Popping At The Top Of The South

Nelson/Tasman has always been highly sought-after. Desired by iwi for its natural resources; European explorers for its potential; and now artisans, creatives and entrepreneurs, writes Sally Lindsay.

31 October 2022

Within the Nelson/Tasman community there is strength and diversity, with more than 48 cultures making the region their home. One in five people living here were born outside New Zealand.

Nelson city is the third most ethnically diverse place in the country per capita; it’s the type of city that regularly attracts foreigners who visit, fall in love, and scheme ways to stay, often by opening a business.

Despite a tendency towards political conservatism and a high number of retirees and rest homes, the region still lives up to its popular perception as an arty enclave of sun-obsessed semi- hippies with a strong community heart.

It retains a solid arty core; it was the birthplace of pottery in NZ and as well as excellent local potters, craftspeople and artists, the institution that best reflects Nelson is the international phenomenon of the World of Wearable Art, an awards show that began in rural Tasman nearly 30 years ago but became so big it was moved to Wellington.

Nelson also produces all of the country’s commercial hops and has consequently become a craft brewing capital with 11 breweries on tap.

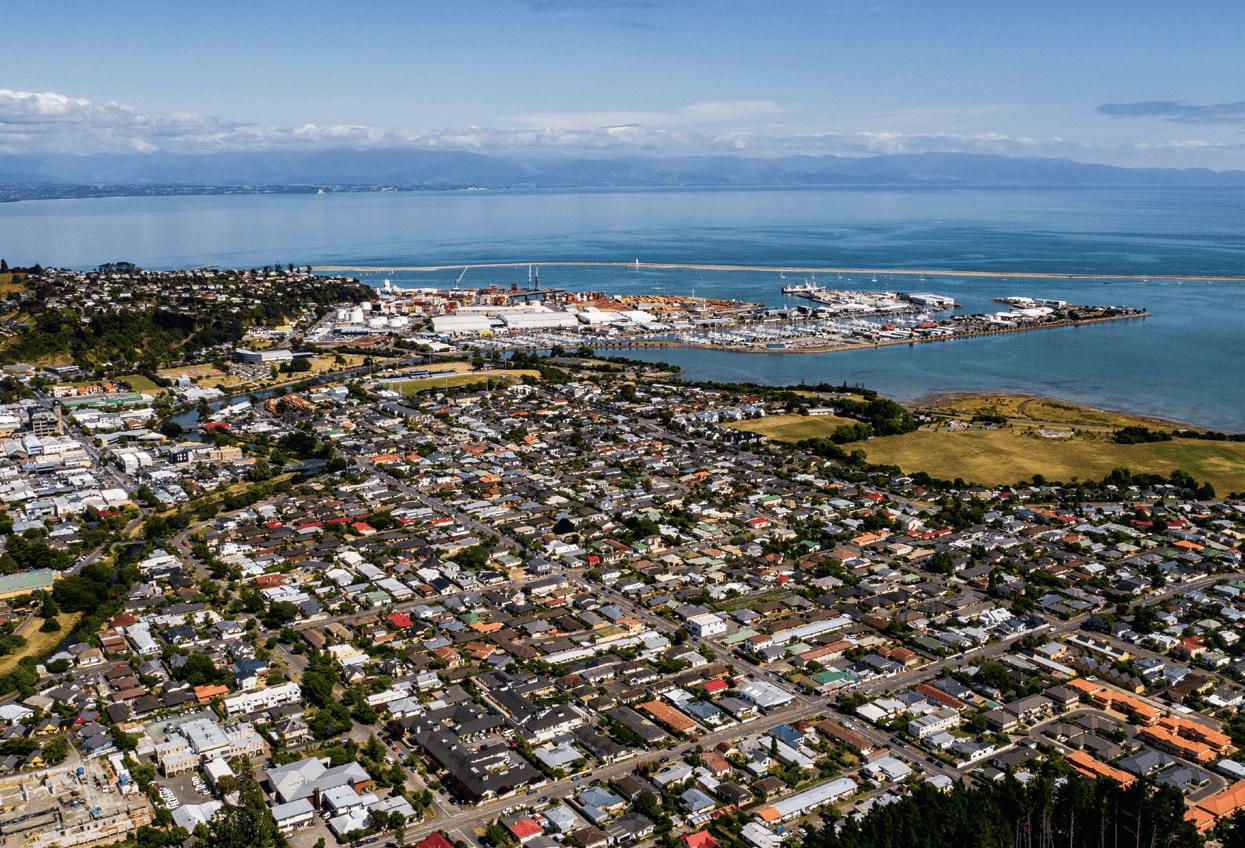

The coastal region is notable for two huge, shallow bays: Tasman Bay and Golden Bay. The interior is hilly and mountainous with attractive lakes and areas of limestone and marble which feature deep caves and sinkholes.

People care about the region’s environment and heritage and consequently there are many older houses throughout the area.

Mapua Magic

However, some Nelson/Tasman house sellers need to adjust their “unrealistic” price expectations as buyers shift from a fear of missing out to a fear of paying too much, says Chris Davies, Harcourts’ sales manager.

While prices are slowing nationally, Nelson/Tasman is still one of the fastest growing regions and prices have not been affected as much.

Over the 12 months to March this year, median house prices rose 11 per cent but sales were down two per cent a trend that has continued over the past six months, latest REINZ data show. There were 15 weeks of inventory in March, which is seven weeks more than the same time last year.

The biggest price increases from March 1 last year to March 1 this year have been in the Tasman region, with the notable exception of Tahunanui in Nelson city.

Price rises ranged from 20.9% in Motueka, increasing from $619,650 to $748,850, to 29.7% in Takaka, rising from $501,850 to $650,750 and 22.2% in Tahunanui, lifting from $604,250 to $738,300, according to CoreLogic data.

The ever-popular Mapua with its beach and bach vibe and inland rural oasis, within commuting distance of Richmond and Wakefield, became a million dollar enclave for the first time, rising 22.4% from $872,150 to $1,067,100.

March was one of the biggest months for listings. Compared with the past six months, new listings were up 25%, significantly above the lows seen in August last year, which had seen FOMO (fear of missing out) driving the market, Davies says.

With the increase in supply, buyers are no longer afraid of missing out, but instead are wary of paying too much.

There have been fewer people at open homes and Davies puts some of this down to tyre-kickers and neighbours being absent because of Covid-related caution and restrictions.

“It means we now have well-informed and qualified buyers turning up to open homes. They are being more selective about which properties they view, but good properties at realistic prices are still attracting multi-offers.

“Last year buyers were having to put in offers immediately after viewing a property, but now they are more likely to take a couple of days to think about it.”

However, it means properties are taking longer to sell.

“Realistically priced properties will sell quickly and others sit on the market for a while as opposed to everything selling last year,” says Davies. “In some cases this is a result of unrealistic price expectations and vendors not prepared to meet the market.

“What we were seeing last year was some agents promising to get vendors $50,000-100,000 more for their properties and sellers would sign up, but by the time the property came to the market, the market had caught up.”

Properties on the market with unrealistic prices are getting little attention from buyers, adding to the impression that there is a surplus of new listings.

Often those houses are withdrawn from the market while the vendor waits for a better offer or decides not to sell.

Market Change

Last year it paid to be a cash buyer as the market was moving so quickly, says Davies. “This year it doesn’t matter so much as more vendors are taking offers subject to the buyer’s house having to be sold. Few buyers have sold before buying as they are afraid they won’t find anything they like or at a realistic price, however cash offers are most often more favourable than a higher offer with conditions.

‘Realistically priced properties will sell quickly and others sit on the market for a while as opposed to everything selling last year’ Chris Davies

“Buyers are looking carefully at a vendor’s motivation for selling as they don’t want to go through the process only to end up with a price they can’t or won’t pay.

“There are still a few vendors who are not listening to the market feedback about prices.”

Out-of-town buyers are also continuing to influence the market with some buying sight-unseen or subject to viewing once the offer has been accepted.

Despite this, Davies hasn’t noticed a big drop in prices. “Monthly median price growth has slowed down but Nelson property prices still increased by 5.5 per cent in February.

“Those buyers who can’t get a mortgage are looking to other alternative lenders, but in most cases the best chance of being able to borrow is still through a person’s existing bank,” says Davies.

Unlike other housing cycles, no one area is the most popular for buyers. Agents are maintaining consistent results across the region and nowhere stands out.

He believes the market will change again this year as there are myriad disruptions through government legislation, tax changes, interest rate hikes, lending criteria, construction labour and materials shortages, plus Covid and New Zealadners heading overseas again, particularly to Australia, in search of affordable living, jobs and cheaper housing.

He says while the market and world change, Tasman/Nelson is still a popular buying place because of the sun, sea and location for locals and out-of-towners who see it as an area to invest, live and work away from the hustle of big cities.

Lack Of Supply

As in most cities and regions across NZ, Tasman/Nelson’s rental market has few vacancies with a long list of people waiting for homes and rents on the rise.

A Trade Me search on April 6 showed just 67 properties listed for rent across Tasman/Nelson, a region covering more than 9,500 kilometres.

The main problem is simply lack of supply, says Summit Real Estate general manager Stewart Henry.

His company is the biggest property manager in the region and he says while there is a lot of building in Tasman not many large homes are being built as rentals and don’t suit big families, who are struggling to find anywhere.

Henry says as house prices have risen, so have rents.

“More investors are coming into Tasman looking for mainly three bedroom homes and influencing the market.”

Rents have risen over the past 12 months by $40-$50 a week for a typical three-bedroom house, which is good for investors. “The rise has been about 7%, when typically rents rise about 3% year- on-year on a steady basis,” says Henry.

In Nelson the average rent is $585 for a three-bedroom house. Between January last year and December rents rose from $480 to $530, and now they are more expensive again.

“In Richmond the average rent has risen from $510 in January last year to $550 in December, and is now pretty much up to $580 on average,” says Henry.

New builds bought by investors in Tasman, around Richmond and Motueka, are seeing higher rents.

Landlords with older houses have been spending money to bring their properties up to the Healthy Homes standards, and rents for them have also risen.

“While there is a lot of development in Richmond, investors have to weigh up what they are paying for a property and what it will attract in rent to make it stack up, otherwise they will just be relying on capital gains and they are not always guaranteed,” says Henry.

Investors are achieving good returns as most people are able to afford rents at the existing level, he says, but houses have to be up to scratch.

“If the landlord has an unrealistic rent on a property, a renter might take it but keep looking for another place. Landlords lose out in the long run because tenant turnover costs money. We encourage them to keep their rents sustainable to attract long-term tenants.”

Henry says long-term investors with existing rentals have been reducing their mortgages in light of the new tax changes which will phase out the ability to deduct interest payments against rental income. “It’s regarded as a thorn in the side of investors rather than a big hurdle, but they are getting prepared for eventually not being able to claim anything.

“The biggest problem for the entire rental market is the government’s awareness of rental property shortages, so investors can’t understand why it is taking away a component of their expenses when every other business can claim it.”