Why Get Into Commercial

In the first of our new commercial property investment series, Amy Hamilton Chadwick finds out what makes commercial property investment so attractive to residential investors.

31 August 2016

Commercial Property Part 1

Run your eye over new zealand’s rich list and you’ll soon notice that property is the star performer when it comes to making, and growing, a multi-million-dollar fortune. Even those wealthy individuals who made money in other spheres put that money into property. And it’s certainly not residential rental property – commercial property is the outstanding favourite when it comes to asset classes. Sir Bob Jones, the Chow Brothers, the Manson family. Commercial property attracts serious money and serious investors.

For many ambitious residential property investors, the ultimate aim is to move across into commercial investment. Could you, too, capitalise on the power of commercial property?

Working Commercial Investment

The idea of stepping into the realm of the commercial landlord is daunting. As a tenant or homebuyer, you’ve already had an introduction to the residential market.

There are PIAs, mentors and plenty of books to help you master the details of residential investment. Commercial property investment is more opaque and that “scares the hell out of people; the huge learning curve puts them off,” Christchurch investor Aaron Shurmer says, “but the cashflow is massively better, the margins are better and the tenants are the biggest difference.”

The value of a commercial property is mainly dependent on three factors:

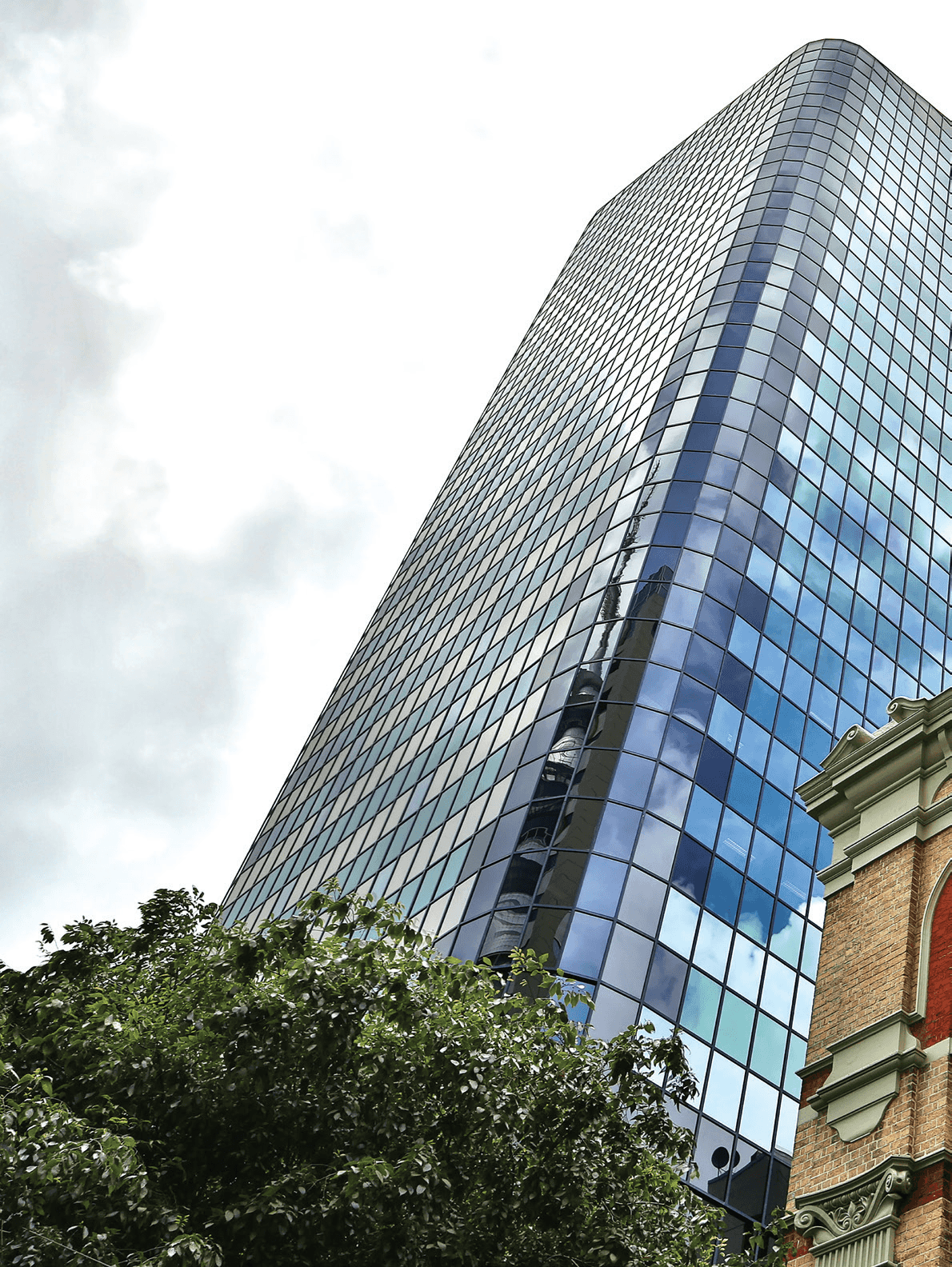

1. Location: the CBD is the hottest spot with values tending to increase the closer the building is to the centre of the city. Commercial buildings are often categorised into prime, secondary or regional depending on their location – and prices will reflect these categories.

2. Lease Term: one or two years might seem like a long time for a tenant to stay, but that’s not a great lease on a commercial building. What you really want is 10 years or more. A long-term lease adds enormously to a property’s value – you can make massive capital gains in a second with the right signature.

3. Tenant Quality:

Can your tenant pay the rent? Is the business sound and profitable? Are they able to maintain your building? The best tenants are well-established successful companies; struggling businesses signing up short leases don’t do much to help a building’s value.

Obviously size is a factor, but it’s less influential than these other measures. Office rents are calculated per square metre for comparison purposes, but a tiny, full building will often be worth more than a big empty one. Solid construction is also vital to give you the best chance of borrowing from the bank (see below). Because the sectors vary widely, information is divided into office, industrial and retail. Which sector you choose will depend on your budget, your appetite for risk and what’s available in your area.

Investors tend to Cut their teeth on Residential, get to Understand leasing And general issues – Martyn Reesby

Starting Commercial Investment

Commercial property is far less accessible than residential for the novice. A lot of data is available to show you typical rents and yields, and to help you work out values, but without context, strategy or personalised advice it’s not terribly helpful. Real estate director research and consulting Chris Dibble recommends talking to lending experts and real estate agents about what you can afford and what might suit your circumstances and investing style. He thinks one of the best commercial property types is a small industrial property:

“Industrial is a bit easier to look after, with one tenant typically, and you can walk in and see straight away if they’re doing okay. It’s much easier than retail with multiple tenancies.”

Industrial is the most commonly bought-and-sold segment of the market and is highly popular with investors, Dibble says, making up about 50% of transactions per year. The remainder is around 20% retail, 20% mixed use and 10% office buildings. (“Those bigger glamorous shiny assets might be what you think of when you think commercial, but there’s not necessarily a lot of those transactions.”)

Neighbourhood Investment

Industrial might be sought-after, but they’re not necessarily the best starting point according to Martyn Reesby, commercial investor and director of Reesby and Co, which specialises in commercial and development finance and sourced more than $1 billion in funding last year. He believes the most user friendly first-time commercial investment is a small retail unit, new or nearly new, in an outer suburb (in Auckland he names Onehunga, St Lukes or Penrose).

The risks are lower because it’s relatively easy to find a tenant and the newness of the build makes it attractive to lenders. Buy in your own neighbourhood, too, because you’ll have a better understanding of the local nuances and you can visit your building regularly.

Auckland is the favourite destination for commercial buyers, followed by Wellington and Christchurch, though Christchurch is a unique micro-market that Shurmer predicts will soon see a substantial oversupply of buildings. “Stay out of Christchurch at the moment; there’s a huge amount of dumb money floating around,” he says. “It’s fantastic for future growth but it’s scary right now.”

Regional commercial buildings are a mixed bag; unless you have a desirable tenant, a solid building and a long lease, small-town commercial buildings tend to be an unreliable investment. It’s not much help for regional investors, especially if you plan to manage your own property.

If, however, you’ve been successful as a residential investor you already have many of the tools you’ll need to do equally well in the commercial sphere: an understanding of cashflow, some knowledge of the risks, good relationships with lenders. If you want to make that move, 2016 looks like being a great year for the commercial market.

“This is a very positive time in the market,” Dibble says. “People are confident in the demand and the property fundamentals. Talk to banking experts and lending guys, look at our data online – find a quality space people want to be in.”

Who wants to Damage the place Where they go to Work nine hours a Day? If the sink blocks, They call the plumber And you never even Know about it. These Are business people – You don’t get the rta Bollocks kicking in. – Aaron Shurmer

Exacting Lender Demands

Dealing with lenders is also very different when you invest in commercial. Banks love to lend on houses; a homeowner can usually borrow at least 80% of the value of even the most run-down, remote residential property. When it comes to commercial lending, though, “it’s chalk and cheese in every respect, there are no similarities at all,” Reesby said.

Banks look at three main factors when deciding whether to approve your loan: first, where is the property located? “If it’s in the boondocks, the bank won’t be interested,” he says. Second, is the building well constructed? Lenders like to see a 67% plus rating on the National Building Scale (NBS); anything below 50% makes them nervous and under 33% means you probably won’t be able to get bank funding.

You’ll need to provide plenty of reports about the quality of your building in order to secure a loan. The Property Council publishes the Quality Grading Matrix and Retail Classifications which ranks office and retail spaces either grade A, B, C or ‘other’. Demand and prices for grade A properties are high and lending is easier to obtain; you won’t have much luck if you’re shopping for ‘other’ properties.

Third, and most important, what is the quality of the lease? The lender wants to know what type of tenant is renting the property, how many years the tenant has signed up for, how much rent is being paid and the terms of the lease.

“If you have a very, very good long-term lease, you might be able to borrow up to 70%. If you have a poor lease you might only be able to get 40% to 50% of the property’s value,” Reesby says.

While Reesby deals at the upper end of the market, at the lower end you may be able to pick up a cheaper commercial building with just a 10%. This is a huge selling point for Auckland investors who are expected to provide a 30% deposit on residential property, says Dibble.

Dream Tenants, Vacancies Nightmare

It’s the quality of tenants that draws in former residential investors, Reesby says: “Investors tend to cut their teeth on residential, get to understand leasing and general issues, then go into commercial because they get sick of bullsh*t tenants,” he says with a laugh.

The tenant-landlord relationship in a commercial property lease is a completely different beast to its residential counterpart. Provided you and your tenant are happy and everyone acts reasonably, the lease can say almost anything and you can charge any rent and any bond – plus you can claim depreciation. Tenants are motivated to look after their workplace and they pay all the operating expenses, either in addition to, or built into, their rent.

“Who wants to damage the place where they go to work nine hours a day?” Aaron Shurmer says. “If the sink blocks, they call the plumber and you never even know about it. These are business people you don’t get the RTA bollocks kicking in.”

Your rights as a landlord are considerably stronger in a commercial lease, Reesby says. “If the tenant doesn’t pay you boot them out.” But while the tenants can be a dream, vacancies are a commercial investor’s nightmare and represent the largest and likeliest risk. During down times, commercial buildings can sit vacant for not just weeks, but months or even years.

Auckland vacancy rates during the GFC were as high as 30% and prices were flat or falling – it wasn’t a happy time for the average commercial investor.

“It’s always a rollercoaster with vacancies and they’re still 15% in the [Auckland] CBD,” Reesby says. “It’s a very specialised world – the leasing of office buildings and bidding them out for new tenants is a very expensive exercise.”

While the big corporate investors will employ property managers, the usual approach for individual investors is to self manage. This works because the majority of leases are for four to six years and the tenants require far less supervision than the average residential renter.

Reesby manages his own commercial portfolio and knows that keeping his tenants happy is the trick to successful long term cashflow. When the lease is nearly up he goes to the tenant and “bends over backwards” to encourage them to re-sign.

“If you micromanage your buildings you can do okay, but if you don’t have the experience it becomes a risky exercise.”