Property thrills and spills

Queenstown is known across the world as an adrenaline junkie’s mecca, but Sally Lindsay discovers life can be challenging.

28 June 2023

Experience the dramatic scenery, ride the rapids and brave the 360° spins on Queenstown’s Shotover jet.

Situated amid mountainous splendour halfway along the eastern shore of Lake Wakatipu, Queenstown is an adrenaline junkie’s mecca.

From heli-skiing and snowboarding on mounts Pisa and Aspiring, “surfing” the rapids of the nearby Kawarau River, to braving the Canyon Fox, a 445-metre zip line ride across the Shotover Canyon, Queenstown has been dubbed New Zealand’s “adventure capital”.

Other adrenaline-fueled activities include bungee jumping and jet boating, which originated in the Southern Lakes District.

There are also plenty of calming adventures. The 110-kilometre Queenstown Trail is a walking path that takes in rivers, lakes and mountain ranges and is an opportunity to spot wildlife, including the elusive kea.

Autumn is a popular time to visit as it creates amazing scenes of changing foliage against the lake and mountain backdrops.

Many of the jobs for the 47,400 residents living across 8,720 square kilometres are in tourism, food services and accommodation, but other key industries include construction, retail and professional, scientific and technical services.

The town was founded during the South Island’s gold rush in the 19th century. Today, its houses are among some of the most expensive in the country: the Kelvin Heights suburb is famous for being the South Island’s first million dollar neighbourhood.

Queenstown has always suffered from a shortage of accommodation due to the transient nature of many industries, such as tourism, and it’s not unusual for people to share a flat or rent with up to 11 others.

Although the town’s property remains the nation’s most expensive, with the median price at $1.4 million in March, compared with just over $775,000 nationally, prices are not tumbling as they have done in other parts of the country.

In March the total number of properties available to buy in the region increased 35 per cent year on year.

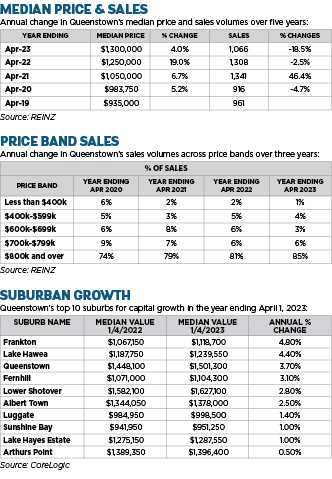

Rising house prices

CoreLogic data shows Queenstown’s suburbs are in the rarefied space of increasing house prices.

Over the 12 months to April 1, Frankton and Lake Hawea had increases of 4.8 per cent and 4.4 per cent respectively. House prices in eight of the 10 suburbs with the biggest increases are in the $1 million plus range. The other two suburbs, Sunshine Bay and Luggate, are in the $951,000 and $998,000 bracket respectively.

Although realestate.co.nz says March’s new listings in Central Otago/Lakes District were down 15.2 per cent year on year, Harcourts Queenstown sales manager Priscilla Uhrle says this may not be a true reflection of what is actually listed and sold.

“Due to the difficulty of selling and buying in the same market because of the housing shortage, some sellers are choosing to list their property, not advertise it and access our extensive database of active buyers,” she says. “For some vendors there is huge value selling off-market with conditions such as subject to buying.”

On the flip side the total number of properties available to buy in March increased 35 per cent in the region year-on-year, but a third of the stock was land only.

Queenstown and Lake Wakatipu from Skyline’s observation deck.

Elephant in the room

The elephant in the room is the purported glut of empty houses in Queenstown. Uhrle says it is difficult to tell whether that is the situation, but she says pre-pandemic holiday home buyers generally needed the property to generate income when not in use by the owner/s. Post-pandemic a new wave of buyers hit the market wanting a lock-up-and-leave holiday home without the need of income generation in between stays.

Professionals senior property manager, Kylie Brown, says there are plenty of empty houses in Queenstown, but she can understand it. “Many of the homes are expensive and the state of the market is not solely because of landlords. The majority are being reasonable with rent rises. The government has to take some of the blame with recent tax and tenancy law changes that have pushed home owners away from wanting to be landlords. The problem is just getting worse.”

She says many Airbnb and holiday houses became permanent rentals during Covid so landlords could earn income. Now the borders are open and migrants and tourists are pouring back into the country they have reverted back to Airbnb or short-term holiday homes.

Despite this, buyers for Queenstown homes are still thick on the ground. Harcourts latest Otago Market Report shows 52 per cent of buyers are local, 11 per cent are from the rest of the South Island, 28 per cent from the North Island and 9 per cent from overseas. Auctions are still a popular choice for selling with recent successful sales under the hammer sitting at 86 per cent.

Queenstown’s housing market is made up of several moving parts, says Uhrle. Nearly 37 per cent of all sales in the three months to the end of March were in the $1-1.5 million bracket.

Buyers in the lower price bracket are not excluded and apartments and townhouses are selling in the $650,000 to $1 million range. There is plenty of inquiry, Uhrle says, but those purchasers are likely to be impacted by mortgage rates. Sales in this area made up 22 per cent of the total.

“There is also good buyer activity in the $2 million-plus range. Often multiple offers are made on the same property in the luxury space. These offers typically contain minimal conditions and the buyers are not worried by mortgage rates.”

Uhrle says the volume of sales in individual suburbs can be more of a reflection of a higher number of properties available to buy than popularity.

CLOCKWISE FROM TOP LEFT Après ski at Coronet Peak, cosy semi-subterranean Blue Door bar in historic Arrowtown, make time for 18-holes at Jack’s Point, Chard Farm vineyard offers tours and tastings, refuel with a lake view at Nest Kitchen, kayaking anyone?

Top spots

Recently, Jacks Point, Arrowtown, Lake Hayes Estate and Shotover Country had the highest number of house sales and Kelvin Heights is always popular for its lake views and all-day sun. Another attractive suburb for buyers is Quail Rise for its central location to Frankton’s amenities.

Fernhill and Sunshine Bay have surged in popularity because banks are favouring house and land packages for buyers who want a new build. As they are few and far between, Uhrle says buyers are turning to Fernhill and Sunshine Bay to purchase pre-existing homes with lake views and also a convenient five-minute drive from the CBD.

Perennial favourites for families are the suburbs with schooling close by and for investors it is short-term holiday homes close to Queenstown’s CBD, with a view. Businesses, unable to hire staff because of the accommodation shortage, have recently been buying large multi-dwelling complexes to house workers.

Uhrle says rental investors have pulled back from the market, citing government legislation making it difficult to be a landlord and the phasing out of interest deductibility on pre-existing rental properties. “As well as this, investors also have to consider higher interest rates when calculating their rental return,” says Uhrle.

However, for long-term investors there is benefit in buying new, but yields have to stack up and this is difficult. She says there is a silver lining for these investors if rents have not been raised by the landlord in the past 12 months.

“As we near winter, a traditionally difficult season for accommodation in Queenstown, rental properties are scarce and rents are rising. Rents for modern warm homes have increased to levels higher than pre-pandemic and older homes are fetching good rental returns at levels on par with pre-pandemic points.”

The bubble

Brown says Queenstown has always been in a bubble of its own, but it’s getting worse.

The shortage of accommodation in the Southern Lakes is a perennial issue, but right now it’s harder than ever for long-term locals and newcomers to find a home. It’s not uncommon to be one of hundreds vying for a potential rental, she says.

“With little emergency housing in Queenstown Lakes District, there’s no support infrastructure – here a person without a home isn’t necessarily without money. There is very little supply and a long line of tenants.”

Brown recently advertised a four-bedroom, two-bathroom property at Lake Hayes on a Friday and received 50 enquiries the same day. “It’s the same situation for every rental that comes on to the market.”

Queenstown has recently had less than 25 properties for rent at any one time and in Wanaka it is worse, with just 15 rentals available. “Pre-Covid it was better, but not by much,” says Brown.

Renters who can’t secure a Queenstown home often look over to Wanaka and Cromwell as they are both about 45 minutes away, but it is just as hard to secure a tenancy in those towns.

“Some of the bigger Queenstown employers now won’t interview prospective applicants for vacancies unless they have accommodation in Queenstown. It deprives a lot of people of a job,” Brown says. Businesses are also shutting up shop two or three days a week because they can’t get staff. “Even if they can there is nowhere for them to live.”

With rents at $850 a week for an average three-bedroom home, $1,100 a week for a four-bedroom, two-bathroom and office house and in better areas with expensive houses rents of $2,000 a week plus, it is easy to see why minimum wage workers struggle, says Brown.

Rents are not much cheaper in Cromwell and Wanaka. Average rents in Wanaka start at $910 a week for a four-bedroom, two-bathroom house, rising to $1,295 a week.

Making ends meet

With a dire rental situation in Queenstown, there have been calls by locals to open showers at swimming pools, gyms and other facilities so workers without accommodation can at least look after their hygiene. Homeless people with a gym membership automatically have a place to shower.

Professionals has about 200 rentals on its books and Brown says no “scum landlords”. Landlords are facing increasing expenses, with rates up 13 per cent, insurance 25 per cent and interest rates at their highest for some years. They are only charging market rent, not trying to rip people off.

For minimum or low wage workers it is difficult to make ends meet, says Brown. For some it means living in their cars, or cramming two or three to a room within a house and even bed sharing. It is not uncommon for 12 people to be living in a bigger house.

“The town urgently needs the government and the local council to step in with help and long-term policies that can alleviate the situation.”

Investing in Queenstown

For more information about investing in Queenstown contact North Otago Property Investors Association: [email protected]

Corelogic Queenstown – Kelvin Davidson, Chief Property Economist

The data

Rental data is sourced from the Ministry of Business, Innovation and Employment based on rental bonds lodged. This data is supplied to us grouped into geographic areas based on statistical area units used by Statistics NZ for the census and as a result do not always match well with common usage suburb names.

The rental data for each area is matched to property price information from our database to determine property prices and therefore yield. The yield is calculated as the annualised rental income divided by the median property value calculated using our E-Valuer.

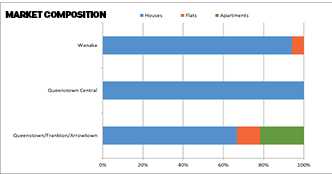

Market composition

Queenstown’s rental market is dominated by houses, although it also has a reasonable spread of apartments and flats. Of the 288 properties recently available for rent, 222 (77 per cent) have been houses, with 39 apartments (14 per cent), and 27 flats (9 per cent).

The largest market for flats has been Queenstown/Frankton/Arrowtown, with 21 properties, followed by Wanaka with six. There haven’t been any available in Queenstown Central. The latter hasn’t had any apartments for rent either (nor has Wanaka), with Queenstown/Frankton/Arrowtown the most important area for apartments. About 22 per cent of the properties recently available for rent in that area have been apartments.

For houses, Queenstown/Frankton/Arrowtown has recently had the most for rent (120), followed by Wanaka (96). Queenstown Central has only had six for rent, but that’s 100 per cent of all of the properties recently available in that area.

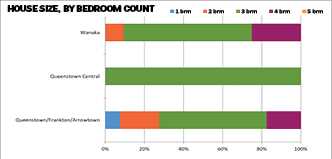

House size, by bedroom count

Looking specifically at houses (222 properties), there have recently been none for rent across Queenstown with five bedrooms, and only nine with one bedroom (all in Queenstown/Frankton/Arrowtown).

Indeed, the largest segment has been the three-bedroom bracket, with 135 houses recently available for rent, or 61 per cent of all houses for rent. Queenstown/Frankton/Arrowton has had 66 of those, and 63 have been in Wanaka. All properties recently for rent in Queenstown Central have been three-bedroom houses.

The four-bedroom bracket has accounted for 20 per cent of all houses recently available for rent in Queenstown, with an even spread across Wanaka and Queenstown/Frankton/Arrowtown. Finally, for two-bedroom houses recently for rent, most (24) have been in Queenstown/Frankton/Arrowtown.

Rent and yield

By matching average value to rent we can look at gross yield for three-bedroom houses in each area.

Median weekly rents for three-bedroom houses across Queenstown are $850 in Central and Queenstown/Frankton/Arrowtown, then drop to $700 in Wanaka. The median values for these properties are $1.4 million or above across the board, with Queenstown Central at that lower mark, and Queenstown/Frankton/Arrowtown above $1.56 million.

The net result is that rental yields are relatively low (by national standards) in each of Queenstown’s sub-markets, with Wanaka sitting at 2.5 per cent, and only Queenstown Central topping 3 per cent.

However, reflecting the widely reported shortages of properties in this part of NZ, rental growth has been strong, ranging from 11 per cent in Wanaka up to about 22 per cent in Queenstown itself.