Five Strategies To Increase Value

Here are some highly effective ways in which to add value to your investment property. By Joanna Jefferies.

31 March 2019

Whether you’re trading, buying to hold, or simply trying to get the most out of your existing portfolio, you’ll want to know how to squeeze as much value as you can out of your property.

The current, softer market (in many but not all locations across New Zealand) means adding value is the focus for many investors in 2019.

Increased value typically goes hand in hand with increased yield, which can only be a good thing, whether you’re selling or holding.

So, to help you strategise for increasing the value of your portfolio, we’ve compiled the top five ways in which investors are currently adding value to their properties.

1 Take Out The Tools: The Do-Up

The simplest way to add value to a property is to upgrade the spaces where buyers and renters see the most value: the kitchen and bathroom.

The cost of solutions for these spaces has come down dramatically in recent times, making the return on investment highly appealing.

Cabjaks’ Charles Bird says in the past, it was expected that kitchens would set an investor back $20,000 to $30,000.

“Now a lot of our property investors are regularly putting kitchens in at $3,000 to $5,000 including laminate tops and sinks.”

Time frames have shortened considerably too, says Bird.

“You used to be waiting for kitchens for five or six weeks, now it’s a couple of weeks and you’re in, so you’re back on the market and rented again really quickly.”

This is partly due to their online modelling systems, whereby landlords can enter in room measurements and play around with their kitchen or laundry design, negating the need for consultants to go on site for lengthy consultations on design, says Bird.

Fulltime investor and trader Matt Bonham takes advantage of Cabjaks’ quick turnaround in his rental renovations, but he says it’s important to know the market you’re in, and correspondingly, how much to invest.

“I modify the [standard cabinetry], so if it’s a real cheapy, say in Ranui, and the end value is going to be a high six or seven then I don’t do much. I still use their kitchens in million dollar homes, but I change what I do: I might put stone on the bench and I’ll tell them not to drill out the cabinet hardware and I’ll put bigger hardware on.”

The same premise applies to bathrooms, says Bonham.

“If they’re around the $1 million bracket I’d tile the walls and leave a plastic tray because it looks a lot more expensive, but if I’m in the cheaper areas where the houses are only $750,000 at their end value, then those ones I wouldn’t tile the showers and II’d tile less walls.”

A recent purchase he made in Auckland’s Brown’s Bay illustrates how much value can be gained from a brief, full makeover.

The three-bedroom, two-bathroom property was purchased for $780,000 and completely overhauled from top to bottom at a cost of $90,300.

A new kitchen including touch hob and integrated microwave was installed, as were tiled bathrooms including tiled showers, new vanities, toilets, hardware, carpet and the exterior was tidied up.

After a renovation period of four weeks and three days, the house sold for $925,500.

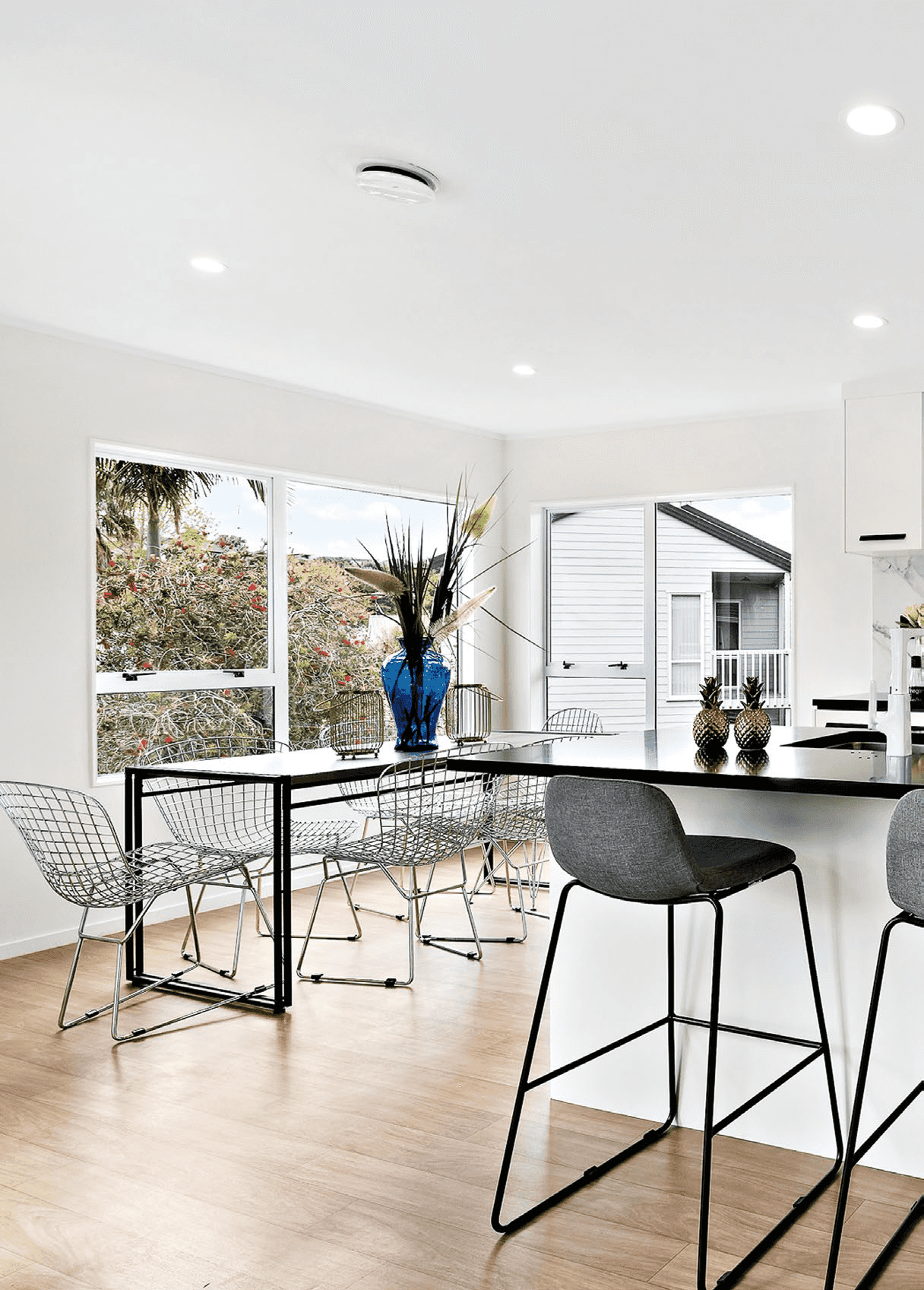

Bonham says investing in kitchens and bathrooms adds massive value and the style that is selling houses well at the moment is a black and white marmoreal palette.

“I’m doing white kitchens with negative details under the bench and black handles; and then I’m doing a Carrara marble-look benchtop and matte black tiles with white grout for the splashback, or the Carrara marble on the back upstand and a black bench – one of those two options seems to work really well.”

2 The Title Defect

Before you get out your sledge hammer and consent application, consider scrutinising your property’s Certificate of Title. Was there a reason you got the property at a cut price?

A property on a cross lease title is typically considered far less valuable than a fee simple property – so it’s certainly worth investigating whether you can rectify this title “defect”.

Property law specialist Joanna Pidgeon says the first step to achieve this is to engage a property surveyor and get them to do a desktop analysis of your property.

Auckland Council needs current subdivision standards to be met, for example a minimum driveway width, fire ratings met, and services separated.

“I always advise people to speak to a surveyor first to see whether it’s feasible and then to start talking to your neighbours,” says Pidgeon.

Once you know the issues and approximate costs, you’ll need to have the agreement of all the cross lease owners to change the title.

The legal cost of changing the title is typically between $5,000 and $10,000 depending on how much negotiation needs to take place, says Pidgeon.

On top of this cost, you’ll need to pay for the council’s subdivision consent costs and any physical work that needs to take place to enable the subdivision.

On the flip side of the coin, there are some investors who are putting cross leases in place to create a separate title from a freehold, says Pidgeon.

“Say you had a granny flat, it might be possible under the Unitary Plan to cross lease it, whereas you might not be able to do a fee simple subdivision – so we are seeing cross leases popping their heads up again as a way of creating extra value.”

Additions and alterations on cross lease properties that haven’t been updated on the property’s plan are another “defect” that can devalue a property in the eyes of potential purchasers.

‘If you’re spending $150,000, you’re getting about $400 a week, so that’s a pretty good return’ GARY LIN

Pidgeon recommends having the plan updated, to create a “clean title”, thereby mitigating objections to the property and increasing its perceived value.

3 Adding Rooms

Auckland investor and property mentor Gary Lin always looks at ways to increase the number of incomes on a property because he says valuers use the capitalisation rate to value rental properties, which means increased income is directly tied to an increase in capital value, as in commercial property.

An example of this is a property Lin’s client purchased and renovated in 2016. The Pakuranga home and income property was secured for $1.4 million. The main dwelling was a three-bedroom home with workshop underneath and the minor dwelling was two bedrooms and 110m2.

The main home was converted to a four-bedroom dwelling and the workshop underneath was renovated into a twobedroom unit. The minor dwelling’s floorplan was altered to create a fourbedroom layout.

The total cost of the renovations was $260,000 and it now achieves a 5.2% yield.

The owner says the property has increased $600,000 in value and Lin says converting a one income dwelling into a three income property can increase a property’s value by 25% to 30%.

This project was a significant undertaking, but Lin says adding a bedroom into any existing dwelling is the simplest way of increasing revenue.

“In terms of the legality of it, as long as you don’t touch structural walls you can add a bedroom. We have spoken to Auckland Council, if you shift your bathroom or kitchen around a couple of metres you usually don’t need consent as long as you don’t add any sanitary fixtures.”

Investors should always consult with their local council before making changes to the layout.

However, Lin says investors should be aware any changes to the property that are not recorded on the plans, regardless of their legality, may not please buyers when it comes to sell.

“Agents will go by what’s on the property file. If Property Guru shows a three-bedroom and you’re selling it as a four, you can have an issue.”

4 Converting A Garage

Converting a garage into a dwelling will have a positive effect on the property’s value, says Lin.

“You need a minimum of 6m2. The cost depends on the condition of the garage as well, the external panels have to come off and you have to put building paper in.

“You have to have a high stud because by the time you put your ceiling in – your Gib board and your battens and all that, you need at least 2.2m, otherwise it feels claustrophobic.”

Lin says this type of renovation will create a single-bedroom studio unit only, but in Auckland a studio can rent out for $400 per week.

The building consent will set you back $40,000 to $50,000 says Lin, and the cost of physical works will depend on how much the external drainage costs.

“For all the physical works allow $80,000 or $90,000 and if you want a separate water meter it will cost about $10,000, But, if you’re spending $150,000, you’re getting about $400 a week, so that’s a pretty good return.”

5 Adding A Minor Dwelling

Christchurch investor Claire Wilson is a fan of adding a minor dwelling for increased value and income. In the past she has used Versatile Homes to build a two or three-bedroom ancillary dwelling on site at a cost of $75,000 and $100,000 respectively, including consents. Wilson says the additional rent of a threebedroom minor dwelling increases the value of the property by $380,000 at a capitalised rate of 6%.

Alternatively a sleepout cabin under 10m2 doesn’t need a consent and in student areas in Christchurch these rent out at $150 and cost only $7,000. However, they may not be seen as adding increased value as they are not fixed buildings.