Nice place to live? Shore thing

They say there are two kinds of Aucklanders: those who live on the North Shore and those who want to, Sally Lindsay explores why.

31 March 2023

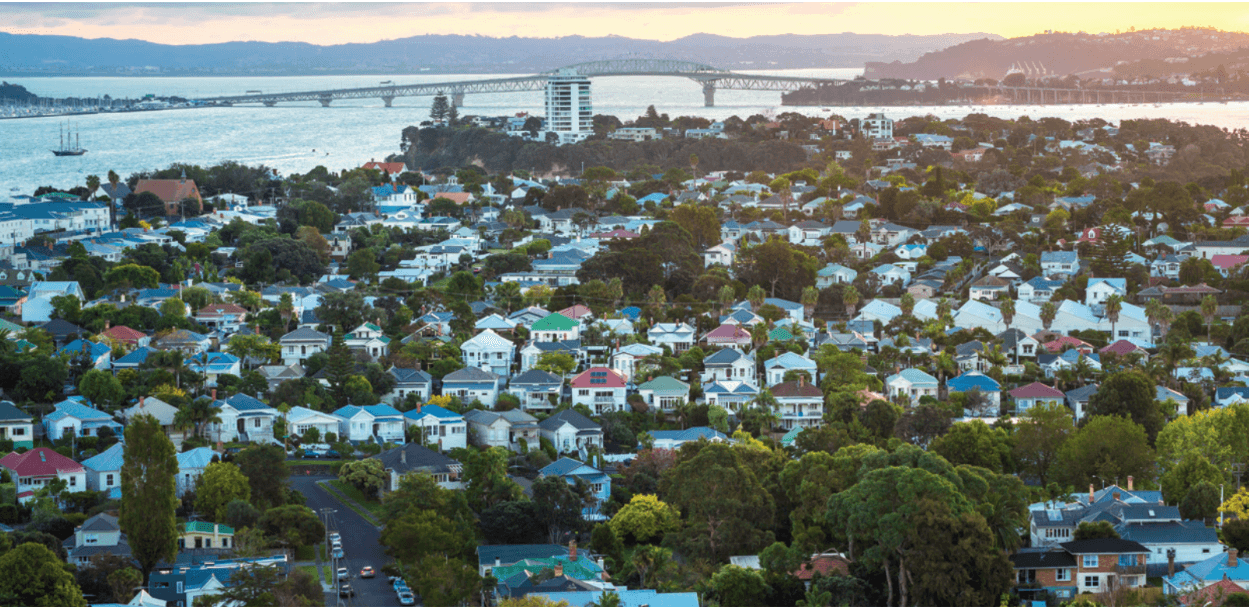

Takapuna to Milford walkway – with its spectacular waterside views – passes some of the North Shore’s most expensive and beautiful homes.

Auckland’s Harbour Bridge, while really only a short stretch of motorway, is a mental barrier for many, but those who do not venture over it miss out on the delights of seaside suburbs, golden-sand beaches and cafe culture.

Even though the North Shore is well-settled, it still has its wild places: pockets of bush persist within the suburbs, and its string of safe beaches are never crowded.

It runs ahead of the pack when it comes to sandy, sunny beaches. The white sand strips at Takapuna, Milford, and Cheltenham in Devonport are just a few minutes away for most of the North Shore’s residents.

Most suburbs, such as Birkenhead, have access to beaches or inner harbour water areas, with many swimming spots dotted from Northcote Point to Beach Haven wharf.

One of the best ways to explore the Shore is to walk along its eastern margin. The Takapuna to Milford walkway traverses black lava and passes some of Auckland’s most beautiful and expensive homes.

Further north, you can walk along the shoreline between Campbells, Mairangi and Murrays bays, and up over the cliffs to Rothesay and Browns bays.

At the northern end is the prosaically named Long Bay, one of the first and the most popular of Auckland’s regional parks. There are also the attractions of an arthouse film at Northcote’s Bridgeway Cinema or Birkenhead’s Sunday Night Market.

The 2010s marked a period of significant change for the area. In 2015, business leaders and scholars committed to a vision of making the North Shore a world-recognised hub for innovation by 2050.

The North Shore now has one of New Zealand’s fastest-growing populations, and the growth of tech jobs has attracted young, diverse residents who give the area a vibrance among Auckland region’s cities and suburbs.

PRICES SLUMP

Along its shores lie some of Auckland’s most sought-after suburbs, with expensive houses, but it hasn’t been rosy for values lately.

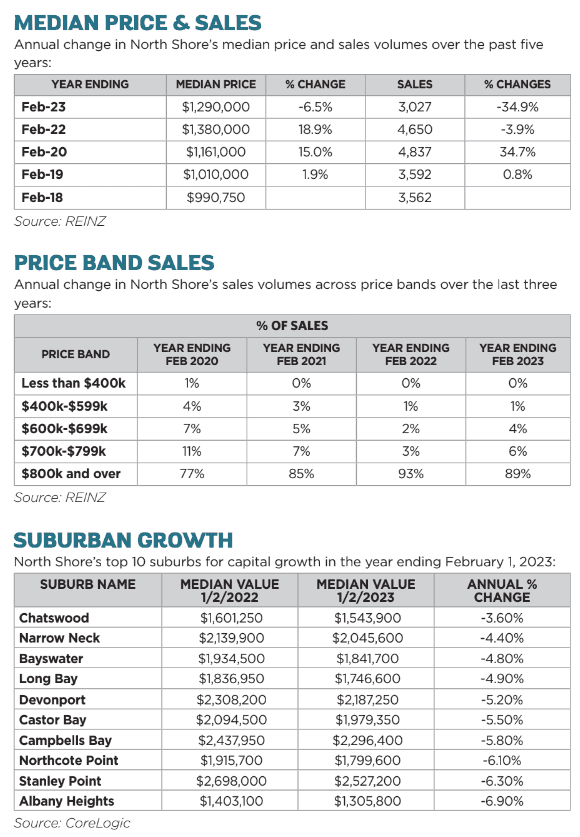

House values have declined 3.6 per cent to 6.9 per cent, the latest CoreLogic figures show.

In the family friendly suburb of Albany Heights house prices have had the biggest drop at 6.9 per cent, slumping from $1,403,100 at February 1 last year to $1,305,800 at the same time this year.

This was followed by house prices at Stanley Point, one of the North Shore’s most expensive suburbs, falling 6.3 per cent from $2,698,000 last year to $2,527,200, while Northcote Point prices declined 6.1 per cent from $1,915,700 to $1,799,600.

Of the other $2 million suburbs, Campbells Bay prices dipped 5.8 per cent from $2,437,950 to $2,296,400; Castor Bay slipped out of the $2 million range, dropping 5.5 per cent from $2,094,500 to $1,979,350; Devonport fell 5.2 per cent from $2,308,200 to $2,187,250; and Narrow Neck declined 4.4 per cent from $2,139,900 to

$2,045,600.

‘The North Shore now has one of the country’s fastest-growing populations’

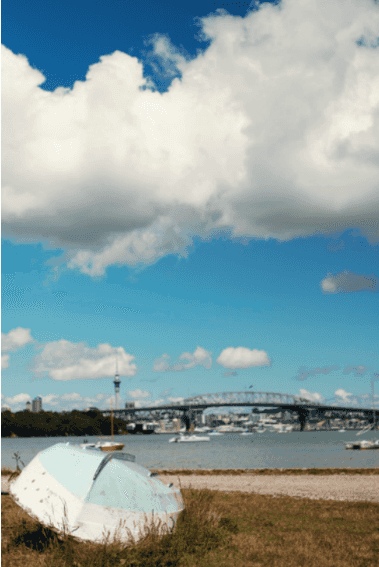

ABOVE East Coast Bays: the perfect way to relax and unwind after a busy week.

CLOCKWISE FROM TOP LEFT Takapuna Beach Cafe catch-up; picturesque Long Bay Regional Park; Devonport and Stanley Point – two of the Shore’s earliest suburbs; views from Little Shoal Bay to Northcote Point taking in the Harbour Bridge; family-friendly Albany Heights.

SHORTAGE OF GOOD STOCK

Drew Miller, of Ray White, says North Shore prices are all over the place because of rising interest rates and people having to sell before they buy.

“Sellers have a fear of not being able to buy again in the same market to the same standard of house they previously had. There is a definite shortage of good houses on the market.”

He recently sold a house on a five-way multi-offer and the sellers now have less than a month to move out. “They have looked at seven houses but none match the flow to the kitchen and outdoors of their previous home. They are in a difficult situation, which is not unusual now.”

Miller says while good quality houses are few and far between there are still a lot of buyers in the market. He recently listed a fully renovated ex-state house on a Thursday and 20 groups looked at it over the weekend. It was sold conditionally on the fourth weekend of open homes when nine groups still turned up to view.

He says the market is not standing still even though prices are dropping. “It is only a declining market depending on when a homeowner or investor bought. If it was in the past two years they could be staring down the barrel of a huge increase in mortgage payments.”

Most of the buyers looking and buying are downsizers and first home buyers. Investors have left the market, says Miller, unless it is “mum and dad land banking by helping their kids into a property”.

“With about half of the mortgages lent two years ago coming off low interest rates this year and tax deductibility rapidly dropping, it is going to be tough for investors to top up any shortfall from the end of this year, particularly if tenants are behind in rent payments,” says Miller. They are being asked for more appraisals and he is predicting that will increase as investors look to sell.

He has found the most favoured sales method is deadline sale, although most agents are still pitching auctions. “With a deadline sale every seller can position their property for a higher price when it becomes a multi-offer situation.”

He advises sellers not to put a price on their property. “Everyone wants yesterday’s prices in today’s market.”

However, he has had a fair share of contracts fall over. Two Oteha Valley properties failed to settle at the end of last year. On one, the buyer could not get finance because they had defaulted on other payments and the other failed a builder’s report.

LANDLORDS STRUGGLE

One of the biggest issues facing landlords and tenants is the removal of interest deductibility now that interest rates are rising, says Mike Atkinson, Aspire Property Management’s managing director.

“It could mean landlords selling off properties and that will disrupt a lot of tenants. Tenants want long-term stability and the government’s decision to remove the ability for landlords to deduct mortgage interest payments against rental income was implemented when landlords were paying 2 per cent interest.

“It simply makes keeping rental properties impossible for a large section of landlords,” says Atkinson.

He says tenants on a periodic tenancy should ask their landlord to put them on a fixed term if they know they want to stay in the property long term, that way if the

property is sold the tenancy will go with it.

Despite it being a difficult time for landlords, Aspire is still signing up new tenancies. Eighteen new tenancies were signed up in February, with 38 per cent of those on the North Shore.

However, those new tenancies are not investors adding to their portfolios but landlords heading overseas or first home buyers in their 20s to 40s going offshore

for better wages.

TIME ON MARKET

Rentals on the North Shore are snapped up fairly quickly. In the three months from December to February, Aspire rented 41 properties on the North Shore at their listed price. In other areas of Auckland the average rental price had to be dropped by $6.70 a week.

Apartments, although the smallest of available rental properties, are newer and are online for on average 18 days; houses, the most prolific of rental properties, are online for 20 days; units 30 days, because they are older. The most popular rental areas are Takapuna, Campbells Bay for school zones and Browns Bay for South African and English immigrants.

Atkinson says in February there was a noticeable increase in rental enquiries after the flooding, which hit parts of the North Shore badly, and the cyclone, which came at the busiest time of the year for the company.

“Many houses along Nile Road, one of the worst hit parts of the city, were wiped out. Many people have been displaced and desperately need a roof over their heads.

“People struggling to find a house has made the market slightly more competitive and five to 10 groups of people are turning up to first viewings, depending on the rent being asked.”