Compact And City-Proud

Wellington’s central city is its economic engine and cultural heart, writes Sally Lindsay.

1 August 2022

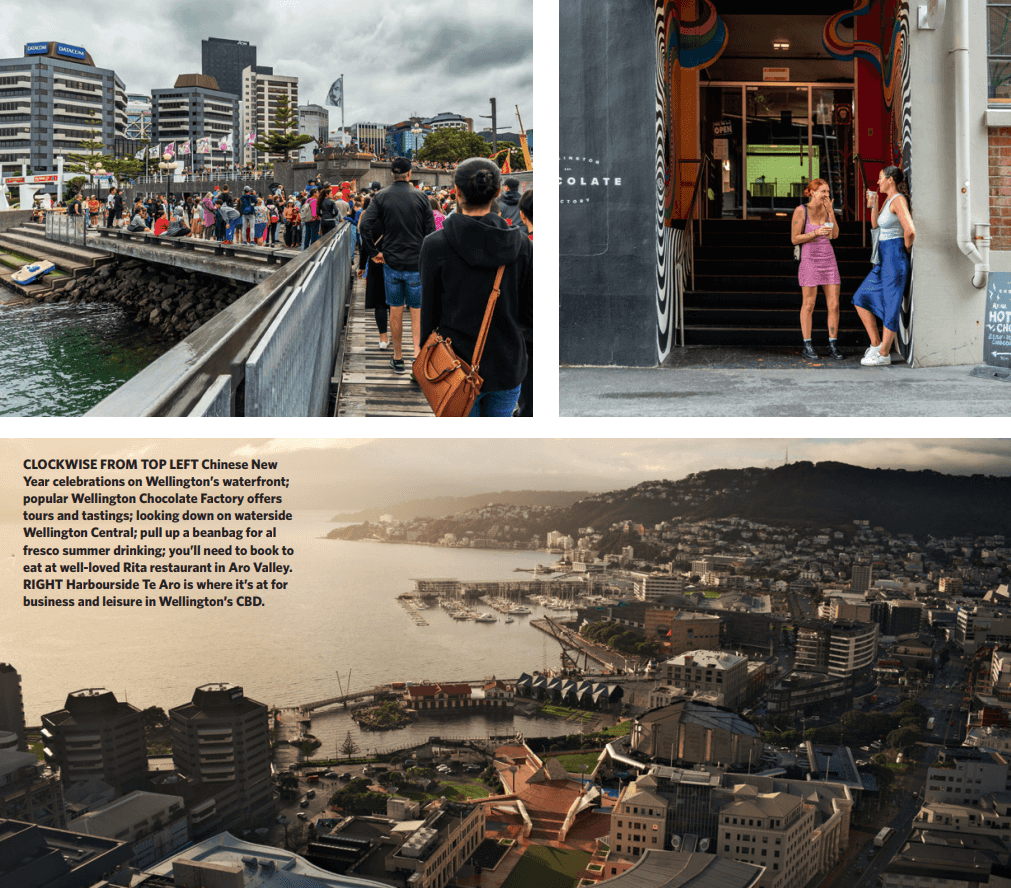

Wellington central is compact, lively, and full of character – the centre of government, business and creativity. It has eateries, galleries, bars, theatres and waterfront walks all within a green town belt with easy access to nature.

For people living and working in Wellington Central, there’s little day-to-day need for a car. Travel statistics show walking is the main way of getting about for almost 75 per cent of residents. The compact layout means nothing is out of reach for a keen walker.

People are friendly and city-proud. There’s always something different to do, and it’s not necessarily expensive: days can be spent perusing art galleries, and the national museum Te Papa, for example.

When the weather is bad, the city centre can bear the brunt of it, but when it’s good residents get the best of it. Oriental Bay is the go-to destination on a hot day for just about everyone in the region.

Wellingtonians know their city is a super cool small city with a big heart. The central city population has risen to about 24,000 and, like anywhere in the world, buying a house or renting in this area can vary dramatically and change from year to year.

The suburbs of Mt Victoria, Kelburn, Wadestown, Thorndon, Aro Valley, Holloway Road/The Terrace, Mt Cook and Newtown are often included in the lexicon for Wellington Central. These inner suburbs are recognised for their character, a combination of topography, site sizes, architectural styles, the concentration of buildings constructed before 1930, and the scale of buildings.

Te Aro had the highest number of consented dwellings out of all suburbs in the capital in 2016 and is likely to experience major change over the next 30 years with the population expected to double, says Wellington City Council. This means a significant number of new apartment blocks in the central city.

In the past year to June 1 properties in Te Aro have risen 8.8 per cent from $713,700 to $776,500, data from CoreLogic shows.

Wellington Central properties had the biggest increase, rising 10.4 per cent from $538,400 to $594,150. Following were Wadestown properties, rising 9 per cent from $1,466,900 to $1,599,200. At the bottom were Mount Cook properties, rising just 6.2 per cent from $831,800 to $883,700.

Changing Market

Wellington Central’s home sales have dropped dramatically.

Tommy’s Real Estate, the biggest agency in Wellington, is down to selling properties mainly to people up or downsizing.

Principal sales director Nicki Cruickshank says although the market has been on a high for the past three years, it is now extremely tough.

“There are virtually no first home buyers. Last year they made up 26 per cent of sales. That figure is now down to 5-6 per cent and those that are in the market are in the $700,000- $900,000 sales bracket whereas a year ago they would be buying in the $1-$1.3 million range.”

Cruickshank says many first home buyers have joined the brain drain overseas.

Investors faced with 40 per cent deposit requirements, rising interest rates and the removal of tax deductibility are also few and far between, taking another 20-30 per cent of sales out of the market.

“We are basically down to transacting for people upsizing or downsizing.” Surprisingly, Tommy’s overall transactions are only slightly down on winter last year. Properties are taking longer to sell, though, sitting on the market for eight to 10 weeks, whereas last year they were out the door in three weeks.

Cruickshank says banks are still not approving the number of mortgage applications they claim they are and loosening of rules last month has done little to help. “Middle managers may no longer be subject to fines and penalties if they get things wrong, but the top echelon are still under those restrictions.”

A significant change has been the 50 per cent plus increase in houses for sale compared to this time last year. The numbers are hovering at about 700-800 houses for sale. A couple of months ago it was closer to 1,000 compared with 400 at Christmas. “Last year buyers had to take what they could get and now they have choice. However, as many buyers are not getting the sales results they want they have taken their homes off the market and put them into the rental pool,” says Cruickshank.

“In a matter of weeks the rental market has gone from a shortage of homes to now an oversupply and not enough tenants. Rentals are sitting empty, although landlords have dropped rents. It’s a tough market.”

Cruickshank, personally, has a solid, well-looked-after rental that has rarely sat empty, but in the past three months there has been no tenant enquiry even though she has dropped the rent. “Tenants in good rentals are staying put and there are just not enough other good tenants around. It’s an extremely tough market, particularly for landlords who have mortgages and increasing costs associated with being an investor to pay.”

Best Buys

Popular with buyers are two, three and four-bedroom standalone houses and the big drop in sales has mainly affected Lower Hutt, where many new townhouses have been built, and suburbs further out, says Cruickshank. “Central Wellington hasn’t been hit as hard.”

Apartments, mainly in Wellington Central, are being sold if they are priced right, she says. “The best buys are off-the-plan new builds because buyers can qualify for cheaper interest rates and tax deductibility and the five-year bright-line test still applies for investors.”

New builds might not last for long. Cruickshank says development has ground to a halt. Developers are finishing off the projects they have but are not going on to any new developments.

“Many people are waiting out the next year to see if there is a change in government, and if there is, relying on National to keep its promise to rescind tax deductibility, which applies to all other businesses apart from property investment, which is a misnomer whatever way it’s looked at.”

Demand for investment properties has fallen away quickly Wellington Property Investors’ Association president Peter Ambrose puts the fall in demand down to rising interest rates and the removal of tax deductibility. He says the market for investors and landlords is the worst it has been for years. “The city is awash with rentals as people put their properties into the pool rather than sell at lower prices than they expect.

“Because there is no corresponding glut of tenants, it is forcing landlords to drop rents, which is no way to run a business. The market seems to be turning in favour of tenants, but it is also affected by seasonality – not many people move in the winter.”

Wait And See

Real estate agency Lowe & Co director and association committee member, Adam Cockburn, says there are few investors buying because compliance is far more onerous.

“The biggest thing affecting investors is the loss of tax deductibility. The government calling it a tax loophole is nonsense. In my opinion it is theft. Investors are paying tax on profit they never made.”

While it is hard keeping rentals tenanted and costs down there is not a huge number of investors selling either, says Cockburn. “A three-flat complex, for example, does not interest owner-occupiers and is not attractive to investors at this time in the cycle.”

Investors have basically stopped buying and he believes they will only start again when the equation between rents and property prices adds up. “They need to cover costs. Many small-scale investors with one rental, for example, have to top up their mortgage by writing a cheque for $20,000 a year. They are not going to buy a second rental.”

Cockburn says rents need to go up, house prices come down and investors need to be able to claim mortgage interest tax deductibility again before the market moves.