Prefab Promise

Building processes are changing and a wide range of prefab options are coming to the fore. Miriam Bell takes a look at the prefab sector and finds out what it has to offer investors.

1 November 2019

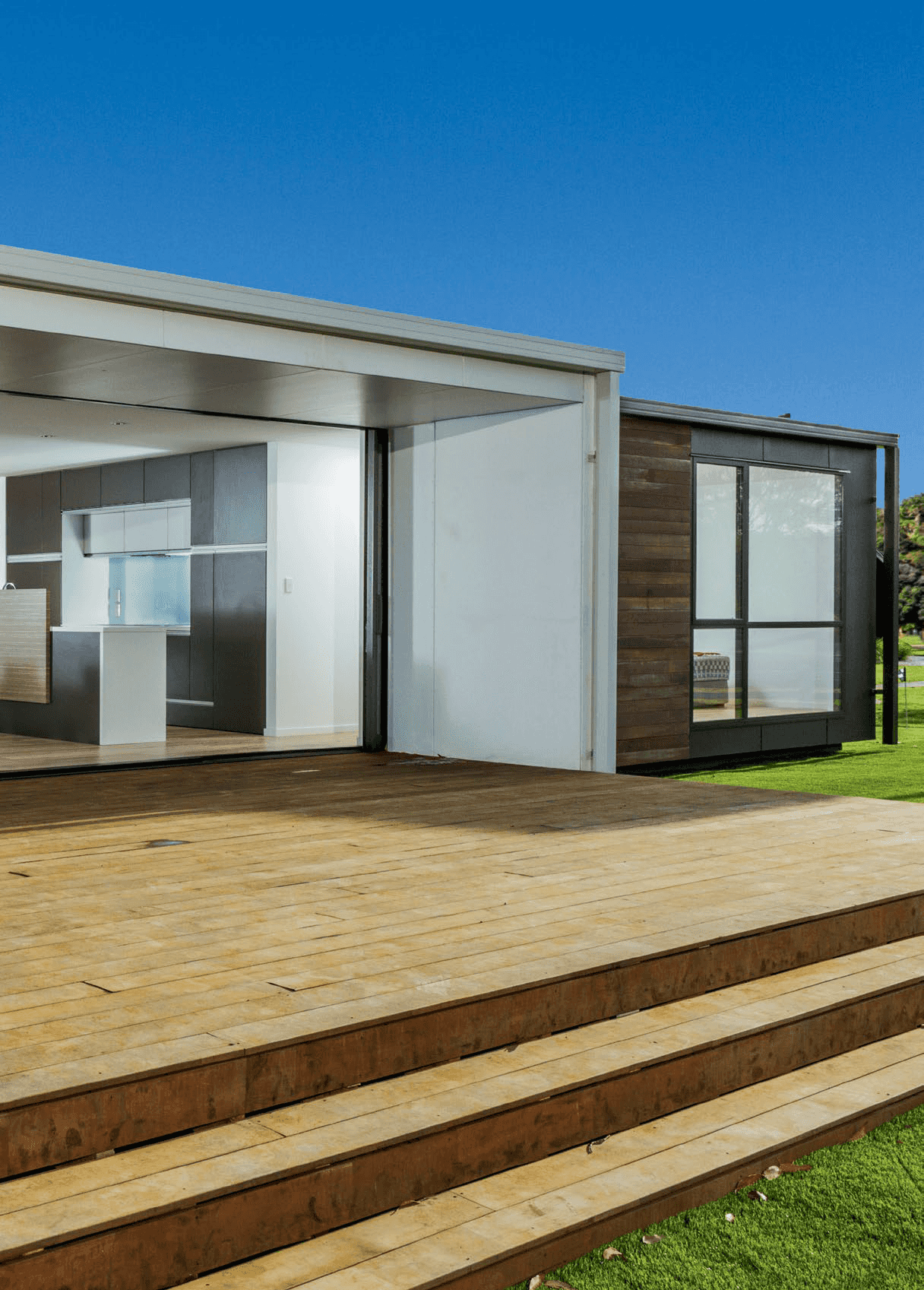

THIS PAGE Keith Hay Homes’ First Choice options range from $146,000 for 60m2 to $196,000 for a 100m2 building, including interior decorating fixtures, fittings and floor coverings.

There’s a sea-change going on in the building industry. Once considered cheap, nasty and temporary, people are now looking at prefab houses with fresh eyes. These days they are increasingly viewed as a cost-effective, eco-friendly, and stylish alternative to traditional building methods.

As it happens there have been prefab options of various types in New Zealand for many years. That’s because the prefab sector covers any part of a building that is made away from the final construction site, whether it’s a single component or a complete building.

Despite this, New Zealand has been slow to adopt the concept en masse – until now. But that’s changing and one major reason for this is that prefabs have been touted as one of the answers to New Zealand’s housing crisis, and accordingly, thrust into the spotlight.

But what do prefabs have to offer investors? Are they a good option for investors looking at doing a subdivision or small development, or who are keen to boost the value of a property by adding a secondary dwelling? We talked to some industry experts, as well as some investors who’ve been down the prefab path, to find out about the pros, cons and possibilities that come with prefabs.

Confronting Roadblocks

It’s the Government’s troubled KiwiBuild programme that is a key driver behind the current focus on prefabs. They have long been pegged as a component of KiwiBuild but they have come further to the fore since the KiwiBuild reset in September. Housing Minister Megan Woods, who has been doing the rounds of prefab production facilities recently, says that it’s necessary to find new ways to get houses built more quickly and off-site manufacturing is one of the ways to do it.

“Offsite manufacturing has the potential to transform the building sector and drive innovative ways to build homes at lower cost, and in faster timeframes. It can significantly change the way we

build homes because builders won’t have to contend with external elements like the weather.”

While the Government has been working with prefab companies in connection with KiwiBuild, Woods also sees it as a way to supercharge the use of offsite manufacturing in New Zealand. “The demand these programmes create has the potential for the construction and development industry to make confident investments in their people and new technology. It could play an important role in smoothing out the ‘boom-bust’ cycle that has plagued the sector in the past and help prevent another housing shortage emerging in the future.”

However, as critics have been quick to point out, there are currently a number of roadblocks hindering the progress of the prefab sector. These can be summarized as issues with consenting, scale, skills and finance. For investors, it’s consenting and finance which have been, and still are, the big problems.

When it comes to consents, the issue is that buildings generally have to be consented in the area they are built as well as in the area they are intended for. The Government is now tackling this particular area of concern.

Building and Construction Minister Jenny Salesa recently announced that for manufacturers who prove their systems and processes are compliant, there will be a new streamlined nationwide consenting process for prefab buildings.

The new process will enable the mass factory production of high-quality buildings and slash the likely number of building inspections for factory-produced buildings in half. It will ensure that only the location where a prefab house is installed requires building consent, removing the possible need for two separate consents.

Salesa says a bill will be introduced into Parliament early next year to ensure this process is in place as soon as possible. While this cutting of red tape around consents for prefab buildings and parts will make it easier for investors to make use of them, issues with finance remain a major impediment for smaller-scale investors.

Essentially, banks are resistant to lending on prefab builds because they are not a fixture on the land during the manufacturing process so there are security issues until there is something on the site. They are considered different to construction funding for a traditional build where payments can be released in stages by reaching milestones onsite.

The Mortgage Supply Company’s David Windler says this means people can usually only get prefab finance when they have existing equity, be it in the value of the property alone or in another property. “So it’s necessary to draw down on existing equity rather than being credited it. And that’s as far as the banks will go until the building is on-site and issued with codes. That can be a big problem because you need to look at about $200,000 to $300,000 in costs.” Only one lender breaks this mould.

Westpac offers a dedicated mortgage product for prefabs. Their Prebuilt loan is similar to a normal construction loan, except it covers buildings manufactured offsite. It has some additional requirements, including insurance ones, but involves a streamlined process. There are no other such products and it’s a big gap in the credit market, Windler says.

“But now that one of the big four has dipped their toes into the water and is providing a product, you can rest assured that the others will be thinking about it too. I’m fairly certain it’s an area where we’ll see some changes in credit policy – particularly if the interest in prefabs continues to grow and develop.”

Attractive Options

In fact, investor interest in prefabs does appear to be on the rise. Prominent Auckland investor David Whitburn says he has seen a noticeable growth in talk about prefabs as an option. “It used to be extremely low, but we’re seeing an evolution in the way things are done.”

The reality is prefabs offer extremely attractive features to investors. These include potentially lower costs, reduced timeframes and build efficiencies. A good example of these benefits comes from PrefabNZ which estimates a prefab build can shave up to 15% off total construction costs and up to 60% off build times. PrefabNZ CEO Scott Fisher says they are seeing more developers interested in prefab construction, but he’s not sure about smaller investors. One reason for this could be that much of the current spotlight is falling on large scale, end-to-end offsite building manufacturers, like Fletchers’ recently opened Auckland facility.

These companies are geared towardsbig development projects, ones like those needed to ramp up KiwiBuild or for retirement village developments. They don’t aim to cater to smaller scale developments, subdivisions or one-offs. However, plenty of other reputable prefab companies do. Fisher says it should be remembered that the prefab sector encompasses everything from prefab building components, like frames and trusses, to kitset builds to transportable houses, as well as the large-scale producers.

“The sector is coming out of its infancyand has learnt from past disruptions. Now we are seeing companies who have been operating under the radar but have got good, solid processes and business plans in place coming out. Often they have unique places in market and are doing well.” And these smaller, niche prefab companies have a lot to appeal to investors.

The main attractions are the speed of thebuild completion, improved quality over traditional onsite manufacturing, more sustainability in the products and build, and also a safer working environment for

contractors, Fisher says. “With the actual build, sometimes it may be cheaper, sometimes not – it does depend and costs vary widely. But there is definitely monetisation there in terms of getting a property ready to go for rental faster. That means an investor can get cashflow and income from the property quicker, which is a good thing.”

‘If you are reducing the time frame, investors can take into consideration the interest savings on their project and the opportunity costs too as it is possible to move onto the next project quicker’ - BARRY WALKER

Challenges do remain, particularly when it comes to finance, he adds. “Banks need to respond to the demand, step up and give consumers, including investors, a range of options which recognise the benefits of offsite manufactured homes.

“Solutions are starting to emerge for other issues though, with the Government’s recent announcement on streamlining the consent process set to remove some of the friction that exists with consents… Although the speeding up of the consenting process must not diminish the quality of the building.”

Fisher may not be certain about investor uptake of prefabs, but Keith Hay Homes’ Barry Walker is. He says that close to 70% of their Auckland business is from investors and it is growing in the regions too; investors account for about 36% of their business nationally.

“Investors like the return on investment that our products can deliver, as well as the potential equity gain if they are being used for a subdivision or secondary dwelling, and the flexibility that comes with transportability. We work with investors to make sure the numbers work for them, so we need to know what they want from the house and what their end goal is.”

Because most customers have specific or unique requirements, it is difficult to get generalized build price. Walker says that when considering just the house price itself - including interior decorating fixtures, fittings and floor coverings - their First Choice ranges from 60m2 at $146,000 to $196,000 for a 100m2 building. This price excludes delivery, foundations and site related costs.

It’s worth noting that buying prefab will not automatically speed up a project, he says. “It is only when an already completed building is purchased or the building process is run in parallel to the site consent process that the timeframe speeds up markedly. This can be done although there are risks. However, we wouldn’t enter into an agreement, if we thought the build wasn’t going to get the consent. If there is a risk of council noncompliance we won’t touch it.”

Taking this into account, Keith Hay Homes can build a 65m2 building in their yard in eight to 10 weeks and they have completed a number of infill projects for customers within six months.

“If you are reducing the time frame, investors can take into consideration the interest savings on their project and the opportunity costs too as it is possible to move onto the next project quicker.”

Investor Experiences

Given the potential benefits that come with prefab options, it seems a logical route for investors to follow. But what are prefab building projects really like for investors? We talked to a number of investors who have gone down various prefab paths and their experiences were overwhelmingly positive.

Peter Axelrad invests in residential rental property because he believes it is the investment which will give him the best overall return for the least risk and effort. To that end, he is always looking for the best way to obtain returns on his investment dollar.

After researching various strategies, he settled on subdividing larger properties in lower income areas and transporting compact, pre-constructed houses on to site.

“I use Keith Hay Homes as they have a specific design that minimises costs, and they tend to do a complete package which includes organising permits and transport. They are, therefore, one of the most cost effective and straightforward builds.”

To construct this type of dwelling it usually takes about three months plus the site has to be prepared beforehand and work like landscaping done afterward, Axelrad says. “It’s very much site and council specific, but a general guideline would be around $40,000 for site works and $40,000 for survey, council permits, and so on.

“Another big advantage is that other than site works, there is very limited on-site construction. This considerably minimises disruption to any occupants of an existing rental property on site as well as the neighbours.” While it is “horses for courses” for investors, in his view for the best return on investment, a new relocatable house is a clear winner, he adds.

Going for a kitset house build is another option which fits into the prefab sphere. Both Nathan Olliver and James Faber chose this option, via QuickBuild Homes, when undertaking subdivision projects. Olliver built a 95m2, threebedroom, two-bathroom, Insulpanel house in about two months, while Faber built a 95m2 house with three bedrooms and an ensuite.

Olliver says he paid $100,000 upfrontfor all the materials delivered. “Then it was only about $7,000 for both the sparky and plumber. If you add my labour to the cost it wouldn’t have been much over $1,350 per square metre. So much cheaper than a traditional build.”

For Faber, the total price for his kitset was $99,900* and QuickBuild Homes can build it for an additional $30,000. “I knew the builder contracted to building them so he did mine on an hourly rate, with two labourers.

The total cost for me was about $21,000 to build for all the labour. “It also cost me about $8,000 for all the electrical work, which was too expensive. My plumbing labour was through my connections. But I believe plumbing and wiring can be done for under $10,000. All wiring and electrical fittings, and plumbing fittings are included, with pre-drilled holes for wires and plugs.”

Both Olliver and Faber had few problems with their builds, are happy with the end product and the costs involved, and are keen to go down the same route with any future builds. Olliver says he is a firm believer that you get a lot of bang for your buck with these products. “I think we will start seeing a lot more of them around once everyone comes to terms with change.”

*Prices have since increased but Faber’s option is still just $109,250.

Prefab Builds Advice

“It’s the same as when you get a builder to build your house. Find a reputable business. Be clear about what you want and what they can do. Make sure you get a match.” – Scott Fisher

“Understand your end goals as an investor and focus on them if issues come up. Make sure the numbers work. Also, understand the time frame. But don’t sweat the small stuff. And do account for time – including your own.” – Barry Walker

“Spend the money and buy a riveting gun. Don’t make the same mistake we did and do them all by hand.” – Nathan Olliver

“It’s not as straightforward as the website makes out, so I would recommend getting tradespeople to build it rather than DIY. At least for the first one and you can see if you’d do it again yourself next time.” – James Faber