Work Hard Make It Happen

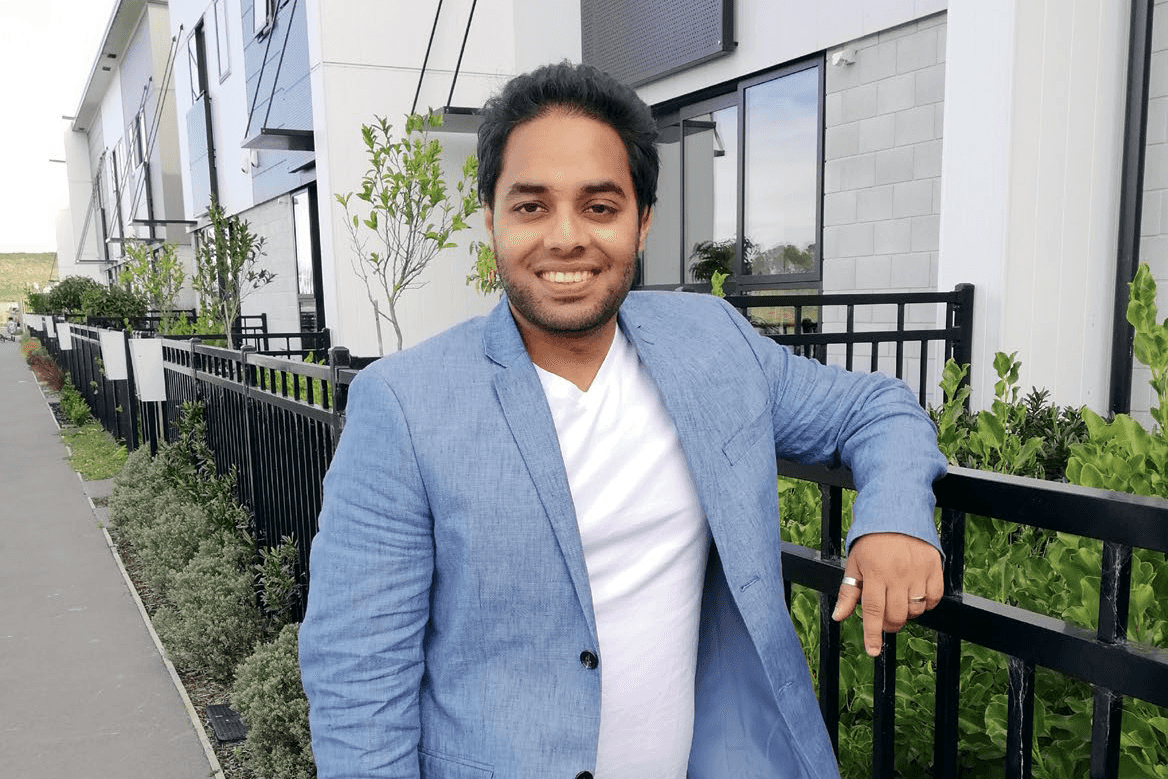

Riyaan Mohamed went from being employed to wash dishes to owning $1.6 million of property before the age of 26, Joanna Jefferies writes.

1 May 2020

Life wasn’t easy for the young Riyaan Mohamed. He arrived in New Zealand at the age of 13, but the move had required his parents to liquidate all their assets in India to allow Riyaan’s father to study. Five years after they arrived, when Riyaan was in his final year of high school, the family’s financial situation hadn’t improved, so he dropped out to start work as a dishwasher and help support the family.

It was discouraging to have left school early and Riyaan knew it had limited his options, but he had confidence in his own ability to make things happen: “My brain worked and I could understand numbers really well. Now I know the term for that – it’s entrepreneur!”

It was a tough few years of saving up, living frugally and earning a low wage first as a dishwasher and then in entry-level retail. By 2017, he had worked his way up to a store manager position.

Shares Felt Risky – Property Stacked Up

“I was working 50 hours a week, saving money, but I knew it wasn’t going to be enough,” says Riyaan. “It wouldn’t put me on the road to financial freedom even if I doubled it. I needed to do something with my money. There was nothing I could do until I actually had some, so I saved up for two years, then I started looking at a whole bunch of things.”

He considered shares, managed funds and a wide range of different investment types. But having worked so hard for his money, he felt as though investing all of it in the share market would be too risky: “I didn’t want to gamble. I looked at my options one by one to see what would work well for me.”

‘My brain worked and I could understand numbers really well. Now I know the term for that – it’s entrepreneur”

Riyaan watched YouTube videos and read extensively online and in print; he became a big fan of investment writers Robert Kiyosaki and Grant Cardone, both proponents of property investment. When Riyaan looked closely at buying a house, he could immediately see some significant advantages. The first advantage was that he would no longer be paying rent, but instead the same amount of money could go towards paying for his house.

Running the numbers, he could buy a two-bedroom with a flatmate, and his mortgage payments would be about the same as his current rent. The idea of paying the same amount of rent, while owning his own home, having no risk of vacancy and still being able to keep saving a big chunk of his income? It made total sense to the then 21 year old.

Buying His First Property Aged 21

In 2016 he purchased a two-bedroom house in Hornby, close to work, for $350,000. The success of that buy made Riyaan feel even more confident in his decision to invest in property. When he met his new partner, she moved into the Hornby house with him and the flatmate moved out. Together the couple decided to keep the budget tight and save up for a bigger home.

Around two years later, they bought a three-bedroom house in Halswell for $484,000, renting the Hornby property out at a very respectable 6% gross return.

“It’s had 100% occupancy since we moved out, with a great tenant, and we haven’t increased the rent. It pays about $100 a week profit all up and that passive income helped me to finance my next house.”

Less than a year after moving into their new house, Riyaan sat down with his partner to strategise. How could he save up the 30% deposit required to buy another rental? Even with two incomes it felt like it would take too long. After doing some research, he realised that buying off the plan would have two big benefits. First, he could put down just a 10% deposit. Second, he could afford to buy in the Christchurch CBD.

Using both savings and equity, Riyaan bought a brand-new one-bedroom townhouse in Armagh Street for $410,000. It would be fully furnished and there was no body corporate levy to be paid: “It’s really hard to get that cashflow when you’re paying out body corporate [fees].”

The Upsides Of Buying Brand-New

Construction was completed in mid-December and the tenant moved in just three days after settlement on a two-year lease, paying enough to make the property cashflow positive.

The brand-new property really appealed to Riyaan: “I don’t like surprises. I want low maintenance. I want them all tenanted by good-quality tenants. I don’t want to make a quick buck, buy a do-up and add equity.

“My plan is to create constant cashflow and then move onto the next one.”

His fourth buy is from the same developer, another off-the-plan onebedroom townhouse in the Christchurch CBD. It’s due to be finished in February and cost $420,000 – and Riyaan believes it’s his best buy yet. He plans to furnish the property and expects it to rent for between $450 and $500 a week.

Riyaan describes Christchurch as a hidden gem for property investors and has great faith in the city’s burgeoning popularity.

Major rebuild projects in the CBD are close to completion and with $30 billion being spent there, Riyaan is delighted to have bought in the centre of town before prices start to rise.

“I’ve told my friends to buy in central Christchurch, but they’re not doing anything. When the value has doubled, they’ll say I got lucky,” he laughs.

Diversifying And Consolidating

When that townhouse is settled, Riyaan estimates he will own around $1.6 million in property. It’s a strong financial position for a 25 year old who didn’t complete high school – and he and his partner are no longer living as frugally as they once did. Now they make sure they enjoy themselves, too, going on regular annual holidays overseas, going to the movies weekly and a restaurant dinner monthly.

Together they plan to buy more property and grow additional income streams. Riyaan’s recently invested in a capital fund, and plans to grow his contribution to that, in addition to locking in that fifth townhouse.

“I think I can do this by the end of the year, by the time I’m 26. Once I have five properties, I’ll wait a year or two and then do something bigger, like diversify out of Christchurch or do a multi-income property.

‘Nobody taught me anything about property investment. I’ve

never been to a class. Vision is what motivates me’

My main goal is to get ahead and have enough money so when I have my kids I can spend a significant amount of time with them.

“Not spend 40 hours a week working and be too tired and stressed when I come home.”

Unlike so many young buyers who’ve needed their parents’ help to get onto the property ladder, Riyaan has been the one helping out his parents.

They’ve now moved to Christchurch to be closer to their son, and they’ve bought a house, learning from his success.

“I will work hard, and I will make it happen,” he says.

“Nobody taught me anything about property investment. I’ve never been to a class. Vision is what motivates me. Long term vision.”