Match Made In Heaven

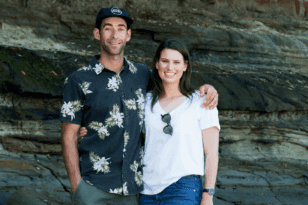

A tenacious young couple has achieved more than they could have imagined in beachside Whangaparaoa, with the help of a successful joint venture partnership. writes Joanna Jefferies. Photography by Stephanie Creagh.

1 December 2019

In any new relationship, there shoul be a fair bit of chemistry, mutual trust and respect – and it’s no different in a successful joint venture (JV). So, much like a new romance, when Auckland couple Daniel and Ashleigh Brown met their future JV partners, feelings were running high, but no one wanted to say “I love you” first.

“Essentially we were like nervous teenagers,” laughs Daniel, “we both wanted the same thing, but no one wanted to make the first move.”

The young couple had only been in the property investment game for several years at the time, but had managed to purchase four rental properties and had completed multiple renovations.

Daniel had been working as a police officer and Ashleigh in marketing management when they first started looking into buying property. But before buying, they decided to take off sailing for a year on their OE. They were just 21 years old, and their year abroad gave them plenty of time to research. Naturally enough, time spent investigating property lead them directly to property investment.

By the time they came home in 2012 they had their sights set on buying a rental, and used Daniel’s $45,000 superannuation fund as a deposit to purchase a home and income in Stanmore Bay. Funnily enough, the deal was sealed when the pair walked past the property on the way to another open home.

They struck up a conversation with a woman who they waved to through a window (they thought she was the new owner, as the house had been on the market recently and was out of their price range). She invited them in for a cuppa, and subsequently agreed to drop her price by $20,000 (to $465,000) if they would let her live there rent-free for a year. In return they could start doing up the exterior of the house and tidy up the property.

“You’ve got to imagine something that’s so overgrown that you can’t get to the majority of the house because the bush was hard up against it,” says Daniel. “We painted the outside, cut the trees back, barked and rocked the garden, gave everything a good manicure and put in a garden shed.”

The deal worked out perfectly – a year later the couple moved in to renovate the main two-bedroom home. Once that was renovated, they rented it out (for $482.50 per week) and moved into the two-bedroom “income” part of the property – where they still live today.

‘We’re happier than we’ve ever been right now, in a personal and a business sense’ DANIEL BROWN

GROWING A PORTFOLIO The deal was such a success, they made a goal that they would do something significant every year, whether that was a purchase or a renovation or both. So, still “hot under the collar” from their first deal, they purchased again in 2013. This time it was a 100m2 two bedroom Warkworth property purchased for $330,000 with a 5% net return. They rented it out for eight months before embarking on a full renovation including a new kitchen and bathrooms. With a lot of help from their parents and friends, they managed to pull off the reno, including creating a third bedroom for just $20,000.

“We re-rented it for a significant increase in rent,” says Daniel. It currently rents for $475 per week. Following that project, in 2015 they had their properties revalued; the fact that they were riding the upward wave of the property cycle meant they had enough equity to go again.

Time To Diversify

Meanwhile, they’d joined the Auckland Property Investors’ Association (APIA) and were networking with other more experienced investors and were attending “all the free seminars”, so they knew they would have to diversify geographically to continue growing their portfolio.

On a trip down to Cambridge they were passing through Hamilton and noticed a four-bedroom freehold home in Dinsdale for $320,000 – what seemed to them a very reasonable price, coming from the hot market up north.

Daniel was blown away when he contacted the vendor, who “had no sense of urgency” and told them to “ring back next week”.

Which is exactly what he did and finally managed to convince the owner to show him through the house, which he signed up for just $290,000.

It got a cosmetic renovation almost immediately, with Daniel staying there for the duration, while Ashleigh came down to help outside of work hours.

“We were tight on money and we were determined to do it on our own. We would always save up our annual leave that was one of the biggest benefits of being in the police you get such a significant amount of annual leave that I was able to take six weeks off and do the renovation, sleeping on a mattress in the back room,” says Daniel.

A heat pump, ventilation system, carpet, and curtains were installed and everything was painted, at a total cost of $7,000 and the house was then rented for $365 per week (it now rents for $480).

A year later in 2016, all their properties had increased in value, including the Dinsdale property, because Hamilton was now riding the upward wave of the property cycle. The couple were able to re-value again and bought a three-bedroom house in Maeroa, Hamilton.

Daniel had put so many “back-up” offers in that he had forgotten he’d even made an offer when the agent rang him to congratulate him, but with only three days’ due diligence written into the contract, they managed to get it over the line for $350,000.

It was the first time they had bought a property with tenants in situ, which turned out to cause “us our fair share of headaches”. The plan to renovate in 2017 was brought forward, the tenants moved out and they convinced their bank manager to bump up their revolving credit to finance the reno.

In the end they managed to renovate it and create a fourth bedroom, and rented it for $430 per week (a weekly increase of $65). Unfortunately it was their worst performing rental – “it’s the only one we’ve sold to this day”.

(Two months ago they gave it a tidy up and sold it for $499,000 – a tidy profit in just two years.)

By the end of 2017, they’d achieved $1 million in equity at just 27 years of age. They were married that year and decided it was also time to get serious about their property investment goals, so they incorporated a look-though company (LTC).

The LTC took on the debt of their entire portfolio including their own mortgage and meant they could live in their own house “essentially free of charge, which was a game changer”. It also meant their goal of becoming fulltime investors was within reach.

Meeting “The Ones”

To resign from their day jobs was a long-term aim for the pair, and it was eventually made possible through a connection they had made at APIA, with an experienced investor and developer couple called Jolene Bagby and Jacek Baranowski.

The two couples became firm friends in 2016 and frequently attended events together.

At social drinks the comment was often made that they should think about working together in the future.

“I’d always remembered that comment, but never wanted to question it or take it any further, because I was afraid it was something that was just said after a few beers,” says Daniel. “This actually went on for about 18 months, that same sort of conversation would come up and I would always want to jump on it.”

Daniel said to Ashleigh that if Jacek or Jolene mentioned a partnership again, that he would actually talk to them about it.

Naturally, it came up again and they had that conversation in the cold light of day.

“Their response to us was ‘We’ve been saying this for the past 18 months but we didn’t want to put any pressure on you, because we didn’t want to make it awkward and whether it happens or not it doesn’t change anything’.”

Much like finding “the one”, the joint venture partnership accelerated rapidly from that first meeting. They incorporated a company called Wild Property Group, and laid out plans for Bagby and Baranowski to facilitate the funding and for the Browns to project manage the trades, with a profit share agreement.

“We made a plan of who would do what and ran it through the lawyers and the accountants and made sure we were all hunky-dory. It would have been late 2017 that we made the call that I would be the first one to jump off the working wagon, because you just cannot do both full-time and do them well,” says Daniel.

Trading The Day Job

At the time Daniel was nine months shy of his 10-year anniversary in the police, and he wanted to see it out. That day came in August 2018, and he made the leap into full-time trading, releasing his superannuation fund to finance his first year in business.

With buying rules in place (“We don’t get into anything that we don’t think there’s a $100,000 profit in, whether that’s a renovation or a subdivision – after expenses, but before tax and GST”) Daniel started property hunting.

But it wasn’t until mid-December 2018 when he managed to secure two properties that fit the bill: a site with two dwellings ripe for subdivision; and a single dwelling doer-upper, both in Manly, Whangaparaoa.

They were both settled earlier this year, and the doer-upper received a full renovation. Daniel says he was far too hands-on in this process, and that was his first learning curve in the trading business.

The $515,000 renovation project was a rundown two-bedroom with a lot of unused space and he converted it to a four-bedroom, two-bathroom house over a period of seven weeks at a cost of $77,000.

It was sold in early June for $710,000, with a before-tax profit of $118,000.

The two-house site (purchased for $941,000) was taken on with a tenant in the back house, and the front house was renovated while waiting for the subdivision to be consented. Subdivision and renovation costs came close to $100,000 and the front house was sold for $575,000. The back house wouldn’t sell with a tenant in place, so once it was vacated, they did a small touch-up and Ashleigh staged it and sold it for $625,000 with a profit of $148,000 (after GST but before tax).

During that renovation period they purchased another doer-upper in Hatfields Beach for $505,000 and spent $90,000 on a full renovation. It settled last week for $750,000 making the company $138,000 before tax and GST.

Looking Ahead

In August this year, nearly one year after Daniel made the leap into full-time trading, Ashleigh quit her day job and now works alongside Daniel.

The couple say they have to pinch themselves that they are getting to do what they are doing currently and “We’re happier than we’ve ever been right now, in a personal and a business sense,” says Daniel.

One of the couple’s big goals for the 2019 financial year was to do $400,000 profit – “We’ve almost done that after tax and GST,” says Daniel. Their next audacious goal is to make $1 million profit before tax and GST in 24 months’ time.

They know it’s an ambitious aim, but the pair feel that it’s within reach, particularly given their unexpected successes thus far. “If we had this conversation five years ago I would never have believed that we were going to be where we are – we are doing now what we’ve always wanted to do, it’s just happened sooner than we expected.”

Tips For JVs

Here are Daniel Brown’s tips for joint ventures.

• “If you’re trying to buy, it’s networking with agents, if you’re trying to learn, it’s networking with people that are actually doing it and not just people with opinions.”

• “Make sure that you’re on the same page as your JV partners from the getgo. Make sure there’s no uncertainty about the direction of the business. Have all agreements in writing – with ‘out’ clauses. We’ve seen in this last 18 months people join up and do JVs together without really establishing the ground rules – it can leave a bitter taste in people’s mouths if they don’t do it properly.”

• “Run everything past your accountant and lawyer to make sure everything is above board.