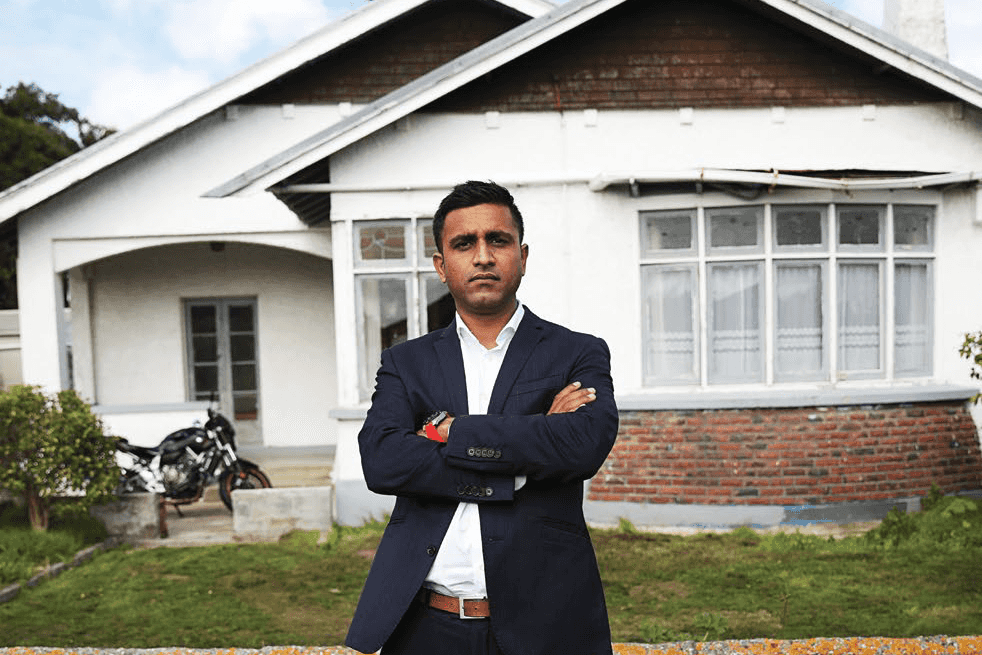

Invercarcill Property Magnate

From a hectic Mumbai lifestyle to a property portfolio and career in Invercargill, Amy Hamilton Chadwick tells the story of a successful young investor.

1 April 2018

In 2002, when Avinash Varghese was 17, he was living in Mumbai – a massively dense, cosmopolitan city with a population of 18 million, an average annual high of 32°C and shops which never close. Then his family moved to Invercargill. His new home was almost 12,000 kilometres away, with a population of 50,000 and with an average annual high of 14°C.

“It shut at 4pm Monday to Friday, and on Saturday and Sunday there was nothing to do,” he laughs. “The culture shock was pretty intense.”

He’s now one of Invercargill’s most passionate advocates, but Varghese is the first to admit he wasn’t too impressed at the start. Everywhere he went he was instantly identified as an outsider and constantly needed to explain that English was his first language: “The assumption is that I’ve just arrived yesterday, even now.”

But, even as a 17-year-old, he was able to see some of the upsides of one of the world’s southernmost cities. One major benefit was the brand-new hospital; not usually a concern for a teenager, but two weeks before arriving in New Zealand, Varghese’s father had been diagnosed with cancer and given six months to live.

‘In Mumbai, a 60m2 flat could easily cost a million dollars; because of population density home ownership is not a given - in Invercargill the property was really cheap’ AVINASH VARGHESE

“His whole lifestyle changed from ‘go, go, go’, to ‘let’s find a place to retire and settle the family’. Invercargill was quiet, it had good facilities and he liked the prospect of seeing the end of his life here – removed, but still first world. It ticked a lot of boxes.”

Varghese’s parents had retired from high-ranking finance jobs in Mumbai, while he and his sister were studying; together the family concentrated on enjoying their last months together.

“My father dealt with the chemo for two or three months. Then something strange started happening. He was getting better. It went from ‘you’ve got six months’ to ‘this is very strange, but we think you’re going to be fine’.”

His dad’s recovery was like having a second chance at life. As he began to feel well and energised again, he wanted to get back into work, but didn’t want to put himself under too much stress. He thought perhaps the opportunity lay in property, which was so abundant and affordable in Invercargill compared to Mumbai.

“We came from a place where property was at a premium,” says Varghese. “In Mumbai, a 60m2 flat could easily cost a million dollars; because of population density, home ownership is not a given. In Invercargill the property was really cheap – so cheap that you were talking about 13 to 14% return in a market showing massive promise of capital appreciation.”

So in 2003, his parents bought a small sustainable family home for $60,000 and then purchased their first rental property for $27,000. Renovating the property proved to be both a lot of fun and a huge learning curve for the whole family: “In Mumbai you could always find a guy to do any job, even something as simple as putting together a kitset table. So doing it ourselves was a change. But it gave the whole family a purpose, to learn to paint and wallpaper – it brought our family together.”

They sold that property within a year, using the money to put back into more properties. Varghese and his father managed their portfolio themselves, learning the tenancy laws and even using their finance and tech skills to develop their own property analysis software. They became very close, working together to buy new properties and deal with tenants. Soon other landlords were asking them to manage their properties, “and it became clear that, as a family, we were career landlords”.

In the mid 2000s, most property managers in Invercargill were still using physical rent books, with all the inaccuracies and late rental payments that came with them. Varghese used custom-built property management software and owners were paid weekly. Few other agencies had websites and when Varghese set one up it was soon ranking at number one on Google. As one of the only agencies they could see online, clients came flooding in from all over the world.

Managing Kiwi tenants proved interesting – Varghese found himself occasionally surprised by their high expectations: “It’s intense, you get involved in people’s lives. Everyone’s got a story, but they’re very subjective; like ‘I can’t pay the rent’, but it’s because they ‘need’ to go to a party at the weekend. That’s not very evident to an Indian who comes from a world where people get up and go to work every day just to pay rent, and feed their families, and do nothing else. But living in two different cultures has helped me empathise with people a lot more.”

Varghese purchased six properties for himself, his sister bought some of her own, and his parents also expanded their portfolio. Then in 2012, Varghese’s father passed away as the result of a heart attack. At that time the property management company had three staff members and Varghese was living off his rental income, not drawing much of a salary. But left to run the business alone, he realised that “it had gone from a fun family-run business to something I could scale up”. He grew the property management revenue by $200,000 annually, bought another local agency and absorbed it, then opened an office in Gore. Now expanding to include sales, he’s able to focus on building the company with the security of knowing he has his properties underpinning his cashflow.

‘The higher the return the greater the risk – they’re directly related’ AVINASH VARGHESE

“They’re all cashflow positive, bringing in a very pretty income, and the portfolio just sits well,” he says. Most are standalone homes on full sites, which Varghese likes because he believes land is always at a premium. He particularly likes South Invercargill: “You can pay $25,000 or $30,000 for about 600 to 700m2 of land there, and five kilometres away down a straight road the same section is $130,000.”

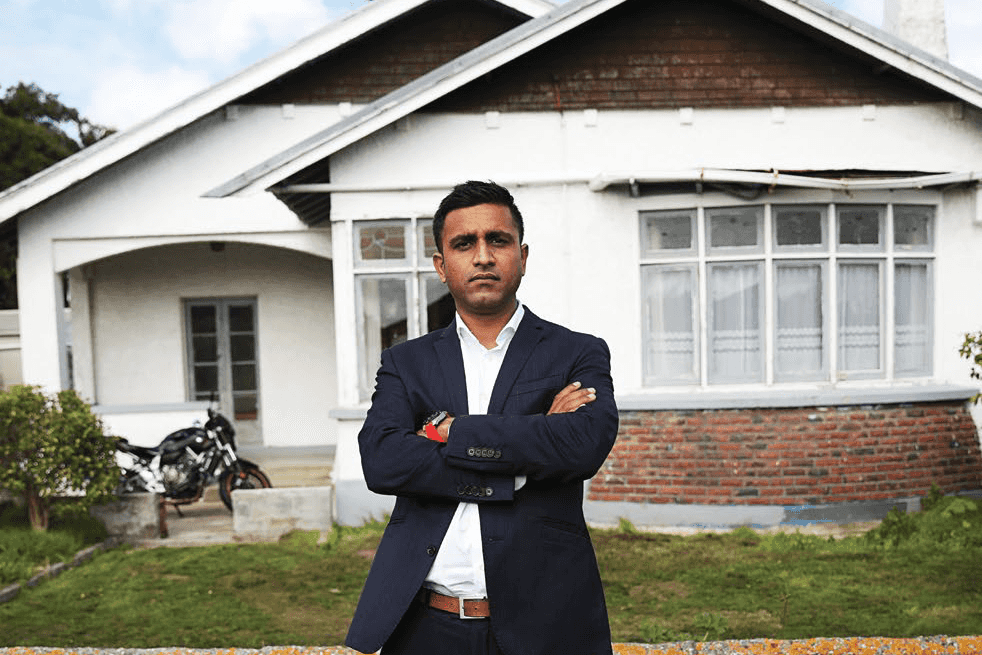

His best buy has been in South Invercargill – a rental he loves so much, he and his girlfriend have moved in. It’s a beautiful 1910 fourbedroom house sitting on a section of around 850m2, which he bought in about 2007 for $108,000. Tenanted for seven years, Varghese is now doing live-in renovations and says it will rent for around $320 a week when he’s finished his current improvements.

Of course, not every property has been fantastic. There’s one in his portfolio he’s not too happy about: “it’s not in the best part of town, the market dipped right after it was purchased and it was supposed to be a flip but it’s been more of a flop.

“It was the worst property we could ever buy,” he says. “A two-bedroom middle unit, standalone, Hardiplank cladding and a Decramastic roof, so it constantly needs maintenance. It’s a classic example of a house that nobody with experience would buy, and every year it’s depreciating.”

Varghese’s quick to point out his own mistakes. However, in spite of some errors along the way, he’s been enormously successful, with not only a booming property business but also a thriving second company, Digital Stock, which makes apps and software. Being an entrepreneur is his main passion now, but he still loves property – especially in Invercargill. His advice for Southland investors is to buy something solid, with character, on a section of about 600m2 or more, with its own driveway access. In South Invercargill, you’ll pay $160,000 to $200,000 for that type of property, and don’t buy based solely on return.

“Landlords call me and say, ‘I want an 11% return’, and I say, ‘don’t bother’. The higher the return the greater the risk – they’re directly related. Get eight or nine per cent and you’ll be happy, it’ll be a good investment and when you sell it you’re better off.”

And, according to Varghese, Invercargill is a brilliant place to invest, to live, to work and to build a business. He thinks it’s severely underpriced right now and there’s nowhere in New Zealand that offers better value for money.

“I love the luxury of buying a home – it’s a dream, people don’t realise this. It’s not my birthright,” Varghese says. “In Invercargill you can work a menial job and live in a house with so much space; it’s extravagant. Any young person spending $180,000 to $240,000 on a house is not making a mistake. We will look at it, ten years from now, and say, ‘Can you believe it?’”

Real Estate Rogues

It’s been an eye-opener to see how many “crafty people” are involved in real estate, says Avinash Varghese. One day he got a call from one of his tenants to tell him someone was demolishing the shed. He rushed to the site and found a crew with a truck taking down his fence and his shed to build a wider driveway for the next-door neighbour’s house. Baffled, Varghese asked them what they were doing. They presented him with a letter signed by his father, which Varghese knew wasn’t a genuine signature. '

“Getting to the bottom of it, the neighbour had become a landlord with Pride Property a week beforehand in order to get the signature from our paperwork. This neighbour then forged the signature! You come to New Zealand and think this sort of thing’s never going to happen because everyone’s above board. But it does happen, and navigating it is part of the job.”