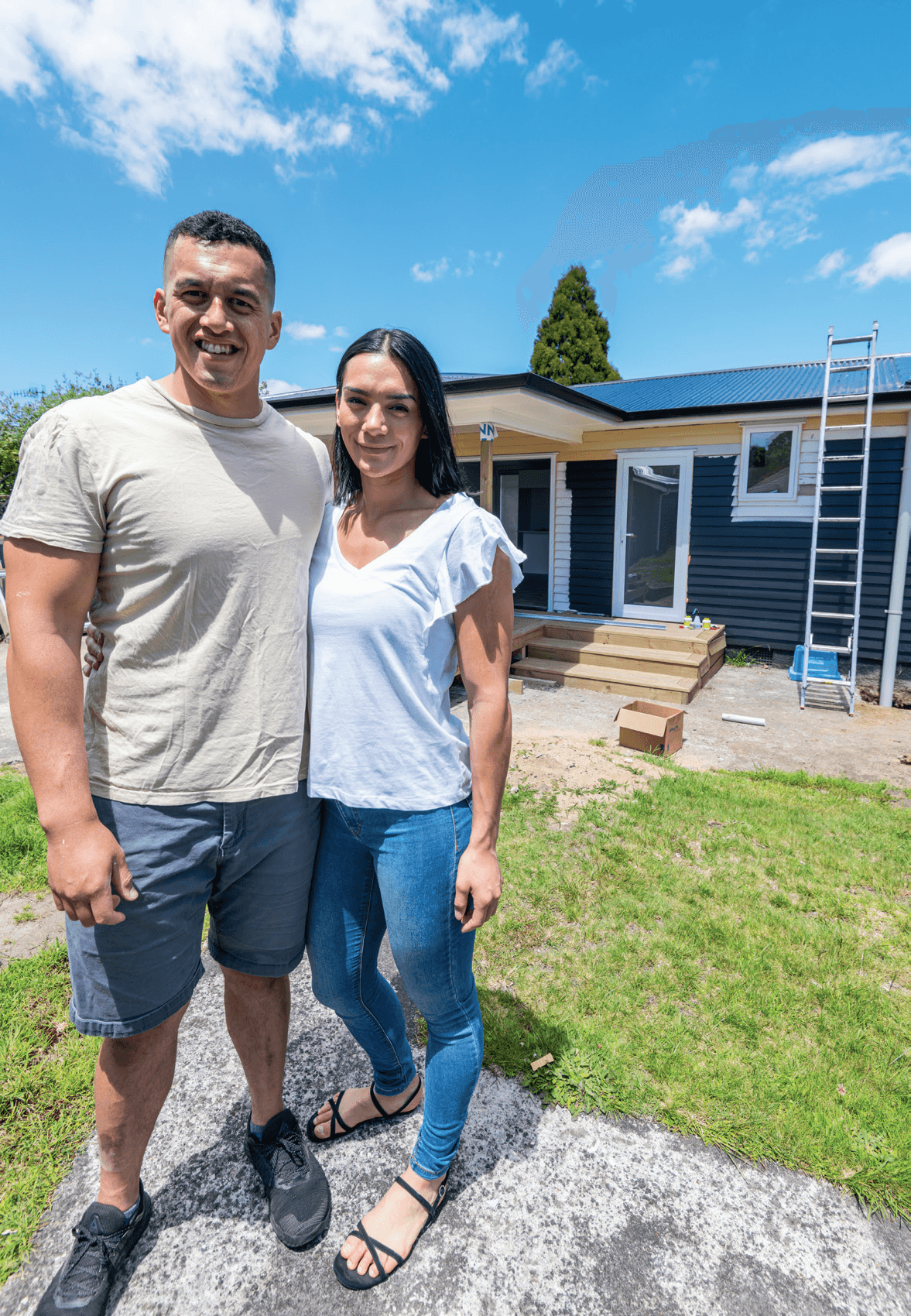

This young Rotorua couple went from newbie investors to buying and renovating five rental properties in just one year, writes Joanna Jefferies. Photography by Adrian Hodge.

6 April 2022

You could say Aden Hare was raised in property investment. By the age of 13 he was spending all of his weekends helping out his mum and dad with their rental properties – renovating and cleaning.

At the time, he thought it was a bit of a punishment, but since then he’s come to view it differently.

Aden met his future wife Zhenna Hare at high school and they married when he was 20. And it was when he was saving for their wedding that he realised property investment could secure a great future for the couple.

Aden (25), project managed a trade his parents had bought in Rotorua, which took two weeks for him to renovate, netting him a tidy profit of $35,000. The cash was used for the couple’s wedding and Aden says, “The penny dropped that there was money to be made in property.”

Soon, the pair were expecting their daughter Gia, and it became even more important to Aden to create financial stability for the young family.

So, instead of ticking up cars and fancy toys like many of his mates were doing, Aden started planning to build a property portfolio.

To finance property, he worked in security, then moved into banking, then MSD, and after a few years started a contracting business which he still operates now.

‘I don’t really look on TradeMe – it’s just too competitive. I’m always on the hunt for off market properties’

On The Ladder

The aim was to generate as much income as possible to enable him to service more debt. Eventually, just over a year ago, Aden and Zhenna were able to secure their first investment property in Rotorua.

The standalone three-bedroom home with garage was bought for just $260,000. Aden renovated the main home and converted the garage into a minor dwelling. The couple then moved into the unit and rented out the main dwelling “so we pretty much had no living costs”.

The property is now worth $605,000 and Aden says it was a strategic move that meant they had the equity to buy again.

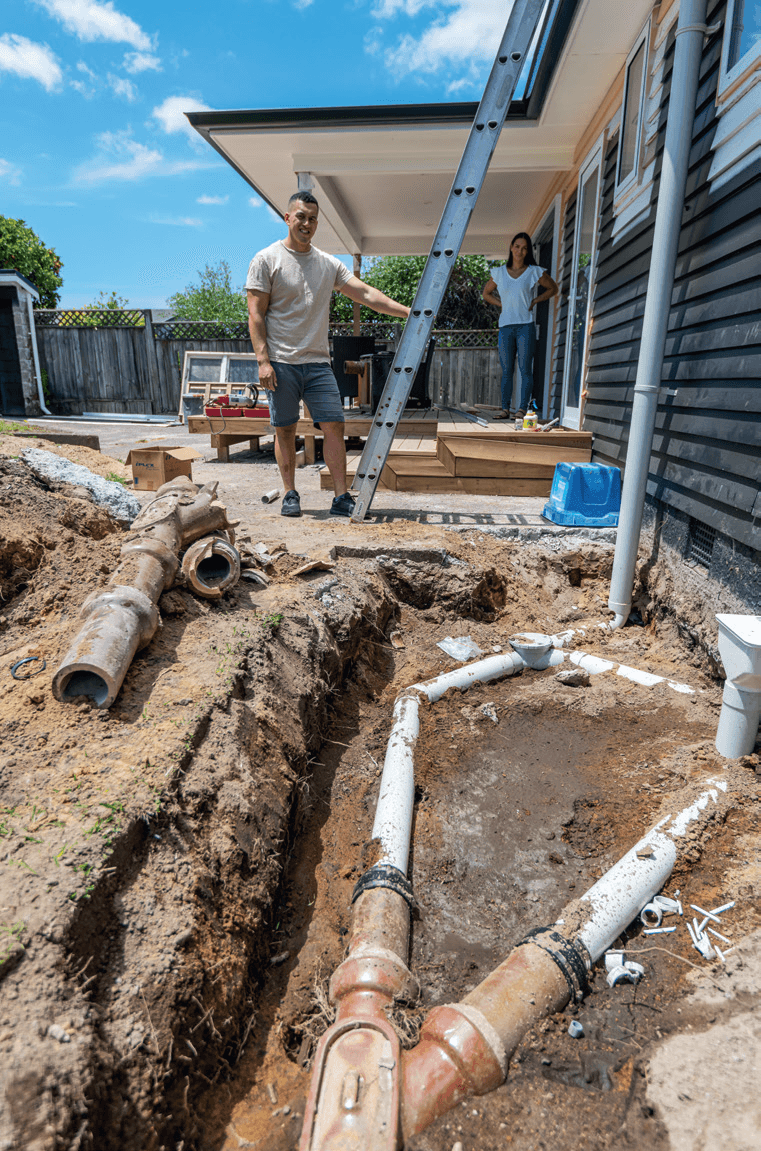

And they did – in November last year they bought a second property in Rotorua for $215,000 and Aden renovated it – plastering, painting, new carpet, new bathroom and landscaping – spending around $25,000. The three-bedroom home was revalued at $400,000 within a matter of a few months.

Their third purchase was incredibly fortuitous – when the rest of the country was wringing their hands in despair because of the imminent Covid-19 prompted lockdown, Aden was rubbing his hands together because he’d just secured his third property, which meant lockdown was spent quietly renovating and creating equity.

The property was conveniently located next door to where the Hares live, and was purchased for $260,000. Aden and Zhenna spent $10,000 on the reno and it’s now rented for $490 per week.

Off The Market Purchases

Aden always buys below market value. In fact, he doesn’t bother at all with online real estate sites.

“I don’t really look on Trade Me – it’s just too competitive. I’m always on them hunt for off market properties.”

He does this by making connections in the Rotorua landlord community, by writing letters and dropping them in letterboxes and by generally being a bit nosy and inquisitive.

His fourth purchase in Rotorua was due to his eagle eye for a deal.

He’d spotted an abandoned home that was vandalised and went to take a closer look. Peering in the window he could see that the taps were running and he went in to turn them off. He then contacted the owner to see if he was interested in selling it.

‘For families that are homeless – they have wrap around support. The housing provider takes care of any potential damage too’

The owner was happy to have it taken off his hands for just $270,000, and Aden set about renovating it – new paint inside and outside, new carpet, bathroom and landscaping – at a cost of $40,000.

It was revalued at $425,000 and is now rented for $490 per week.

When Aden gets passed a deal that he can’t finance himself, he’s happy to pass it on to another investor for a small cut.

“I get them under contract and then sell them on to other investors. Then I use that money to get into my next purchase.”

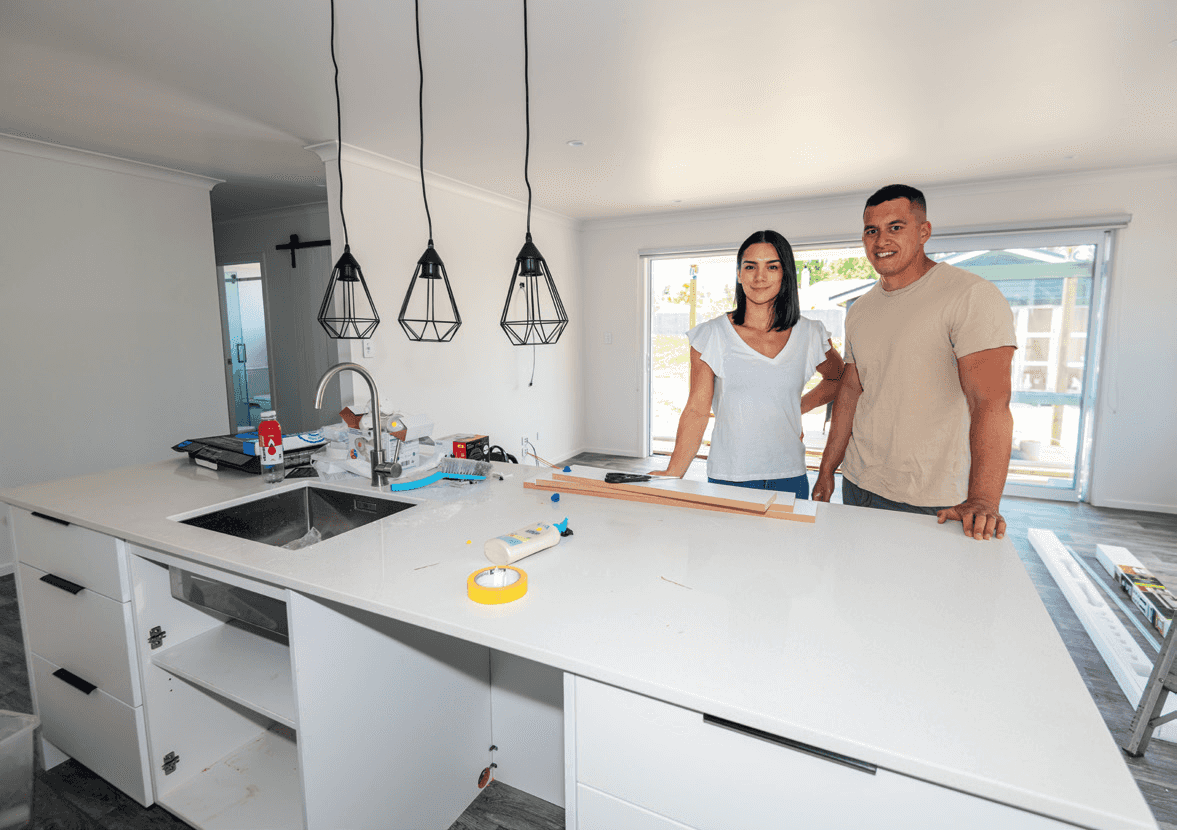

The last house they purchased was a step above the others and it’s in the right school zones for little Gia, so when they settled in July, Aden set about completely gutting and renovating the home for them to live in. The property also has subdivision potential, so they may develop it at a later date.

Linking With Housing Providers

Considering the Hares are such fans of DIY, it’s somewhat surprising that they don’t manage their own properties.

Instead, all of their properties are rented to at-risk tenants through housing providers VisionWest and LinkPeople.

“For families that are homeless – they have wrap around support. The housing provider takes care of any potential damage too.” This means that all of their rentals are rented throughout the year and the Hares are secure in knowing that their properties will be well taken care of, as well as provide an important service to those in need.

Looking Ahead

With five properties under their belt, the Hares have no intention of slowing down. The plan is to build a solid passive income so they can travel and spend more time with their daughter.

But for now, he’ll carry on wholesaling deals, plastering and painting, as well as doing his parents’ rental renovation projects.

The post-Covid-19 surge in Rotorua’s property market means securing good deals in Rotorua is getting more difficult too, which is slowing his plans.

“The market is going crazy here it’s ridiculous! It’s a really hot market. But I figure out other ways to generate off-market deals.”

To achieve this goal, he’s started looking outside of Rotorua for the first time and may also look to do his first joint venture with another investor. He’s also keen on trying to secure a multi-unit property.

It’s certain that with his determination, audacious attitude and willingness to look outside the box and get his hands dirty, there’s no doubt he will succeed.

But it means the pair have more hard work ahead of them and they’ll have to put off the usual toys and treats that many young people enjoy in their twenties. However, Aden knows that they have a game plan and they’re committed to it.

“I went through that phase, wanting to have the latest things, but my wife trusts me and really supports what we do and that’s helped.”

Aden Hare’s Advice For New Investors

• Educate yourself – “I still read books on property investment.”

• Learn how to do the numbers and stick to them.

• Once you’ve worked out that a deal makes sense, don’t delay – “Take action straight away!”

• Get a good income and save as much as you can – this could mean starting your own business.

• Forget about toys – put that on hold and focus on generating a passive income for long-term wealth.

• Don’t get into debt – “All my friends were ticking up cars – but we just have a simple lifestyle,” says Aden.

• Do reward yourself along the way, as you kick your property goals – “I bought a motorcycle after the third house.”

• Pay cash for your big purchases, such as cars and furniture – don’t get into unnecessary debt because it won’t help your servicing ability.

• Despite your sacrifices, don’t forget to live a little. Each year since their honeymoon in Hawaii, the Hares take a holiday there.