Welcome To The Vibrant South

Auckland’s south is a melting pot of cultures and the heart of the city’s Maori and Pacific communities, Sally Lindsay writes.

2 July 2023

Thriving economic and industrial centres sit alongside art, history and nature in the south. Manukau at its heart – a cosmopolitan centre, commercial hub, and home to the largest Polynesian community in the world.

With significant population and employment growth expected over the next 30 years, plenty of developments and improvements are planned for Manukau, including new public spaces, residential apartments and urban renewal projects in and around its centre.

The area’s growing population has also led to attractive new subdivisions popping up and more are in the pipeline.

Manukau Institute of Technology (MIT), one of Auckland’s biggest education providers, is located in central Manukau along with the South Campus of Auckland University of Technology (AUT), which is ranked in the top 1 per cent of universities in the world.

By contrast, Mangere and Mangere Bridge town centres have more of a village vibe, with the views and outdoor activities offered by Manukau Harbour, nearby Mangere Mountain, and Ambury Regional Park.

Otahuhu and Manurewa serve as the crossroads to and from the city centre.

Two of the south’s biggest employers are Auckland Airport in Mangere and Wiri Inland Port. Other employers include a wide range of manufacturing, health, food and beverage companies.

Further south, residential developments in the past decade have seen couples and families find homes in Pukekohe and Bombay, which offer more affordable housing than the city centre.

More housing will be a feature of a new urban development at Drury over the next 30 years. It is forecast to bring 22,000 new homes and 60,000 new residents to the area, as well as large-scale retail and industrial developments, two new train stations, and up to 12,000 new jobs.

This will have a major effect on house prices. In May REINZ data showed house prices in Manukau City were down 12 per cent year on year.

CoreLogic’s most recent data shows a dip in prices of 15 per cent across South Auckland suburbs over the year to May 1.

The biggest drops were in Mangere Bridge and Otara, where house prices fell 15 per cent in both suburbs from $1,419,950 to $1,207,650 and from $881,350 to $749,200 respectively over the year. Following close behind were Papatoetoe at a drop of 14.3 per cent, Manurewa at 14.1 per cent, Mangere East at 14 per cent and Mangere at 12.8 per cent.

Saturday-morning fun at popular Otara Market.

Rise In Activity

Despite these falls in house prices Ray White director and branch manager Tom Rawson says price falls have levelled off recently.

The company had its busiest month in May for the past 18 months, despite listing volumes declining.

Rawson puts the uptick in market activity down to months of small price drops and interest rates levelling out over the past three or four months, as banks had already priced OCR rises into their mortgage interest rates some time ago.

“Buyers and sellers now have enough information to make informed decisions, so investors, property traders, first home buyers and second home buyers are back in the market as well as developers looking for land to develop their next batch of houses.”

He says the market has been resilient for good property through the slump. However, during the pandemic even the worst houses on the worst streets were getting similar activity to the best houses on the best streets because it was like a feeding frenzy. “Whereas, now we’re seeing good property getting great attention, which is promising for market equilibrium.”

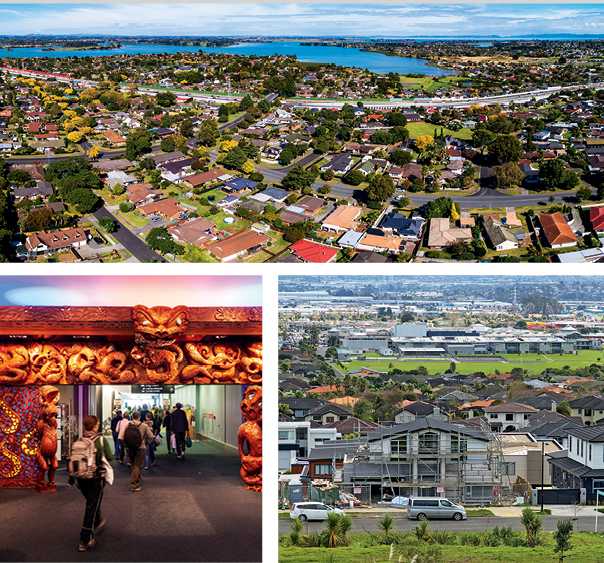

CLOCKWISE FROM TOP Family-friendly Takanini, East Tamaki Heights, Auckland Airport travellers.

Part of this could be because there aren’t enough new listings coming to the market, says Rawson. “We have a shortage of supply. If we continue selling at the existing rate and bringing new listings to the market at the same level as we have, we will run out of property to sell in six weeks.”

In May, Rawson’s branch, which covers Manukau, Mangere, Mangere Bridge and Otara, sold 113 properties and brought 64 new listings to the market. In April the company sold 72 properties. Rawson expects as the October election draws closer sales could drop again.

“Buyers and sellers will wait to see if there are any changes to development rules, LVRs or if the bright-line test is pulled back to two years,” he says. “If the bright-line test is changed then a bunch of new property will come to the market. A lot of people who want to sell now can’t due to the 10-year bright-line forcing them to pay 39 per cent or 33 per cent tax on any capital gains if they sell beforehand. It is one of the main issues causing a supply shortage.”

Those dipping their toe into the market have included overseas buyers coming home, first time buyers, first time and long-term investors, developers and parents buying for their children.

“We’ve had every single type of buyer,” Rawson says. The most popular price bracket has been $600,000-$800,000 – the historical first home buyer range. Now is as good a time for first time buyers as investors.

Investors tend to favour three-bedroom properties in Manurewa and Mangere. Four-bedroom houses probably represent the best yield, Rawson says.

The two types of investors dominating South Auckland are yield hunters and freehold buyers.

“Those just wanting yield and the rent to cover their outgoings are finding it increasingly hard in South Auckland, especially when interest deductibility is added into the mix. Rent on most properties doesn’t cover outgoings.”

Investors predominantly looking for freehold land that will increase in value, whilst the rent helps cover the costs, are also finding it a difficult market, Rawson says. Land values bottomed out to below $1,000 a square metre, but they are now anywhere from $1,000-$2,000 a square metre if zoned residential.

In Papatoetoe – one of the top suburbs for home ownership and investment – there have been several land sales for $2,000 a square metre.

CLOCKWISE FROM TOP LEFT A day out at Pukekohe Park raceway, new developments in Flat Bush, finding produce bargains at Otara Markets, land earmarked for future development in Drury.

Big Rental Demand

On the rental front it is just as busy.

Reliance Property Management owner Indy Singh recently had 20 families through a Papatoetoe house his company had for rent.

That was three months ago when immigration was not at the levels it is now. Many economists believe the number of migrants coming to New Zealand will reach 100,000 this year.

Many applicants were new migrants and Singh is concerned as there are not enough private rentals in South Auckland. From a book of 300 properties he manages, he has only one for rent and a brand new house he has just signed up.

“In short, the market demand is so much higher than the current supply,” Singh says. “Immigration is one of the factors and others include developers not building because of high interest rates, the October general election outcome and the removal of interest deductibility, which is affecting investors.”

He says many of the properties he has signed up to manage belong to first home buyers crossing the ditch to work. “These are people who bought in the past two years and are not selling due to the current property prices.”

There are still a few investors buying, but not as many as previously when they were buying properties specifically to rent.

Some investors have tried to sell and if they haven’t got the price they want they have pulled back.

Rents are definitely rising. “Landlords are pushing interest rate rises on to tenants.”

He has recently rented a four-bedroom house in Papatoetoe for $900 and a five-bedroom house in Otara for $850. A new four-bedroom house in Mangere is being advertised at $870 a week.

Popular Suburbs

Even at these high rents, Singh says everyone needs a place to live and what is generally happening is either two separate couples are going in together to afford the property or four or five working adults. It’s usually not a single mum and dad with two kids – it’s extended families in order to pay the rent.

Manurewa, Takanini, Papakura, Otara, Papatoetoe and Manukau are the most popular suburbs for renters where a three-bedroom house rents for $650-$720.

The most sought after rental is a two-bedroom property, because people feel they have their own privacy. These rent for $550-$580 a week.

Rent for a four-bedroom house starts at $780 a week and rises to $900, depending on the property’s condition. Five-bedroom properties rent for anything above $800 a week.

Because the market is tight, Singh says he gets on average eight applications for any rental he advertises and 15 to 20 for bigger properties where extended families can live.

Properties go quickly and are usually rented in two weeks.

Singh says while the market is active, the biggest issue facing the property management industry and tenants is a lack of regulation.

He is behind the government’s plans to regulate the industry. “Anyone can open up a property management company without being qualified. Some people are operating without a trust account.

“There have been cases where property managers have left the country with landlords’ money – the rent and tenants’ bonds.”

Property managers need a minimum level four certificate and insurance of up to $1 million to operate.

“There are people doing it for the wrong reasons and that is not helping the legitimate operators.”

Investing In South Auckland

For more information about investing in South Auckland go to: www.apia.org.nz.

Corelogic South Auckland

Kelvin Davidson, Chief Property Economist

The Data

Rental data is sourced from the Ministry of Business, Innovation and Employment based on rental bonds lodged. This data is supplied to us grouped into geographic areas based on statistical area units used by Statistics NZ for the census and as a result do not always match well with common usage suburb names.

The rental data for each area is matched to property price information from our database to determine property prices and therefore yield. The yield is calculated as the annualised rental income divided by the median property value calculated using our E-Valuer.

Market Composition

The rental market across key (selected) parts of South Auckland is dominated by houses, with much smaller shares of flats and apartments. Indeed, of the 720 properties recently available for rent, 606 have been houses (84 per cent), with 87 flats (12 per cent), and 27 apartments (4 per cent).

In terms of apartments, the largest markets have been Mangere East (12) and Mangere (9), with most flats concentrated in Manurewa North and Papatoetoe South (21 each), along with Papatoetoe West and Papatoetoe North (15 each).

Turning to the much bigger house segment, Manurewa North has recently had 201 properties recently available for rent, which is 91 per cent of all properties recently on the market in that suburb. Each of the other sub-markets have also had a reasonable number of houses recently for rent too, but in Mangere Bridge/Airport and Otara, the concentration rate for this property type has been highest, at 100 per cent.

House Size, By Bedroom Count

Looking specifically at the 606 houses, none have had five bedrooms, while only six have had one bedroom (all in Manurewa North). By contrast, 59 per cent have had three bedrooms, with 22 per cent in the two-bedroom bracket, and 18 per cent with four bedrooms.

For four-bedroom houses recently for rent, Papatoetoe South and Manukau and Manurewa Heights have been the latest markets (21 properties each), with relatively high concentration rates too, of around 29-30 per cent. For two-bedroom houses, Manurewa North has been the largest market by quite a margin, although those properties represent a higher share (29-30 per cent) of all recent rental houses in Papatoetoe West and South.

Finally, for three-bedroom houses recently available for rent in these key South Auckland areas, Manurewa North has again been the largest, with 129 properties. However, Otara has had the highest concentration rate – or in other words, of all houses recently for rent in that suburb, 80 per cent have had three bedrooms.

Rent And Yield

By matching average value to rent we can look at gross yield for three-bedroom houses in each area.

Median weekly rents for three-bedroom houses in South Auckland range from $620 in Otara up to $685 in Manukau and Manurewa Heights. The range of values on these properties is relatively wide, however, starting at $761,900 in Otara up to $1,102,650 in Mangere Bridge/Airport.

This means that gross rental yields also have a fairly wide range too, with that figure for three-bedroom houses sitting at 4 per cent or more in areas such as Manurewa North, Otara and Papatoetoe West, but as low as 3.2 per cent in Mangere Bridge/Airport. Rental growth itself has been pretty subdued lately in these suburbs, with Mangere showing a strong gain for three-bedroom houses (14.5 per cent), but each other area much flatter.