The Winning Formula

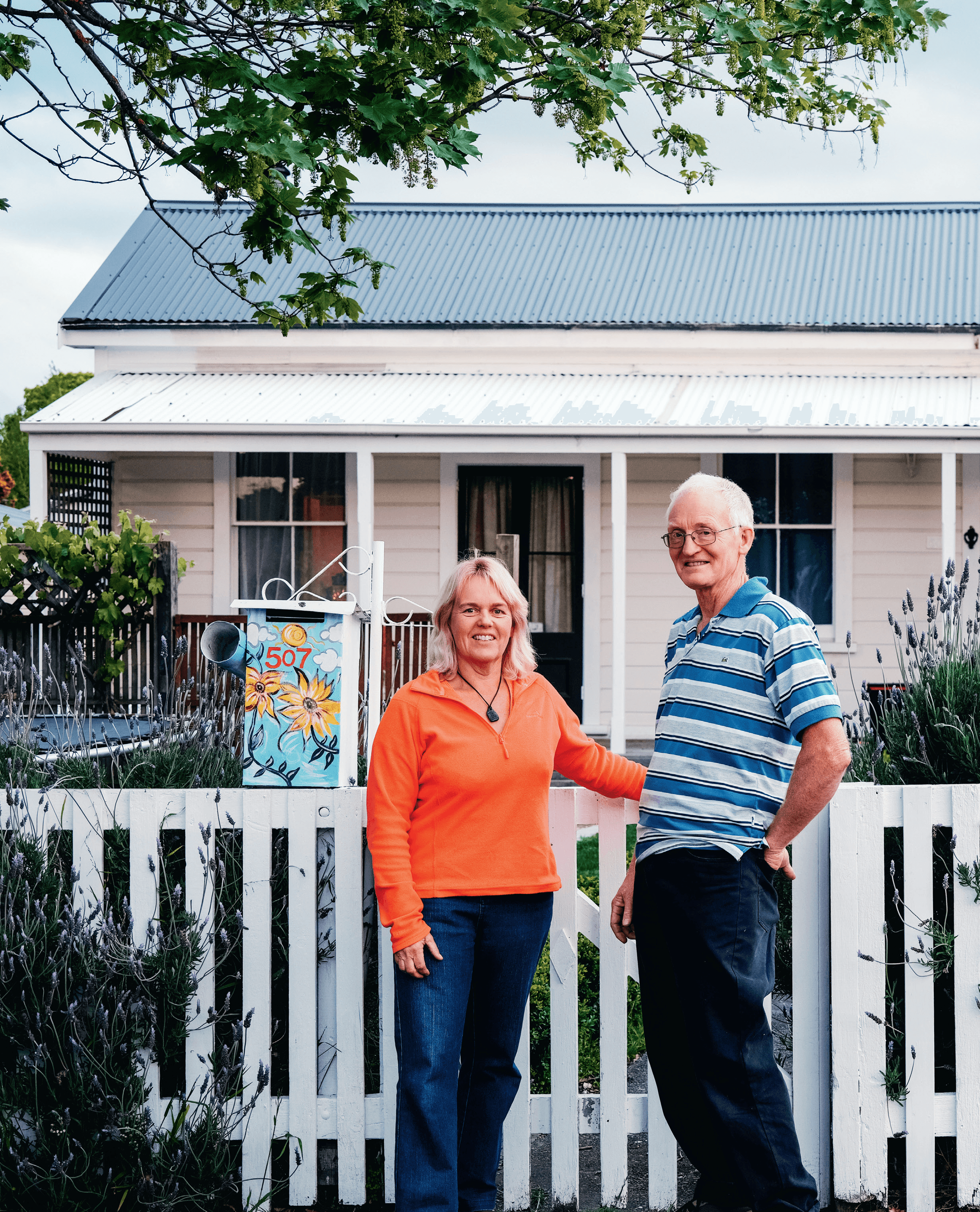

Fiona Baker might just be the perfect landlord and she’s inspiring friends and family to take the same path, Joanna Mathers discovers. Photography by Florence Charvin.

1 November 2021

Fiona Baker brings coffee for her tenants often when she does flat inspections. She also puts $20 notes in her pocket to give out for a job well done: tenants who go the extra mile to make sure her investment properties (and their homes) are clean and tidy.

The Hastings investor was recently given the gong for NZPIF Landlord of the Year and you can see why. She’s smart, savvy, and compassionate – but she’s also a force to be reckoned with.

“When I first meet a tenant, I tell them that we are likely to become friends. But I also tell them that if they miss rent payments, they will get a 14-day notice."

Inspiring Gran

Baker and her husband Neville (who does much of the building work alongside his wife) have been investors since 1999. She didn’t have parents who were investors, but her grandmother (deaf and eccentric apparently) was one.

She remembers her grandmother worked in a factory to save up the money for her first rental property, before then purchasing more. “I thought it was cool,” says Baker.

“She yelled and ate with her mouth open, but I thought it was great that she had rental properties.”

Baker says that her particular love is for old houses: villas and bungalows that have fallen into disrepair, and on which she can work some magic.

“I love houses and hubby just follows along,” she laughs. She says that many of them are “dungy old houses” with falling down roofs and holes in the wall. But they do them up to their own exacting standard.

“If there is a leak in the bathroom, for example, we will tear down the wall and start again. We’ve encountered a lot of rotten showers which other people may just fix quickly but we will completely rebuild.”

Wairoa To Hastings

The Bakers started their portfolio with two properties in Wairoa (one was $31,000 the other $54,000); they would end up with six properties in the district.

But a move to Hastings would change their location focus.

“The original six in Wairoa were slowly sold off (some to the tenants to get them on the housing ladder), and the proceeds relocated to Hastings where it was easier to do maintenance and inspections

“We doubled and tripled our money on each of those [Wairoa homes], which gave us enough for deposits on investment properties in Hastings.” They now have a portfolio of 13 houses in the Hawke’s Bay city, and while they are committed “buy and hold” investors (“we don’t do flips,” Baker says) they will sell strategically if there is the need.

When they moved their portfolio to Hastings, they started off purchasing homes in affordable areas that may not appeal to other buyers. But after a few years they sold these houses and purchased in more expensive (and popular) parts of town.

New Build Strategy

A new build strategy has also led to some property sales. “Last year we subdivided three of our larger sections and are currently building new brick and tile homes as long-term rentals.”

To further this plan, they purchased an old villa on a 1,000m2 section. This was facilitated by the sale of two properties they bought in 2006: a bungalow for $206,000 (which they sold last year for $500,000), and a villa they’d bought for $206,000 (which they sold for $520,000).

“We are thinking of our long-term economic situation. By selling these places we are able to be mortgage free; we can subdivide and build with Platinum Homes.”

All of these new dwellings will be rented out, adding much-needed stock to the Hastings housing market.

Alternative Accounting

Baker manages the entire portfolio of properties herself and has an unconventional method of keeping track of her finances and tenants: “I have various pieces of paper sellotaped together,” she laughs.

She has a great memory and this works for her, “But I was so surprised when I won, because I remember other winners talking about their excel spreadsheets, and I have nothing like that.”

What she does have is an eye for potential do-ups, a thorough understanding of the local building rules and restrictions, and a friendly relationship with local council.

“I like to find houses that I can do a ‘twist’ to,” she shares. “I know most of the building rules and I know the building officers by name – they probably roll their eyes when the see me coming!”

One of these properties earned her the runner up prize for NZPIF/Resene Renovation of the year in 2019. The “grand bungalow” in Charlotte Crescent, a special character zone of Hastings, was a saggy mess when they purchased it. But it was in a great location and had a separate 1990’s dwelling on the back.

“The main house was sagging into the ground at it had been butchered. It was definitely the case of ‘worst house on the best street’. After a four month renovation, at a cost of $52,000, the house was restored to its former glory: gaining $220,000 in value and bringing in $200 extra a week in rent.

6% Yield

At the moment, Baker says that her portfolio is yielding at around 6%. She does her budgets on the back of envelopes, she laughs, but she loves numbers and the results speak for themselves. In fact, they are so impressive that she recently convinced her bank manager to change careers.

“I love educating people around property,” she says.

“I trained up my bank manager and now she is on her own property journey. She could see the numbers and realised I was having much more fun than her, so quit her job and has become a property investor!”

The Bakers are in the fortunate position of being mortgage free, so the changes to interest deductibility rules won’t affect them. But they are finding it hard to find bargains; the past year’s sizzling market not sparing Hastings. She’s door knocking at houses that she thinks could be suitable for her “extreme makeover” strategy, but nothing has come up in recent months.

She often finds her bargains via neighbours of her properties; “people say they have places that we may be interested in,” she says. And if it’s an old house with potential, she may well be.

Next Generation

The Bakers’ two children are already on the property ladder, although they said it took a bit to convince the older boy into buying.

“I explained to him that if he saved $100 in beer money, and spent it on a mortgage instead of renting, he would be able to own a home,” she says. The capital gains that have been made on this purchase have astonished him, says Baker.

And while Baker looks for her next bargain, she’s still busy looking after the tenants for her 13 properties, many of which don’t have computers or even mobile phones.

“I have to go and knock on their doors,” says Baker. “All the tenants are friends as well, and many of them are older people, so it’s nice to be able to catch up with them.”