Continuing Confidence

House prices are maintaining their upward trend with low rates driving demand for stock, writes Daniel Smith.

28 February 2021

We are now truly into the swing of 2021. How crazy to think that this time last year we were in a blissfulnstate of ignorance, having little idea what the word coronavirus meant. But what is even crazier is that a year after the beginning of a global pandemic, multiple lockdowns, and tumultuous markets, the economy is booming . . . and property is leading the charge.

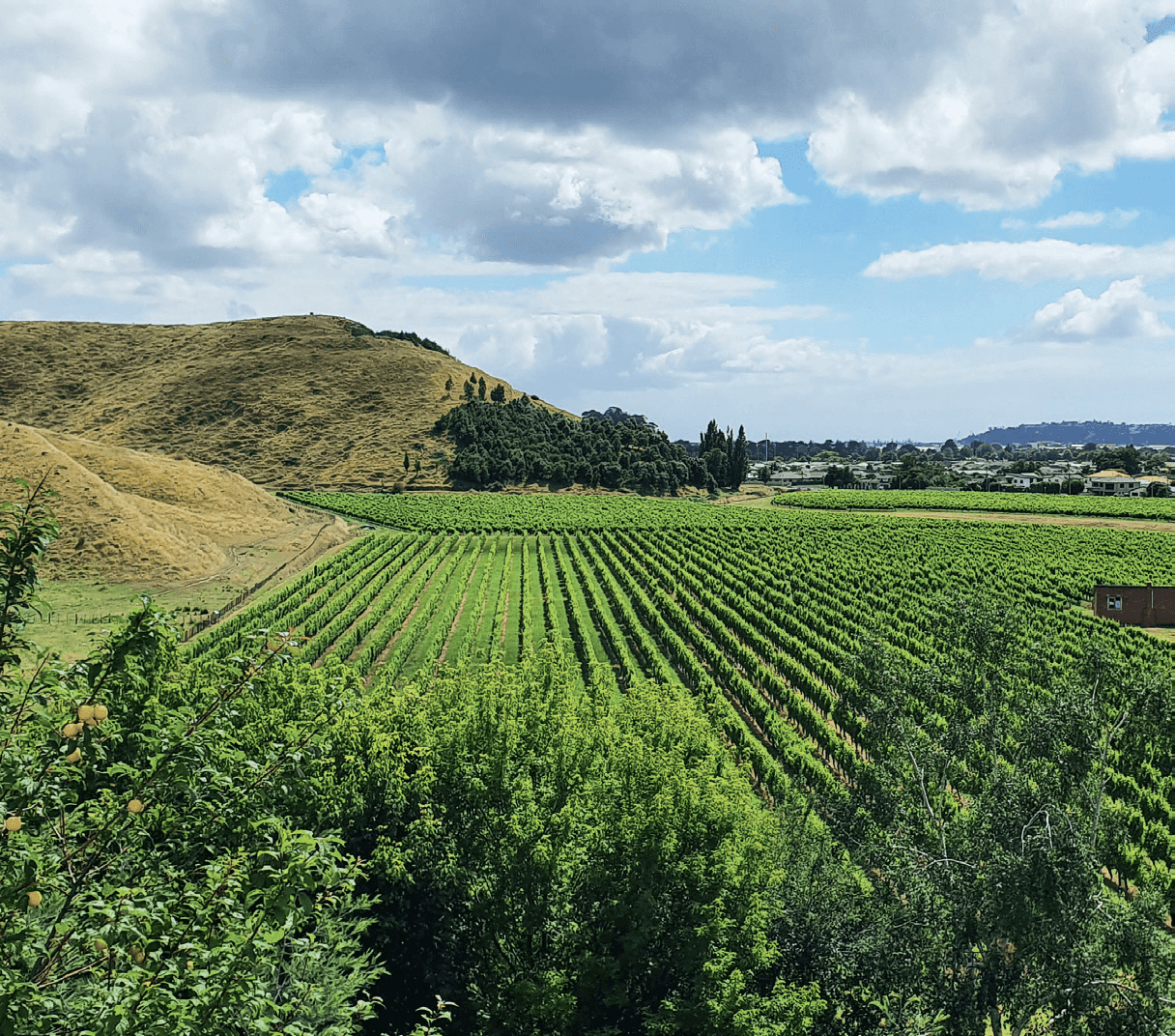

A combination of low volumes and high competition has led to record high sales numbers across the country. The sales we saw over summer are continuing, and the regions are also starting to give some competition to the main centres with Hawke’s Bay, Taranaki and Nelson regions seeing median price increases that leave Auckland in the dust.

But it isn’t all plain sailing on the horizon. Data shows that the short supply of houses driving up prices in the early stages of 2021 may become a hurdle for portfolio diversity as investors head towards the middle of the year. But with growth in the main centres as well as the regions, it looks like property will continue to be a hot commodity.

Record January Prices

The summer rush that saw house prices increase across the country has continued into the new year, according to data from REINZ. Median house prices across New Zealand increased by 19.3% from $612,000 in January 2020 to $730,300 in January 2021. While median prices were down marginally from December, house prices held up better than we would normally expect when moving from December to January as indicated by REINZ’s seasonally adjusted median pricing data which showed a 2.0% lift.

Bindi Norwell, chief executive at REINZ says: “Usually, in January the residential property market slows down, and prices ease off a bit as people head to the beach for their summer holidays. However, the first month of 2021 was anything but normal, as house prices across the country have continued to rise.”

REINZ data shows that while Auckland’s median house price increased by 14.9% from $870,000 at the same time last year to $1,000,000, the country’s biggest city had some stiff competition from other regions. Hawke’s Bay: with a 25.9% increase from $550,000 in January 2020 to $692,500 in January 2021. Taranaki: with a 23.8% increase from $420,000 in January 2020 to $520,000 in January 2021. Additionally, New Plymouth District ($600,000) and South Taranaki District ($395,000) reached record median highs in January. And Nelson: with a 19.2% increase from $597,500 in January 2020 to $712,500 in January 2021.

Nick Goodall from CoreLogic highlighted the strength of the regions in his latest report. The data shows that outside the main centres, Gisborne (29.4% annual growth) and Whanganui (25.7%) continue to experience strong growth, as lower property values compared with other cities, alongside accessible credit and low interest rates, translates to demand and growing prices.

Goodall says that, “Confidence in the New Zealand property market remains high, as the fundamentals of strong demand and limited supply remain. The outlook is for further growth, assisted by political commentary regarding the need to protect property wealth.”

Mixed Bag For Sales

The story of sales over this period has not been the cut and dried positive tale that investors have come to expect over the past few months. It has been a tale of two cities, or rather two regions. One where volumes continue to climb, and the other where volumes are beginning to dip.

Norwell, says that “January saw the highest number of properties sold for the month of January in five years. Looking around the country, results were varied with some regions experiencing the highest number of properties sold in a January month for years and other regions experiencing the lowest number of properties sold in a January month for years.

This highlights how those regions with solid levels of new listings back in November and December are now benefiting from an uplift in sales volumes, whereas those with chronic low listings and total inventory shortages such as Taranaki, Manawatū/Whanganui and Wellington – are now starting to see this impacting the market. “Again, the Auckland market has seen one of the largest percentage increases in sales volumes when compared to the same time last year, with a 37.6% uplift in January 2020 – this was the highest for the month of January in 14 years.

North Shore and Manukau cities both saw annual sales volume increases exceed the 50% mark showing how strong demand is in these popular parts of the City of Sails,” continues Norwell. “Looking forward to the next couple of months, we would expect sales volumes to continue at a reasonable pace, but again, as we’ve said in the past, this does rely on reasonable levels of new listings coming onto the market.”

Stock Remains Low

The low housing stocks that we have seen at the beginning of 2021 have continued to deplete as buyers and investors hustle to get in on the rushbof sales. Data from realestate.co.nz has shown that stock shortages may pose challenges for Kiwi buyers at the start of 2021. realestate.co.nz has said that housing stock was down year-on-year in almost every region in New Zealand during December, with 16 of 19 regions falling to all-time lows since records began 13 years ago. The national stock level was also at a record low.

Vanessa Taylor, spokesperson for realestate.co.nz, says this is despite a year-on-year 19.2% increase in new listings coming onto the market during December. “There were 29.1% less homes available for sale at the end of last month compared to December 2019, creating a significant mismatch in supply and demand.”

CoreLogic’s Goodall also confirmed that the current situation of demand outstripping supply is one that will not easily be remedied. “Inventory remains tight across the country, although Trade Me recently reported that advertised stock levels had lifted (8%) year-on-year in our largest city. Even so, it seems demand continues to exceed supply, leading to growing values. In fact mortgage demand across Auckland (and Northland), as measured by valuations ordered through the banks, is already 6% higher than it was at the end of 2020.“Signs are optimistic for stock to continue to come to market, with agent appraisals (lead indicator for listings)

‘As prices get higher the pool of people that can buy gets smaller and smaller’ KELVIN DAVIDSON

already back to the same levels as pre- Christmas, however it must be noted that there would need to be an above seasonal lift to match current demand, and for now that seems unlikely,” says Goodall.

Look To The Listings

For Kelvin Davidson, senior property economist at Corelogic, the low stocks that we are seeing in the market are a driver of competition affecting both house prices and speed of sales. “This isn’t a new thing, we have had a lack of listings for quite some time. A lot of the heat we are seeing with prices is because strong demand is also hitting up against very low supply.”

Davidson says that buyers are a mix of first home and investors, but that competition is pushing prices up to a point where certain investors and homebuyers may become locked out of the market. “As prices get higher the pool of people that can buy gets smaller and smaller. I don’t think we are there yet, but the data is showing that those kinds of pressures could be on the horizon.”

For investors the pressure is compounded by new regulation coming into force. But Davidson reminds investors that “The LVR restrictions are sort of a token thing because it has already been bypassed. We know the banks have already gone there themselves so really we are already there.

Although last time in 2016 when the Reserve Bank brought in a 40% LVR for investors we did see the market share fall quite a bit in 2017, from 27-8%, to 22-3%. So I think we will see some change, there will be some investors who are locked out by that requirement, while there will be opportunity created for buyers and other investors who are more cashed up.”

While the LVR is the major change, Davidson reminds investors that the Government has also made some vague hints that there is incoming policy on housing. “In terms of Government regulation we don’t have much visibility on that. There has been an announcement that they are going to do something but we don’t know what that will be. There could be changes to the bright-line test or tax, but really all we can do is wait and see.”

For the investor looking at the crystal ball for what can be expected over the rest of the year, Davidson recommends looking towards the listings. “While the past few months have seen low supply, there are just a few signs that we are seeing some more housing coming to market. Recently there has only been enough listings to achieve the demand at the other end of the pipeline keeping total stocks very low. If we see these LVRs kick in and sales activity tail off, alongside a new flow of listings we may see the market start to loosen up. I think how listings evolve is certainly something to watch in 2021.”

Low Rates Driving Demand

For Dominick Stephens, chief economist at Westpac, the talk surrounding housing stocks is a mere distraction from the real engine of this housing boom, low interest rates.

“I think that prices will continue to rise throughout this year due to low interest rates stimulating large purchases for investors and first-home buyers. Real estate agents often talk about the stock of property for sale, I think that is rather an approximate measure of the market.

You have to ask yourself why is the stock of property for sale low. Obviously if it is low prices will go up but I think you need to think more deeply about what is driving demand for homes. That is largely low interest rates.”

Last time we spoke to Stephens Westpac’s forecast for 2021 was house price inflation of 12%. That has since been bumped up by quite a margin. “Our forecast for 2021 is now a 17% increase in house prices. Back in August 2019 we saw interest rates falling and we predicted a house price inflation of 7% for 2020, we got 12% despite Covid coming along and that is largely because we saw a further drop in interest rates.

For 2021 we are predicting a 17% increase.” Stephens again reiterated his old warning to any investors thinking that this exponential increase will continue indefinitely.

“In my opinion when interest rates eventually rise house prices will fall. I don’t think it will happen for years but when it does we will see a change in the market.” ■