Prices Up... But So Are Listings

Median prices have reached a record high, but headwinds are gathering, writes Sally Lindsay.

1 January 2022

Median prices for residential property across the country. They increased 23.8% from $747,000 in November 2020 to $925,000 last year — a new record high.

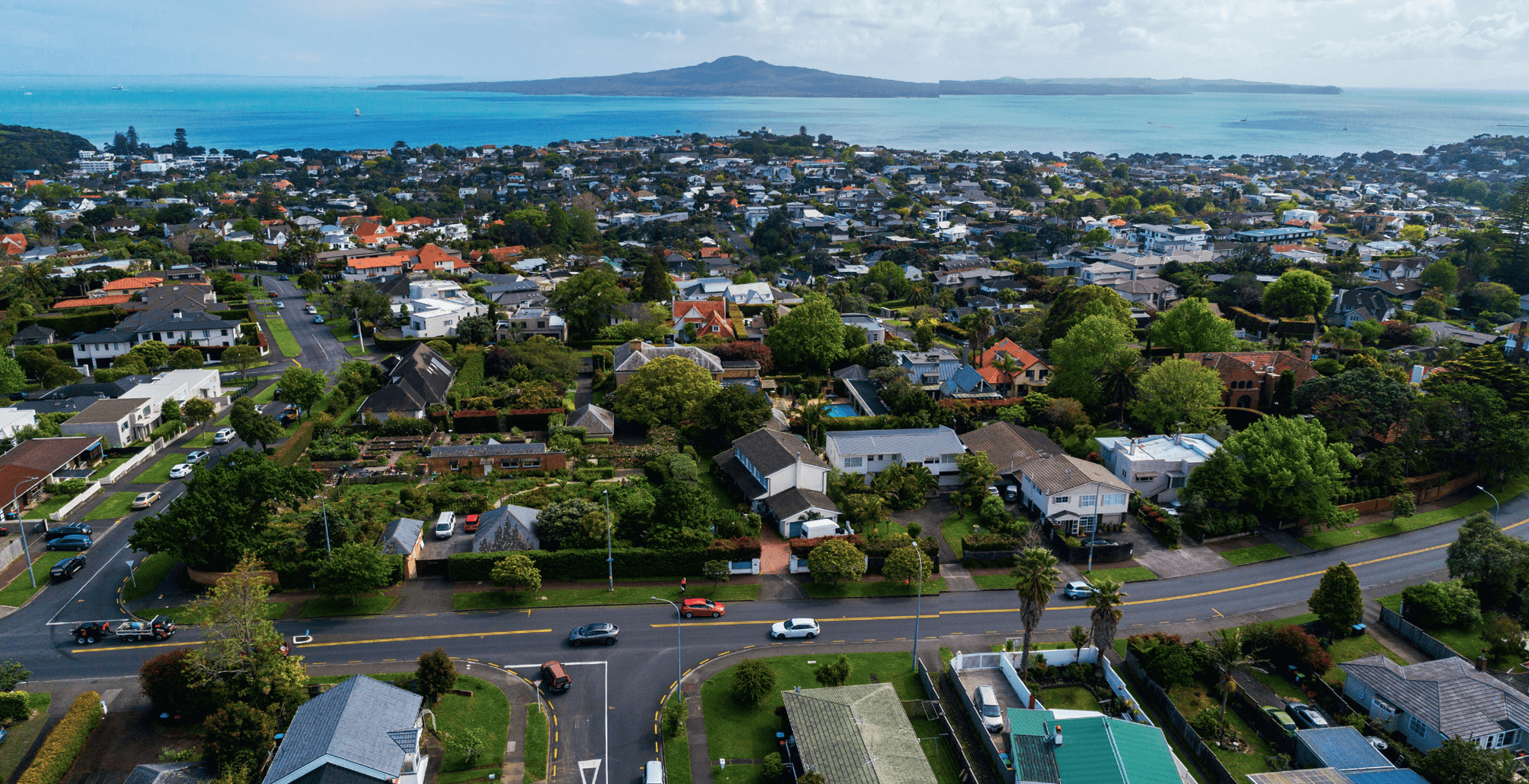

The median house price for New Zealand, excluding Auckland, increased annually by 26.0% from $615,000 to a new record of $775,000. The median property price in Auckland increased 26.2% annually from $1,030,000 in November 2020 to $1,300,000 in November last year.

REINZ chief executive Jen Baird says the market has settled back into its stride — returning to business as near-usual across the board. November shows an active market where property prices continue to increase. There has been a firm property market, with all regions experiencing annual growth and 24 territorial authorities reaching new record medians.

“While the supply versus demand imbalance continues to push prices inventory levels increased 5.1% annually and listings increased 9% — providing buyers more choice and giving reluctant sellers confidence that if they take their property to market, they will be able to buy their next one,” Baird says.

“Despite steady growth, headwinds are gathering. Government measures to moderate the New Zealand property market, the Reserve Bank’s OCR increases and growing challenges around financing as banks tighten their lending criteria are aligning. While the longer-term impacts of these changes will play out over the coming months, the strength of the market suggests that the growth trend will continue — albeit with a more moderate trajectory.”

QV and Barfoot & Thompson say strong demand for expensive houses is pushing up average prices, even as the market as a whole starts to ebb. QV says high priced houses helped push national average values to a record $1,029,820 in November.

Of the 1,182 homes Barfoot & Thompson sold in November, 960 (or 81.2%) went for more than $1 million, and of the 960, 216 sold for more than $2 million. The average price for November at $1,250,886 was up 5.2% on October’s prices, and 18.5% higher than at this time last year, says the real estate agency.

The same movement was seen for the median price, which at $1,240,000, was up 7.8% on October’s number and 27.3% higher than at the same time in 2020.

QV says while the November numbers look extremely bullish there are growing signs the property growth cycle is starting to transition.

Open Home Attendance Falls

QV general manager David Nagel says real estate agents are reporting a significant upswing in listings, while open home attendance rates are falling. Some properties are being passed in at auction, which was unheard of a few months ago.

Because of the booming market in higher-priced properties, the average value of a home increased 6.9% nationally over the three months to November, up from 5.3% quarterly growth in the three months to October.

The annual growth rate in the year to November was 28.4%, up from 27% in the year to October. “In almost all cases the greatest price increases were occurring in the top 25% of properties by value,” says Nagel.

In the Auckland region the average value reached $1,482,005, with annual growth of 27.9% — even higher than October’s year-on-year growth of 24.8%.

Barfoot & Thompson says the threat of rising mortgage interest rates had no impact on Auckland sales activity in November, with sales edging closer to pre-Covid lockdown numbers.

“In recent months the trend had been a gradual decline in the rate at which prices were increasing, but this stalled in November with the rate of increase edging up.”

Sales for November at 1,182 were the highest since the lockdown was introduced in August, but were still a quarter down on those for November last year, which was not restricted by lockdown regulations.

A feature of the month’s trading was the growth in the number of new listings brought to market. At 2,724 for the month, it was a third higher than last month and 16.7% higher than in November last year.

“With a further easing of trading restrictions in December, the Auckland housing market is now close to returning to the point where normal supply and demand factors are the major influencers on trading,” says Barfoot & Thompson managing director Peter Thompson. At month end tHEY had 3,933 homes on its books, close to where the market was this time in 2020.

New building consents dropped for the second month in a row in October. Statistics New Zealand figures show the number of new dwellings consented in October fell 2% after falling 2% the previous month.

During the month 4,043 new dwellings were consented throughout the country, down from 4,483 in September and 4,490 in August.

However, the figures were up 10.5% compared to October 2020 and the number of new dwellings being consented annually remains at a record high of 47,715 over the 12 months to the end of October. On an annual basis new dwelling consents are up 25.6% compared with the 12 months to October 2020, and up 57.9% compared to five years ago.

Auckland continues to account for the biggest share of residential construction, with 19,936 new dwellings consented in the 12 months to October, accounting for 41.8% of all dwellings consented throughout the country over that period. The total construction value of new dwelling consents issued in the October year was $18 billion, up 28.2% compared to the October 2020 year.

Affordability Drops Again

The latest Massey University Home Affordability Report shows affordability has declined 14.3% across the country over the past year.

This has been put down to soaring house prices in most regions and increasing interest rates.

The affordability report covering the quarter to August shows median house prices across the country increased 3.7% in aggregate. This, combined with an increase in interest rates, has seen national home affordability decline by 2.7% in the quarter.

However, national house price-toincome ratios have slightly improved this quarter, with house prices moving from 12.4 to 12 times the average annual wage.

Within the aggregate result, there are some big regional changes, including a 57.9% decline in affordability for the Manawatū/Whanganui region over the past year, and more than a 30% decline in affordability for the Bay of Plenty, Gisborne, Hawke’s Bay and Tasman regions.

The greatest increase in median house prices, in percentage terms, has for the last quarter occurred in Marlborough, 34.6% or $225,000; Waikato 6.8% or $50,000 and Auckland 4.5% or $52,000. Nine of the 16 regions showed an increase in house prices in this quarter except there was a drop in Gisborne of 19.4%, or $120,000, Tasman 5.9% down or $50,000 and Northland, a drop of 5.1% or $35,000.

The average property value in Auckland has now surpassed $1.4 million for the first time, CoreLogic’s House Price Index shows.

Property values in the country’s largest city grew by a further 1.5% in November, although the annual rate of growth did slow slightly to 25.7%, from 26.3% in October. Listings in Auckland remain 26% below the same time last year.

Nationally, property values were up 1.8% over November. This was a slower increase than October at 2.1%. The November reading shows a return to the trend of gradually easing property value growth, which has been in play since April this year, but was disrupted by the bounce in values in October.

In fact the annual growth rate trimmed back to 28.4% at the end of November, down from 28.8% at the end of October. This is the first time the annual growth rate has dropped since August 2020 when the market stalled following the first Covid-19 forced lockdown in April and May of 2020.

CoreLogic research head Nick Goodall says the slowdown reflects the natural loss in momentum after an extended period of strong growth, which has led to a deterioration in affordability, further impacted by rising interest rates and tighter credit conditions.

Properties Withdrawn

Meanwhile, rising listing volumes are also set to act as a headwind for property value growth. While on a nationwide basis there are still fewer properties available than in November in the past two years, the opposite is true in some regions.

The lift in advertised stock levels is most acute in the wider Wellington and Manawatu-Whanganui regions, where there are 30% and 33% respectively, more properties for sale now than the same time last year. Hawke’s Bay (+22%), and to a lesser degree Southland (+2%), also have more properties on the market than November 2020.

“At this stage sellers aren’t adjusting their price expectations, which leads to somewhat of a standoff as properties take longer to sell. The likely outcome will be seen in either downward price adjustments from vendors or more properties being withdrawn from the market without selling,” Goodall says.

Incoming legislation intended to help cool the over-heated housing market is already having a major effect on investors – but largely due to confusion and lack of detail than clear policy.

A survey by Chartered Accountants Australia and New Zealand (CA ANZ) and Tax Management New Zealand (TMNZ) sought the views of 361 accountants in public practice on recent tax policy developments.

The survey shows a considerable lack of confidence in how the legislation will work, and that it will likely result in noncompliance and issues around who is captured and who isn’t. Among the findings the survey revealed 70% of respondents have already seen clients change or voice their intention to change their residential property investment behaviours due to ongoing adjustments to the extended bright-line test, and proposed changes to deny interest deductions.

The survey shows that more than 21% of respondents, or one in five, feel “not at all confident” about advising clients on the proposed new build interest limitation rules, and more than 65% of participants feel the phase-out and denial of interest deductions will be somewhat or extremely difficult to comply with.

Similarly, almost 50% of respondents said they were either somewhat confident, or not at all confident on advising on the new build bright-line test.

“Because this policy hasn’t been developed in line with the generic tax policy process (GTPP), there’s a much higher chance of collateral damage.”